Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

Apple (AAPL 1.82%) is down today after reporting weaker-than-expected guidance, while the S&P 500 (^GSPC 0.92%) is up on mediocre economic data, which some believe makes the Federal Reserve unlikely to draw down its monthly asset purchases at its policy-setting meeting this week. As of 1:30 p.m. EDT the S&P 500 is up 0.45% to 1,770 and the largest exchange-traded fund tracking the S&P 500, the SPDR S&P 500 (SPY 0.94%), is up 0.45% as well.

Apple, the largest stock in the S&P 500, is down 1% today after the company's guidance last night disappointed analysts. Apple reported earnings of $8.26 per share, down from last year's $8.67 per share but better than analyst expectations of $7.92. Revenue came in at $37.5 billion, beating analyst expectations of $36.8 billion.

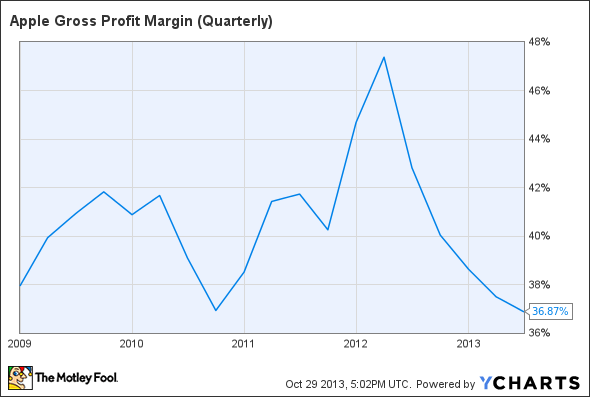

However, investors are focusing on Apple's guidance for gross margins: The company said it expected its gross margins to be flat at 37%, down from a high of 47% last year.

Revenue was expected to be up slightly from last year to a range of $55 billion to $58 billion. One of Apple's major strengths as a business has been its ability to charge premium prices for its products and still sell huge amounts of product. That ability has been called into question this year as the company's gross margins have declined for five quarters straight. If not for the decline in gross margins, net income would have climbed as well. It remains to be seen whether Apple can keep its gross margins flat after the company recently announced it would give away its OS X Mavericks operating system for free.

While Apple is down today, the S&P 500 is up following today's four economic reports.

|

Report |

Period |

Result |

Previous |

|---|---|---|---|

|

Producer Price Index |

September |

(0.1%) |

0.3% |

|

Core PPI |

September |

0.1% |

0% |

|

Retail sales |

September |

(0.1%) |

0.2% |

|

Retail sales ex-autos |

September |

0.4% |

0.1% |

|

Case-Shiller home price index |

August |

0.9% |

0.6% |

|

Consumer confidence index |

October |

71.2 |

80.2 |

September's sales data was mediocre at best, and October's will be worse as we see the effects from the government shutdown earlier this month. Perversely, the mediocre data is a positive for the market, as speculators believe it means the Federal Reserve is more likely to continue its asset purchases at the going rate of $85 billion a month. The Federal Reserve has been known to surprise investors before, so we will have to wait until tomorrow at 2 p.m. EDT to see what happens. While it will be interesting, your investing strategy shouldn't be dependent on the Federal Reserve. Constantly educate yourself, find great companies, and invest for the long term.