On Thursday, shares of Hilton Worldwide Holdings (HLT 2.00%) began post-IPO trading with a rise of 7.5% to close at $21.50. As a result of the transaction, the company raised $2.35 billion, and it is currently valued at more than $21 billion. With such a successful haul on Hilton's first day of trading, especially as the S&P 500 fell 0.38%, investors might be asking themselves if they should invest now or stay away. In an effort to answer this question, I delved into the company's offering document and compared its financial results to those of Marriott International (MAR 2.12%) and Starwood Hotels & Resorts Worldwide (NYSE: HOT).

A little background is important

In 2007, Blackstone Group (BX +0.00%) took Hilton private in a deal valued at $26 billion. Aside from the $7.5 billion in debt taken on to pursue the transaction, Blackstone paid for the hotel in cash. At the time of the company's last quarterly report before going private, it reported 490,000 rooms in operation. Since the deal closed that year, the number of rooms has swelled to nearly 672,000. This is comparable to the 670,000 rooms operated by Marriott and far higher than the 335,400 rooms controlled by Starwood.

However, room count isn't the only thing that matters. The Foolish investor would also be wise to look at revenue and net income growth, as well as debt and return on equity. By examining these data points, we might be able to gain a better understanding of the value proposition that Hilton offers in comparison with its peer group.

Hilton looks remarkably unremarkable

Over the past three years, Hilton has seen its revenue rise by 15% from $8.07 billion to $9.28 billion. The primary driver behind the jump in revenue has been an increase in the number of locations and, in turn, the number of rooms operated by the chain. Similarly, Starwood has also seen a jump in revenue. Between 2010 and 2012, the company experienced a remarkable 24.6% rise in revenue from $5.07 billion to $6.32 billion. In juxtaposition, Marriott has only seen its revenue rise by 1.1% from $11.69 billion to $11.81 billion, as the chain has had difficulty competing with its smaller peers for customers.

On the other hand, net income growth is another story entirely. During the same time-frame, Marriott outpaced Starwood in terms of net income growth. Between 2010 and 2012, net income at the chain has risen 24.7% from $458 million to $571 million. Instead of experiencing greater profitability because of an increase in revenue, the company has benefited from a reduction in costs relative to sales. With that said, Starwood's results aren't anything to be ashamed about. From 2010 through 2012, net income at the business has risen 17.8% from $477 million to $562 million. Meanwhile, Hilton's jump in revenue, combined with some significant cost reductions, has led to net income rising by 175% from $128 million to $352 million.

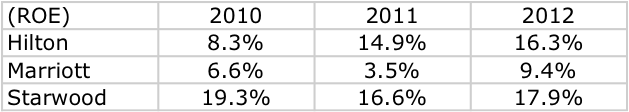

Using this data alone, we could conclude that revenue growth at Hilton has been reasonable while margin improvement has been strong. On the other hand, there's more to the picture than meets the eye. Looking over the past three fiscal years, we can measure each company's return on equity. Essentially, by dividing each company's net income by its book value of equity, we can arrive at how much money an investor made for every dollar invested in the enterprise.

As we can see in the table above, Marriott's return on equity has been the lowest of the bunch (after adjusting for the value of treasury shares). This is due to the company's low earnings relative to its equity. Both Hilton and Starwood have performed much better, with Hilton leading the way in terms of improvement. This might suggest that Hilton's future prospects are brighter than either Marriott or Starwood, but there is one catch: debt.

In an effort to finance growth, companies can issue shares, use cash on hand, or go into debt. When a company decides to take on debt to fuel growth, assets and liabilities increase while equity should stay the same. This allows the company to increase its book value but has the negative side effect of artificially increasing its return on equity.

By looking at Hilton's long-term debt/equity ratio, we see that Blackstone wasn't afraid to borrow to finance Hilton's growth. When Hilton went private, total debt outstanding (including lease obligations) stood at $9.4 billion. This eventually peaked at $17 billion in 2010, but it has since declined to $12 billion as of Hilton's most recent quarter. As things stand, the company's debt/equity ratio stands at 3.14. This means that for every dollar in assets the company has after covering liabilities, it has $3.14 of debt. To put this in contrast, Marriott's debt/equity ratio stands at 0.49, while Starwood's ratio is even lower at 0.44.

Foolish takeaway

Based on the analysis of Hilton and its peers above, it appears as though Marriott is the least appealing of the three. Though the company possesses a low level of debt, its returns have been mediocre. Hilton's metrics are far more attractive, but its high debt load suggests that its results could fall substantially if business deteriorates even slightly. Meanwhile, Starwood's metrics have consistently surpassed those of its peers, while the company maintains relatively little debt. I don't know about you, but I would say that Marriott and Hilton appear to be foolish, not Foolish, when you compare them to Starwood.