Chinese e-commerce company Vipshop Holdings (VIPS 2.02%) is all about growth. A $10,000 stake invested in January would be worth more than $57,000 today. This return is amazing and higher than other players in the competitive Chinese e-commerce arena, such as E-Commerce China Dangdang (DANG +0.00%) or LightInTheBox (LITB +3.83%), which suggests there's something special about Vipshop. To understand Vipshop's fair value, it's necessary to examine the company's filings, presentation slides, and press releases.

The growth story

It's no secret the e-commerce arena in China is highly competitive, with Alibaba's Taobao -- a general online marketplace with more than 800 million product listings -- dominating 80% of the market.

To compete against Taobao, most e-commerce companies first build a strong reputation by specializing in a particular segment. For example, Dangdang's main focus is selling books. After becoming the largest book store in China, Dangdang chose to expand its product offerings. It now sells digital, beauty, and home products, and even supports third-party merchants. However, the fact that transactions from third-party sellers accounted for less than 4% of total revenue suggests Dangdang may have a difficult time competing against the leader, Taobao.

LightInTheBox chose to specialize in lifestyle products. However, the company's approach to deliver products to over 200 countries exposed LightInTheBox to multiple competitors from a very early stage. The company recently experienced a massive sell off after management revised its revenue forecast.

Vipshop built a reputation as a reliable online discount retailer for luxurious brands, employing an online discount retail model that relies on over 5,800 partnerships with brands. Vipshop allows these companies to get rid of unnecessary stock quickly via flash sales, and provides high value to brand lovers, creating a win-win situation.

Choosing the online discount segment as a starting point was a great business idea. Although China is expected to see total estimated retail sales of $3.8 trillion this year, there is limited presence of large discount retail chains in the second-largest economy. Furthermore, compared to the U.S., China's offline retail is very underdeveloped in terms of infrastructure. By 2010, there were roughly 24 square feet of shopping center space for every American. On the other hand, China has only 2 square feet of shopping center space per capita, causing underserved consumers to shop online, especially for branded products.

Vipshop's management saw in the lack of well-developed physical discount chains -- and absence of an online solution -- a huge business opportunity, and quickly became the leader in the online segment. Between 2010 and 2013, the company increased its customer base from 255 thousand to 1.7 million. Revenue also took off, growing from $3 million in 2009, to $692 million in 2012.

Margin expansion

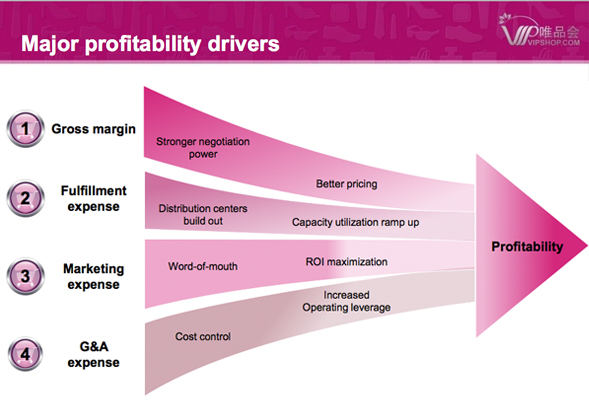

Margin is also expanding, having reached 24.2% in the latest quarter. Net income remains low, but this is because the company is still in "investment mode" -- it is constructing two huge warehouses in Guangzhou and Hubei. Long term, these investments will strengthen profitability, while inexpensive word-of-mouth marketing will sustain top line growth.

Source: Vipshop Investor Relations

From now own

Vipshop continues being a growth favorite. For the fourth quarter, management expects a year-over-year growth rate of roughly 94%, achieving at least $580 million in revenue. The company has a clear first-mover advantage, which combined with its operational expertise -- a logistics system optimized for flash sales -- should protect its business from potential challengers.

Foolish bottom line

Vipshop's amazing growth story is supported by a real business model. As the largest flash e-commerce site in China, the company benefits from word-of-mouth marketing and is strategically investing in warehouse space, which should generate strong cash flow. Considering the bullish market, good future prospects for China's retail industry, and the fundamentals of Vipshop, it seems like the company has great potential, even after achieving a 572% return.