Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Big Lots (BIG) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

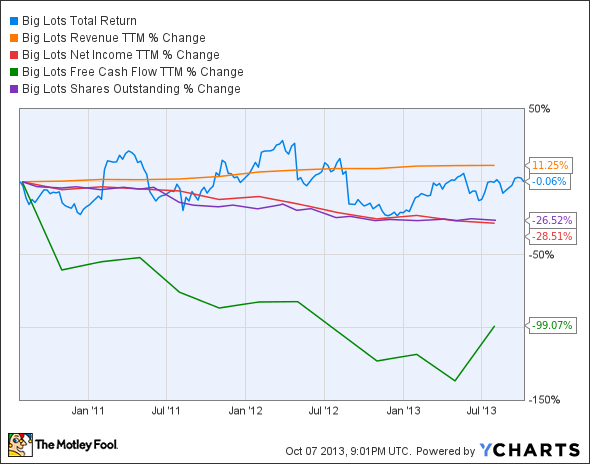

The graphs you're about to see tell Big Lots's story, and we'll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Big Lots's key statistics:

BIG Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

11.3% |

Fail |

|

Improving profit margin |

(35.7%) |

Fail |

|

Free cash flow growth > Net income growth |

(99.1%) vs. (28.5%) |

Fail |

|

Improving EPS |

2.3% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

(0.1%) vs. 2.3% |

Pass |

Source: YCharts. * Period begins at end of Q3 (Aug.) 2010.

BIG Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(11.2%) |

Fail |

|

Declining debt to equity |

12% |

Fail |

Source: YCharts. * Period begins at end of Q3 (Aug.) 2010.

How we got here and where we're going

Things look grim for Big Lots today, as the deep-discount retailer has earned only two out of seven possible passing grades. Much of the U.S. retail industry has been struggling to restore growth in the wake of increased payroll taxes and other economic uncertainties. Big Lots' aggressive expansion plan has also cost it a failing grade on this test, as so much cash has been plowed into new locations that the company has very nearly sunk into the red on its free cash flow. How might Big Lots improve its flagging metrics? Let's dig a little deeper to see what might be in store.

Over the past few quarters, the U.S. retail sector has been struggling to maintain sustainable growth due to a combination of the wobbling economy, higher prices on some necessities, and increased payroll taxes. Last quarter, Big Lots' top line was nearly flat, while rivals Target (TGT 0.45%) and Wal-Mart (WMT 0.41%) barely pushed higher, as revenues were up 4% and 2.4%, respectively. Only Target managed to increase its same-store sales, which it did by 1.2%. Big Lots and Wal-Mart, on the other hand, experienced a same-store sales dip of 2.2% and 0.3%, respectively. These performances barely outrun inflation at best and point to a beleaguered American consumer under most interpretations.

However, Big Lots has plans to fight back against its larger and more recognized peers. Fool contributor Michael Lewis notes that CEO David Campisi has been trying to revamp consumers' shopping experience at Big Lots' stores through various marketing campaigns. Big Lots is also poised to benefit from its Canadian business, as sales north of the border grew 8.2% while same-store sales also rose 8.3%. Big Lots has also started offering frozen and refrigerated food at nearly 80 stores across five test markets, presaging the possible launch of a fleshed-out grocery business to compete with Target and Wal-Mart, the latter of which is already America's largest grocer by a wide margin. Big Lots is also changing its customer loyalty program, which might help it improve same-store sales over the next few quarters. Fool contributor Dan Caplinger notes that prominent retail investor Eddie Lampert sold off his stake in Big Lots, which points to flagging big-money faith in the company's future growth prospects.

On the other hand, Fool contributor Dan Moskowitz points out that Target has been aggressively expanding into the U.S. and Canadian markets over the past few quarters, which may pose stiff competition for Big Lots. Target has opened 10 new stores in the U.S. and 68 stores in Canada, and it has a hefty plan to open a total of 124 units in Canada during 2013. These supercenters will undoubtedly put pressure on Big Lots' best market. With Big Lots currently trading at less than 11 times earnings, it might look cheap, but it could easily be a value trap, given all the challenges it faces in the retail sector.

Putting the pieces together

Today, Big Lots has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.