In case you haven't already heard, Amazon.com's (AMZN +1.41%) Jeff Bezos appeared on 60 Minutes, revealing the company's plans for its octocopters. If you're new to the story, then you're probably thinking that was a typo. However, octocopters are suddenly real. Octo pertains to the eight extensions on these flying drones (for easy landings), and copter refers to flight.

This article will focus on the plans and potential for octocopters, and it will briefly cover how Amazon is faring against Wal-Mart Stores (WMT 0.65%), which is constantly looking to grow online, and Overstock.com (OSTK +1.90%), which is a much smaller version of Amazon.

Octocopter potential

Jeff Bezos hopes to have Amazon's octocopters flying out of the company's fulfillment centers and to customers' homes within four to five years. If Bezos can pull it off, then octocopters will deliver packages of five pounds or less within 30 minutes. For the record, Bezos says that 86% of packages delivered by Amazon are five pounds or less. This service will be called Amazon Prime Air.

This is exciting, but the challenges for Amazon Prime Air will be so steep that a multitude of headwinds are likely to harm the company more than they help. In the long run, success is possible, but Amazon Prime Air isn't something that you should expect to be an instant success.

The first and most obvious problem is FAA regulations. Considering Bezos' track record, he'll likely find a way to clear this hurdle. However, the next step of public acceptance will be much more challenging.

Nobody wants to talk or write about it, but it can't be denied that many people relate drones to airstrikes overseas, some of which kill innocent civilians. Of course, consumers won't have to worry about this with Amazon's octocopters, but perception and association are powerful forces, and it's highly unlikely that the general public is going to quickly approve of drones flying over their heads.

Amazon's octocopters use GPS, but as we all know, GPS isn't always 100% accurate. Therefore, drone crashes are bound to happen. Thefts of octocopters are also likely. Furthermore, it's possible that at least one person will attempt to shoot down these drones to send a message that they don't approve of a robotic world. This all might sound like science fiction, but these are potential scenarios, and none of them benefit Amazon. The public backlash, even if just partial, will not help Amazon's performance.

Also consider that Amazon currently has 96 fulfillment centers. If an octocopter can only reach consumers within 10 miles of a fulfillment center, then Amazon must build many more fulfillment centers if it wants to reach everyone. This wouldn't help the company's bottom line, and it's already fighting to make consistent profits due to exceptionally low margins (its current profit margin is just 0.2%).

If this works out for Amazon, it's likely to take much longer than four to five years. On the other hand, in the present, there's much better news for the company: Amazon is crushing its competition online.

Online exposure

Amazon.com's same-store sales improved 46% year over year on Cyber Monday.

According to Alexa.com (global leader in website analytics), Amazon.com has a global traffic ranking of 11 and a domestic traffic ranking of 5. The website's bounce rate (only one page-view per visitor) has declined 39% to 29.1% over the past three months. Not only is that a huge move in the right direction, but the overall number of 29.1% is extremely low, indicating that Amazon.com is excellent at keeping consumers on its site.

Also over the past three months, page-views per user have skyrocketed 64.3% to 10.3. Time-on-site has jumped 65% to 8:42. You could make an argument that these impressive moves are due to holiday shopping, but if that's the case, then why aren't Wal-Mart's website and Overstock.com seeing similar moves?

Walmart.com has a global traffic ranking of 173 and a domestic traffic ranking of 27. The bounce rate increased 8% to 30.8% over the past three months. During the same time frame, page-views per user improved by 0.6% to 6.32, and time-on-site has slipped 10% to 5:28. These are solid numbers, but they're not Amazon-like.

Overstock.com has a global traffic ranking of 748 and a domestic traffic ranking of 168. Over the past three months, the site's bounce rate has increased 2% to 32.4%, page-views per user have improved 3% to 5.1, and time-on-site has slipped 6% to 4:48.

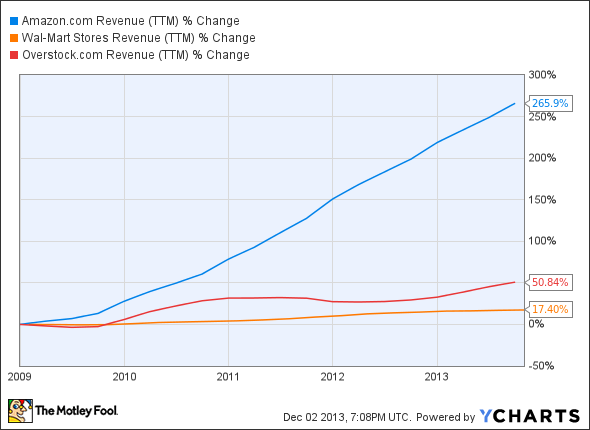

Despite Amazon.com having a strong head start in online presence, which means it should be more mature, it's still growing the fastest of the three companies online. It's also growing the fastest on the top line over the past five years:

More people opting to shop online helps tremendously. However, Amazon isn't a surefire winner. It's great that Amazon uses its free cash flow to reinvest in its business, but no dividend yield limits downside protection if anything goes wrong. Wal-Mart, on the other hand, yields 2.3%. Like Amazon, Overstock doesn't offer any dividend.

Additionally, Wal-Mart sports a profit margin of 3.6%. Though that's thin, many investors feel comfortable going with sustainable profitability. Overstock sports a profit margin of 1.9%.

Furthermore, Amazon is trading at 148 times forward earnings, whereas Wal-Mart is trading at just 14 times forward earnings. Therefore, expectations are high for Amazon and low for Wal-Mart. Overstock once again falls in the middle, trading at 26 times forward earnings.

This isn't to say Wal-Mart is a better investment that Amazon. However, it's likely to be a safer investment.

Conclusion

Amazon's top-line growth is phenomenal, and betting against Jeff Bezos isn't often a good idea. At the same time, he might be a little overambitious with his plans for the company's octocopters. They have the potential to be long-term winners in a massive way, but new groundbreaking technologies often must suffer through extreme volatility before seeing sustainable success (think Tesla).

In the meantime, Amazon is an online behemoth. The top line should continue to grow, and continued stock appreciation is likely, but a lack of sustainable profitability and an extremely high valuation are reasons for at least a little caution.