CarMax (KMX 1.56%) has risen by almost 40% over the last year, and the stock is now looking comparatively expensive when compared to peers like AutoNation (AN 4.37%), Copart (CPRT 0.05%) and Penske (PAG 1.58%). On the other hand, higher growth rates and a superior business model deserve a premium valuation, and CarMax looks well positioned to continue outperforming over years to come.

On valuation and growth

The following table compares market capitalization, trailing P/E ratio and forward P/E for CarMax against competing car dealership companies AutoNation, Copart and Penske, and CarMax comes as out as the pricey alternative in the group.. Only Copart has a slightly higher trailing P/E ratio and CarMax is the most expensive one in the group when it comes to forward P/E.

All else equal, growth typically slows down as companies become bigger over time, so the combination of a bigger size and a higher valuation can be interpreted as a negative sign for investors in CarMax.

On the other hand, CarMax has sensibly outgrown its peers over the last years, and that´s an important variable to consider. Especially in a tough and competitive industry like car dealerships, in which sales volume can have a big impact on profitability, higher growth merits a superior valuation.

But looking at past growth rates and extrapolating them into the future is not enough to make sound investment decisions. Investors need to analyze the company´s business model and competitive strengths to determine if CarMax can effectively continue delivering superior growth for shareholders in the long term.

Not your average car dealer

Operating a network of 123 used car superstores in 61 markets, CarMax is the leading used car dealer in the US. The company´s slogan "The way car buying should be" says a lot about CarMax and its differentiated business strategy.

As opposed to the typical high-pressure sales tactics and obscure sales terms used by most competitors, CarMax follows a customer-friendly and transparent approach to the business which resonates remarkably well among customers.

The company´s sales consultants work on fixed commissions, so they make the same amount of money regardless of which car the customer buys. This means that employees in the sales team don´t have the incentive to push those cars which generate higher margins for the company, and they can focus their time and energy on finding the best vehicle for each customer.

CarMax has a no-haggle pricing policy which makes the negotiation process much simpler and comfortable. The process is also more transparent than at competing companies, the price of the car the customer is buying does not change depending on factors like vehicle trade-ins, and customers get to see the same information as the sales associate on a computer screen.

Salespeople seem to be really happy with CarMax´s innovative approach, the company has been in the Fortune "Best 100 Companies to Work For" over the last nine consecutive years.

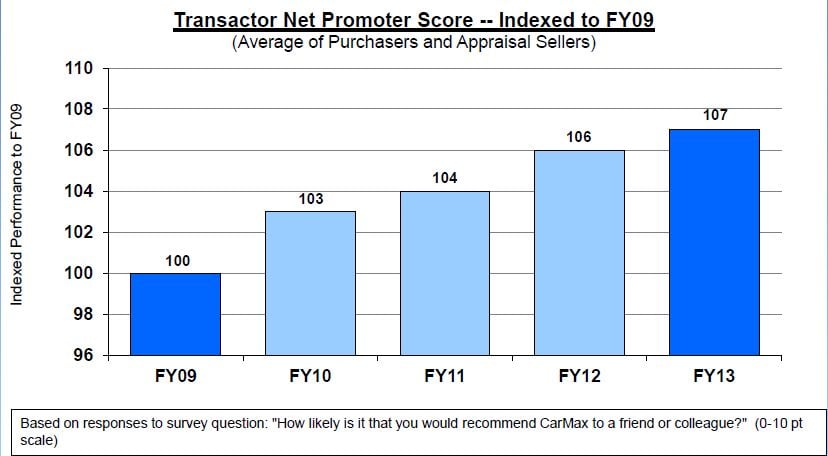

Not surprisingly, a happy and well incentivized workforce is doing wonders in terms of customer satisfaction: 93% of customers say they would recommend the company to a friend, and that figure has been consistently increasing over the last few years.

Source: CarMax investors presentation.

Building competitive strengths

An innovative and customer-friendly business model is a big differentiating factor for the company, and CarMax is leveraging that strength by building other sources of competitive strength on top of that one.

Scale advantages allow CarMax to offer more than 35,000 vehicles on a nationwide basis, and the company gives customers the possibility to have cars transferred to the nearest store for a modest transfer fee. Variety and flexibility are very valuable for customers in the search for a big-ticket item like a car.

The company also has sales and appraisal data going back to 1993 which it uses to make better purchasing and pricing decisions. This information can be very valuable when it comes to deciding how much to pay for a vehicle in an auction or via appraisal from a consumer, and CarMax uses this data to maximize profitability and streamline inventories via a proprietary national pricing algorithm.

The company´s unique customer-centric approach to the business is CarMax´s biggest competitive strength. But that doesn´t mean it's the only one: scale, variety, geographic reach and growing brand recognition are other important factors making the company an extraordinary player with superior growth prospects in the car dealership business.

Bottom line

CarMax may look expensive in comparison to peers. However, make no mistake; this is no average car dealership company. As long as CarMax continues delivering a superior experience for customers while building scale advantages and inventory variety as it grows over time, the company deserves a valuation premium. A higher price tag is a reflection of superior quality when it comes to CarMax, hence, Foolish investors have no reason to stay away from the stock.