Although we don't believe in timing the market or panicking over daily movements, we do like to keep an eye on market changes -- just in case they're material to our investing thesis.

The Dow Jones Industrial Average (INDEX: ^DJI) is up after two better-than-expected reports on the economy, as well as dovish comments from Boston Federal Reserve Bank President Eric Rosengren. As of 1:30 p.m. EST, the Dow was up 116 points to 16,541. The S&P 500 (INDEX: ^GSPC) rose 11 points to 1,838.

There were two U.S. economic releases today.

|

Report |

Period |

Result |

Previous |

|---|---|---|---|

|

CoreLogic home price index |

November |

0.1% |

0.2% |

|

Trade deficit |

November |

$34.3 billion |

$39.3 billion |

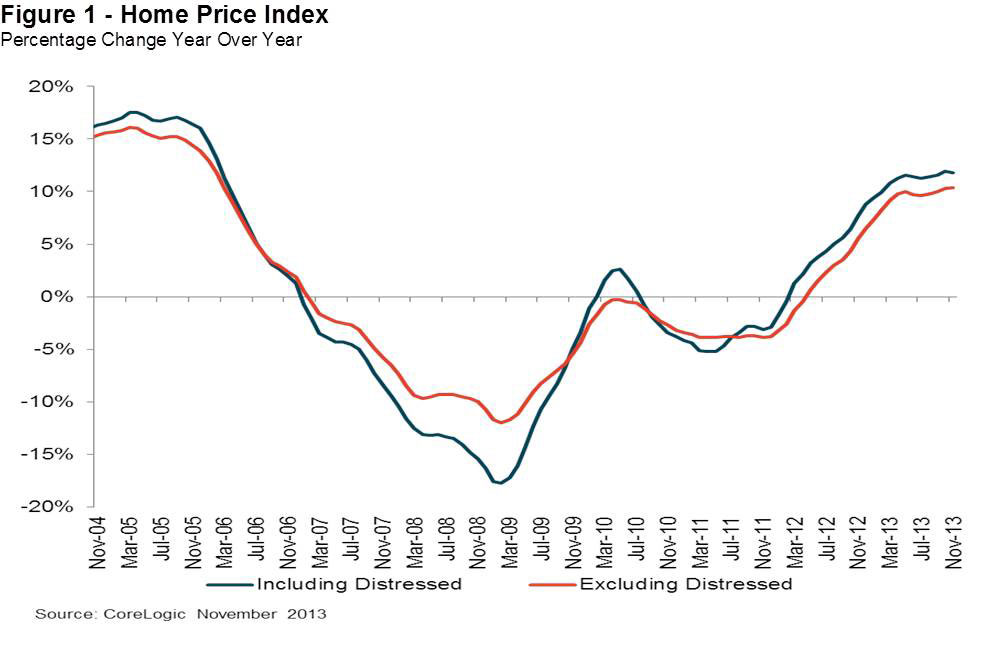

CoreLogic's home price index rose 0.1% in November, down from October's 0.2% growth. Year-over-year home prices were up 11.8% in November versus 12.5% year over year in October, and 17.6% below their peak in April 2006.

Source: CoreLogic November 2013.

Home price appreciation has slowed, as demand typically drops in winter, there's more housing inventory on the market as prices have risen, and increasing mortgage rates make it more expensive to buy a house on credit.

US 30 Year Mortgage Rate data by YCharts.

With mortgage rates now 33% higher than they were a year ago, home price appreciation will likely be lower in 2014.

The second economic release today was the updated trade deficit, which is the amount that imports exceed exports. The big story was that U.S. imports of fuels continue to drop while U.S. exports of refined oils and chemicals increased. The value of U.S. fuel and crude oil imports dropped by $3.4 billion month over month while exports of refined products rose by $700 million. While we still import significant quantities of crude oil, it is against the law for U.S. companies to export unrefined crude oil from the United States. Many U.S. oil and gas companies are pushing for this to change as supply bottlenecks in the here cost them significant profits.

The Boston Fed's Rosengren, who rotates out of a voting position on the Federal Open Market Committee at the next meeting, said today in Connecticut that the Federal Reserve should be careful and taper slowly because the economy has not yet reached his estimate of full employment of 5.25%. "This recovery has already been too slow, and we do not want premature tightening of monetary policy to delay the return to more normal economic conditions," he said. Rosengren is a dove on economic policy and was the only member of the FOMC to dissent from its decision last month to reduce its monthly bond purchases by $10 billion beginning in January. Rosengren argued at the time "that, with the unemployment rate still elevated and the inflation rate well below the target, changes in the purchase program are premature until incoming data more clearly indicate that economic growth is likely to be sustained above its potential rate."

What's an investor to do?

Your investment strategy shouldn't be dependent on the most recent economic releases or comments by Federal Reserve members. Constantly educate yourself, find great companies, and invest for the long term.