Fayez Sarofim made a fortune investing in brand-name consumer product companies and energy stocks. The Egyptian-born investor manages nearly $30 billion for a select group of clients using a philosophy not unlike that of Warren Buffett.

In the late 1990s, Sarofim's investors pleaded with him to buy Enron -- the hottest stock in the energy business. But Sarofim refused because he could not understand Enron's balance sheet. He was right to avoid Enron; his Buffett-like refusal to invest outside his circle of competence made him and his investors billions.

Like Buffett, Sarofim favors a buy-and-hold-forever strategy and sticks to businesses that have durable competitive advantages. In fact, Sarofim hates selling so much that he often owns the same stocks for decades. Such is the case for Coca-Cola (KO 1.04%), Altria (MO 1.96%), and Procter & Gamble (PG 1.46%) -- all three have resided in the billionaire investor's portfolio for over a decade and will likely remain in his portfolio for decades to come -- and for good reason.

Beat Buffett to Coca-Cola

Most people know that Buffett made a fortune in Coca-Cola when he bought the stock in the late 1980s, but few had heard of Sarofim, who bought a stake in the soft drink company before the Oracle of Omaha. Coca-Cola is a typical Sarofim investment; it is the best in the world at what it does, it has a ubiquitous brand name, and it does the same thing year after year.

It also has another attribute that is necessitated by both Buffett and Sarofim: a long track record of profitability. A chart of Coca-Cola's net income shows that the company continues to grow despite generating nearly tens of billions in annual revenue.

Source: Mergent Online.

Source: Morningstar.

With worldwide per-capita consumption of Coke still lagging that of the United States by a factor of four, the world's leading carbonated soft drink company remains a good company to buy and hold forever.

"Marlboro Friday" didn't keep him out of Philip Morris and Altria

Marlboro Friday -- the day in 1993 when Philip Morris, now Altria(MO 1.96%) and Philip Morris International (PM 0.64%), slashed the price of Marlboro cigarettes due to competition from private labels -- caused Sarofim's portfolio of brand names to crater. The shocking announcement caused many investors to question the value of consumer brands; if Marlboro could not command a premium over generics, then how could Coca-Cola or Procter & Gamble? But the even-keeled Sarofim held firm in his conviction in brand names and continued to buy America's best brands, even as other investors dumped them.

Sarofim's stubborn belief in the power of brands has paid off. In 2013, Marlboro is once again a brand that commands a premium. Philip Morris USA, now a subsidiary of Altria, distributes the leading cigarette in the United States. According to the company, 2 in 5 cigarettes sold in the United States is a Marlboro, and more Marlboro's are sold each year than the next 11 brands combined.

The story is similar overseas, where Philip Morris International distributes the best-selling cigarette in the world. Lead by Marlboro, Philip Morris International has a 29% share of the worldwide cigarette market excluding the U.S. and China. Altria and Philip Morris International generate outsized returns on capital due to the power of their brands. Investors who are as patient as Sarofim will make a lot of money if they buy these companies and hold forever.

Procter & Gamble

Procter & Gamble is another of Sarofim's favorite blue chips. Buffett also owns the consumer products conglomerate, but has sold about half of his 100 million share stake since late 2008. For a guy who likes consumer brands, Procter & Gamble is a must-have. The company is a hodgepodge of America's most valuable brands; its brands range from Cover Girl cosmetics, to Charmin toilet paper, to Tide laundry detergent.

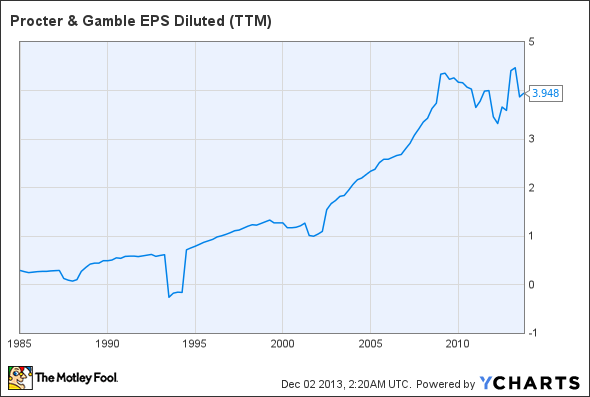

The company is a cash cow that still manages to grow earnings faster than inflation.

Source: Procter & Gamble EPS data by YCharts.

In addition to growing earnings Procter & Gamble reliably produces $0.13 in free cash flow for each dollar of sales. This makes the company's free cash flow relatively easy to predict -- which means the company is rarely cheap. The stock currently trades at a free cash flow yield of about 4%, not very attractive for most investors.

But, like Buffett, Sarofim wants to buy and hold forever. According to Morningstar, Procter & Gamble earns a 12.44% return on invested capital. The longer an investor owns the stock, the closer his or her return will be to the return on invested capital rather than the initial earnings yield. As a result, true buy-and-hold-forever investors may still find Procter & Gamble's shares attractive.

Bottom line

Even among a growing list of Buffett copycats, rarely can you find a manager who seeks to buy businesses and own them forever. Fayez Sarofim is one of those few. If you like to invest in market-leading companies that have durable competitive advantages, I suggest you keep a close eye on Sarofim to see what he is buying.