Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Harley-Davidson (HOG 1.28%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Harley-Davidson's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Harley-Davidson's key statistics:

HOG Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

24.3% |

Fail |

|

Improving profit margin |

744.1% |

Pass |

|

Free cash flow growth > Net income growth |

(45.3%) vs. 898.5% |

Fail |

|

Improving EPS |

895.4% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

211.5% vs. 895.4% |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

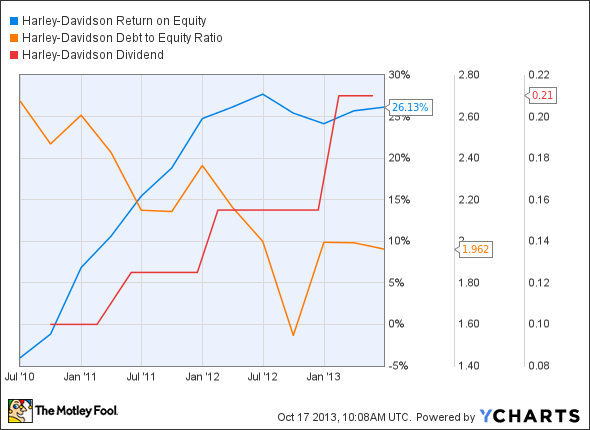

HOG Return on Equity data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

748.4% |

Pass |

|

Declining debt to equity |

(26.6%) |

Pass |

|

Dividend growth > 25% |

110% |

Pass |

|

Free cash flow payout ratio < 50% |

23.3% |

Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here and where we're going

Harley-Davidson got off to a great start, but its declining free cash flow presents the only real source of weakness in an otherwise sterling performance. Harley-Davidson earned seven out of nine passing grades regardless, and it has a very good chance to achieve a perfect score next time around with just a modest improvement on the top line and on free cash flow.

How might Harley-Davidson rev its engines over the next few quarters? Let's dig a little deeper to see what lies ahead.

Harley-Davidson's ubiquitous brand has long been its driving force, which has helped it to expand its business in international markets -- these markets now account for more than 35% of its total sales. My Foolish colleague Brian Hill notes that Harley-Davidson has an ambitious plan to expand its overseas business to 150 dealerships by 2014.

It has also expressed its intentions to set up a manufacturing plant in India , which would allow it to compete with Japanese and European bike makers. The company has been aggressively courting a rising middle class in India, which has been busily engaged in new highway construction. The company is developing a low-cost 500cc motorcycle at a base price of less than $7,000, of which it expects to sell around 10,000 units over the next two to three years.

Harley-Davidson also expects its Chinese sales to increase by 35% every year, but regulations in some Chinese cities have hindered the growth of leisure motorcycling there.

Harley-Davidson has gained market share in Europe, but its motorcycle sales nevertheless declined by 7% in the region due to an ongoing economic crunch. As a part of an ongoing restructuring process, the company hopes to save around $320 million a year, which ought to offset any European weakness. It looks like India might be its brightest star for the time being.

But Harley-Davidson hasn't forgotten its roots -- the company is also trying to capitalize on female bikers in the United States, which has involved the promotion of female-centric cycle training classes. The company also introduced eight new 2014 model bikes at its Project Rushmore , which will help it to bolster its position in the luxury touring and performance segments.

However, Harley-Davidson's rival Polaris (PII -0.81%) recently launched its 2014 Indian Chief models, which has put it in direct competition with Harley's offerings. Fool contributor William Bias notes that Polaris recalled its Kings Mountain- era Indian motorcycles, after the company noticed a possible defect in the rear rim. These were older bikes, but Harley-Davidson was forced to initiate a recall of its 2014 touring motorcycles , because of the possibilities of defective hydraulic clutch system.

This seems more a net negative for Harley-Davidson, since Polaris' newest models got superb reviews from many bike enthusiasts, including longtime Harley-Davidson loyalists. On the other hand, Harley-Davidson may soon see a rebound in its RV segment, as wholesale shipments are expected to soar by 12% over the course of this year, and by 5% in 2014, according to the Recreational Vehicle Industry Association.

Putting the pieces together

Today, Harley-Davidson has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.