It may sound like science fiction, but it's real. According to Amazon (AMZN 1.85%), its Prime Air delivery system designed to get packages into customers' hands in 30 minutes or less using unmanned aerial vehicles, or UAVs, could be ready to enter commercial operations as early as 2015.

Amazon has been working on Prime Air in its next-generation research and development lab, and the service, which would be available for packages weighing five pounds or less, currently awaits the necessary Federal Aviation Administration rules for unmanned aerial vehicles to commence operation. According to Amazon, one day seeing Prime Air drones could be as normal as seeing mail trucks on the road today.

Amazon Prime Air Quadcopter-Courtesy Of Amazon.com

Delivery time as a competitive advantage

Already known for free two-day delivery via its popular Amazon Prime expedited-shipping membership program introduced in 2005, Amazon has lately been experimenting with same-day delivery. The company aims to be able to deliver most items the day they are ordered.

Amazon has also expanded its grocery delivery offerings and, most recently, announced that it was teaming with the U.S. Postal Service to deliver Amazon packages on Sundays.

Under a program called Vendor Flex, Amazon has even placed its own workers in other companies' warehouses, where they ship consumer staples such as diapers and paper towels directly to consumers. Current partners include Procter & Gamble and Kimberly-Clark, who effectively save on transportation costs to truck products to Amazon distribution centers and get Amazon's help boosting online sales.

A good example is Procter & Gamble's Clorox, which realized $75 million in e-sales last year. The company predicts that number could reach $200 million by the end of the decade. As for Amazon, the program enables the company to reduce overall shipping and storing costs.

To help further speed delivery, Amazon is now building its warehouses much bigger and closer to customers. The company has invested roughly $14 billion since 2010 to build 50 new warehouses, more than it had cumulatively spent on storage facilities since its 1994 founding, bringing the total to 89 at the end of 2012, with five more coming online in 2013.

Other companies have seen the sense in competing over delivery time, with eBay (EBAY +0.41%) introducing eBay Now, the company's local shopping service that provides valets who complete a shop-and-drop-off in about an hour, a timetable crucial to eBay's intensifying efforts to one-up Amazon in the delivery game.

While it seems unlikely that eBay is making a killing on the service, which costs $5 per delivery and requires a minimum order of $25, the program could lock in customers and improve overall long-term margins, another justification for eBay's relatively high P/E ratio of 24 and price-to-sales ratio of 4.8.

Implications

Despite Amazon's assurance that its delivery drones are not something out of a science fiction novel, the gimmick looks more like a publicity stunt rather than a solid mainstream delivery option. However, the timing was perfect. Jeff Bezos' CBS "60 Minutes" interview on Sunday night generated widespread buzz that spilled over into Cyber Monday, the busiest online shopping day of the year.

Amazon Valuation

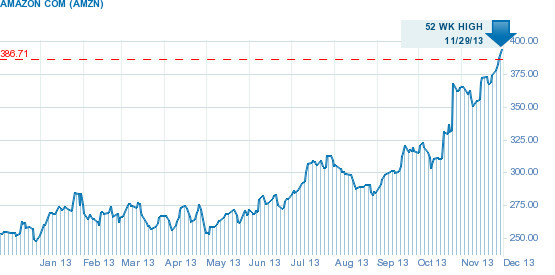

At a market cap of over $180 billion, Amazon has gained 58% year-to-date and is currently trading at an all-time high. Amazon's Q3 2013 worldwide revenue grew 24% to $17 billion, but the company posted a net loss of $41 million, or $0.09 per diluted share.

Since it is not easy to accurately predict actual demand, Amazon's Q4 2013 guidance offered a rather wide range of possibilities, with expected sales ranging between $22.5 billion-$26.5 billion and income ranging from a $500 million loss to a $500 million profit.

With the economy bumping along at a lackluster pace, and this year's shorter-than-usual window between Thanksgiving and Christmas, sales and promotions began weeks before Thanksgiving Day, making this holiday shopping season more diffuse than ever.

That left Black Friday weekend itself, the season's customary kickoff, looking a bit gloomy. Over the course of the weekend, consumers spent about $1.7 billion less on holiday shopping than they did last year.

Foolish takeaway

At a price-to-sales ratio of 3, a stratospheric P/E, and prospects of ending the year close to its lower end of guidance, I would say sell Amazon now, cash in your profits and reenter the stock sometime in the future at a more rational entry point.