Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does JetBlue Airways (JBLU -2.87%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

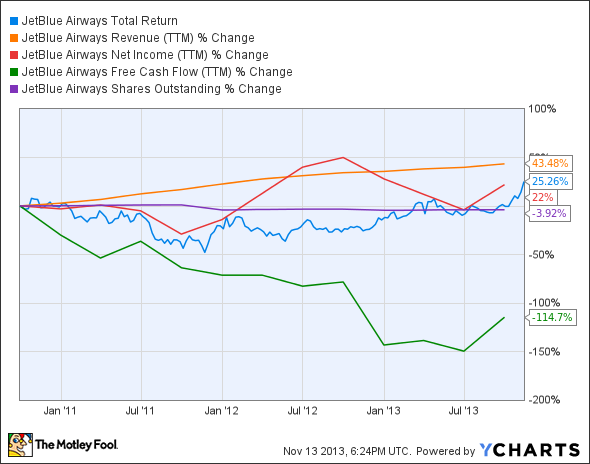

The graphs you're about to see tell JetBlue Airways' story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at JetBlue Airways' key statistics:

JBLU Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

43.5% |

Pass |

|

Improving profit margin |

(15%) |

Fail |

|

Free cash flow growth > Net income growth |

(114.7%) vs. 22% |

Fail |

|

Improving EPS |

19.6% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

25.1% vs. 19.6% |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

JBLU Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(1.7%) |

Fail |

|

Declining debt to equity |

(100%) |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

We first examined JetBlue Airways last year, and it has unfortunately lost two passing grades in its second assessment, scoring only four out of seven passes as compared to last year's six-out-of-seven score. One major source of that weakness is the company's falling profit margin, the result of stiff competition from fellow low-cost carriers Southwest Airlines (LUV -0.58%) and Spirit Airlines. Can JetBlue overcome a difficult airline environment and become the market's darling again, or are the skies about to get a lot less friendly for this company? Let's dig deeper to see what might lie ahead.

JetBlue recently rallied as much as 11% after the U.S. Department of Justice approved the merger of American Airlines owner AMR and US Airways (NYSE: LCC), creating the world's largest airline. However, the merger is subject to the condition that US Airways and American Airlines divest around 52 gates at Washington Reagan National Airport and 12 gates at New York's LaGuardia Airport, as DOJ wants to enhance competition among low-cost carriers at these two key Northeast airports. Fool contributor Adam Levine-Weinberg points out that JetBlue and Southwest have emerged as potential bidders for nearly all the divested gates, which could be worth between $200 million and $300 million. JetBlue is already well-established in New York with a central hub at John F. Kennedy Airport, but it could easily benefit from an expanded DC presence.

Adam Levine-Weinberg also notes that JetBlue had also shown interest in expanding to Dallas Love Field, but it was barred from that airport by a piece of legislation called the Wright Amendment, which forbids long-distance flights. With that legislation vanishing next year, JetBlue could bid for the two gates held there by American Airlines, which will give it a foothold from which to combat Southwest Airlines, a major flight operator in Dallas.

JetBlue should also see benefits from the recent Federal Aviation Administration ruling allowing smartphone and tablet use for the entirety of most flights. Fool contributor Tim Beyers notes that premium services -- such as Wi-Fi access and plug-ins for powering gadgets -- will allow some airlines to raise fares among elite flyers who seek out constant connectivity. Following FAA approval of JetBlue's Wi-Fi system last month, the company intends to set up the new antennas on its Airbus aircrafts by the end of next year. JetBlue's "Ka-band" satellite-based system, which boasts substantially more bandwidth than rival offerings, could be a game-changer for in-flight connectivity and entertainment. The company has long been a leader in in-flight connectivity, so further progress in this field is bound to engender more customer loyalty for this well-loved airline.

Putting the pieces together

Today, JetBlue Airways has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.