Dividend stocks outperform nondividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two of America's oldest and largest chemical companies will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1802, DuPont (DD) is the world's third-largest chemical producer by market capitalization, and is also one of the components on the Dow Jones Industrial Average. DuPont operates in more than 90 countries and boasts in excess of 150 research and development centers and 70,000 employees. Over the past century, the company has operated in such diverse segments as gunpowder, automobiles, fabrics, plastics, agriculture, construction, electronics, and nutrition, and it continues to produce innovative new chemicals and products today. DuPont even broke into the energy industry with its acquisition of Conoco in 1981, but this tie-up ended in 1998.

Founded in 1897, Dow Chemical (DOW) is the largest chemical manufacturer in the U.S. and the second-largest by revenue in the world after BASF. Headquartered in Midland, Mich., the chemical giant provides more than 5,000 technology-based products and solutions, which are manufactured at more than 188 facilities in 36 countries, to customers in more than 160 countries. Dow manages its global operations through a number of subsidiaries, including the well-known Union Carbide, and through joint ventures such as Dow Corning.

|

Statistic |

DuPont |

Dow Chemical |

|---|---|---|

|

Market cap |

$55.8 billion |

$50.4 billion |

|

P/E ratio |

20.8 |

16.9 |

|

Trailing 12-month profit margin |

13.3% |

4.9% |

|

TTM free cash flow margin* |

3% |

8.3% |

|

Five-year total return |

175.9% |

151% |

Source: Morningstar and YCharts.

* Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

DuPont began its payouts about 110 years ago. Dow Chemical began paying quarterly dividends in 1977 and has been paying ever since. A 37-year long dividend-paying streak might be impressive in most cases, but it can't hold a candle to DoPont's streak.

Winner: DuPont, 1-0.

Round two: stability (dividend-raising streak)

According to Dividata, DuPont and Dow Chemical's dividend payouts were both hurt by the financial crisis. DuPont held payouts steady from the end of 2007 to the beginning of 2012, while Dow actually reduced its payouts in 2008, only to increase them again in 2011. Since Dow's current payout remains below the level its of pre-crisis dividends, we'll award this point to DoPont as well.

Winner: DuPont, 2-0.

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

DD Dividend Yield (TTM) data by YCharts.

Winner: Dow Chemical, 1-2.

Round four: strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years.

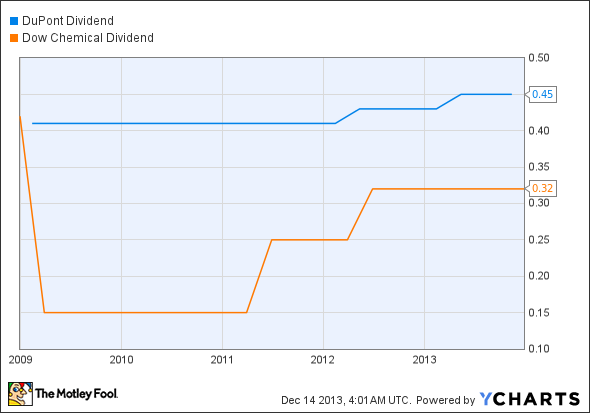

DD Dividend data by YCharts.

Winner: DuPont, 3-1.

Round five: flexibility (free cash flow payout ratio)

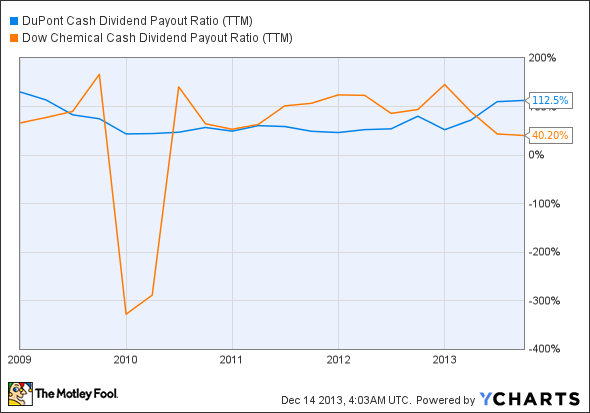

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

DD Cash Dividend Payout Ratio (TTM) data by YCharts.

Winner: Dow Chemical, 2-3.

Bonus round: opportunities and threats

DuPont may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

DuPont opportunities:

- DuPont plans to spin off its titanium dioxide (TiO2) division to focus on more profitable segments.

- DuPont's teamed up with Deere to develop advanced field-management technology.

- It bought most of South Africa's Pannar Seed to capitalize on the African agricultural market.

- DuPont and Monsanto (MON) have agreed to cross-license agricultural technology.

- The company might bet on electric vehicles by developing advanced charging technology.

Dow Chemical opportunities:

- Dow Chemical will sell off most of its chlorine assets, which generate $5 billion in sales.

- It has been building a new ethane cracker to capitalize on a surge in natural gas supplies.

- Dow's electronics and functional materials are used in 95% of smart devices on the market.

DuPont threats:

- The global TiO2 market has been suffering from high inventory levels and low pigment prices.

- Huntsman may join with Tronox to expand its TiO2 business.

- Increasing health concerns over genetically modified organism ingredients and foods could hurt GMO manufacturers.

- Monsanto's also entered the South African seed market with acquisitions of Sensako and Carnia.

Dow Chemical threats:

- Dow's polyurethanes division has been suffering from high feedstock costs.

One dividend to rule them all

In this writer's humble opinion, it seems that Dow Chemical has a better shot at long-term outperformance, thanks to its dominant position in the U.S. chemicals market, which has been depressed in recent years and which could enjoy a rebound in prices and demand. International markets also present major opportunities, should many beleaguered nations shift to higher growth. DuPont, on the other hand, has been going through extensive restructuring, which has included acquisitions, spinoffs, and divestitures, to concentrate on high-margin businesses. DuPont is also likely to be hurt by any backlash over GM crops, as it's one of the world's largest seed companies. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!