Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two of the world's largest oil and gas companies will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1911, Chevron (CVX +0.29%) is America's second-largest integrated oil and gas producer, and is also ranked among the top 10 companies on the Fortune Global 500 list. It has been a component of the Dow Jones Industrial Average since 2008. Chevron operates more than 22,000 service stations across six continents, including 8,060 gas stations in the U.S. alone. Chevron completed the acquisitions of Texaco and Unocal in the aughts, which significantly beefed up its crude oil and natural gas assets around the world. Chevron boasts recoverable resources of 11.3 billion barrels of oil equivalent and a daily production capacity of 2.6 million BOE, but it also owns interests in 11 power-generation facilities with a total operating capacity of around 2,200 megawatts.

Founded in 1909, BP (BP 1.34%), previously British Petroleum, is one of the six global oil and gas supermajors, a distinction that also includes Chevron. The British company is actually the largest oil and gas producer in the United States and also operates 15 refineries with a total processing capacity of approximately 2 million BOE per day. Headquartered in London, BP controls more than 20,000 BP Connect gas stations in more than 80 countries around the world. During the late 1990s, the company merged with Amoco, and it subsequently acquired ARCO and Burmah Castrol in 2000 to bolster its leadership position in American oil and gas markets. However, the 2010 Deepwater Horizon oil spill has already forced BP to pay more than $20 billion in related damages, which has dented its prospects with investors somewhat.

|

Statistic |

Chevron |

BP |

|---|---|---|

|

Market cap |

$240.8 billion |

$151.6 billion |

|

P/E ratio |

10.2 |

6.3 |

|

Trailing 12-month profit margin |

10.2% |

6.1% |

|

TTM free cash flow margin* |

0.2% |

(0.7%) |

|

Five-year total return |

99.1% |

28.2% |

Source: Morningstar and YCharts.

*Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

According to Dividata, BP began paying half-yearly dividends to American shareholders in 1987, but it switched to quarterly distributions two years later. BP's 27-year long dividend-paying streak can't hold a candle to Chevron, which has been paying dividends since the legendary 1911 Standard Oil antitrust decision split it off as an independent company.

Winner: Chevron, 1-0.

Round two: stability (dividend-raising streak)

BP kept its dividend payouts steady between 2009 and 2010 after the global financial crisis, and then made substantial reductions to distributions as a result of Deepwater Horizon. Thus, BP's dividend-raising streak only begins in 2012. That makes this an easy win for Chevron, which has been increasing dividends at least once every year since 1987, according to the DRIP Investing Resource Center.

Winner: Chevron, 2-0.

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's look:

CVX Dividend Yield (TTM) data by YCharts

Winner: BP, 1-2.

Round four: strength (recent dividend growth)

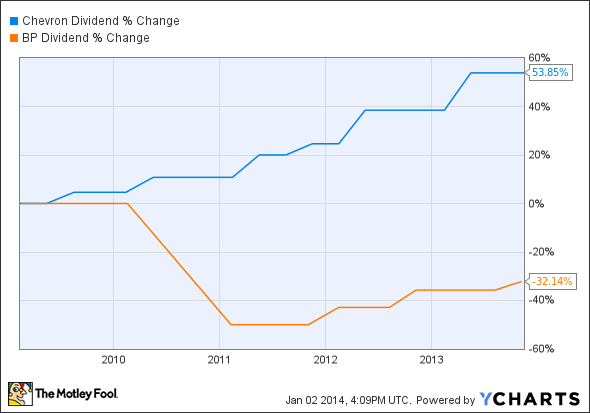

A stock's yield can stay high without much effort if its share price doesn't budge, so let's look at the growth in payouts over the past five years.

CVX Dividend data by YCharts

Winner: Chevron, 3-1.

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

CVX Cash Dividend Payout Ratio (TTM) data by YCharts

Winner: Tie.

Bonus round: opportunities and threats

Chevron wins the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Chevron opportunities

- Chevron has signed a shale oil and gas production-sharing agreement with Ukraine and Poland.

- CPChem can leverage substantial benefits from low-cost feedstock in the U.S.

- Chevron's Gulf production will get a boost from several major new projects.

- Chevron could reap substantial profits from $100 oil (by WTI pricing).

- Freeport-McMoRan and Chevron are working on a potential 547 billion cubic feet of natural gas at Lineham Creek.

BP opportunities

- BP purchased a major stake in the Shah Deniz gas field project in Azerbaijan.

- BP is developing proprietary technologies to produce fuels from hydrocarbon resources.

- BP recently signed a gas production agreement with the government of Oman.

- BP has plans to invest at least $4 billion per year to develop projects in the Gulf of Mexico.

- BP's valuation is by far the lowest of the six supermajor oil companies.

Chevron threats

- Chevron has cut its 2014 capital expenditures by approximately $2 billion.

- Chevron withdrew from a Nigerian liquefied-natural-gas project after superfluous delays.

- Ecuador might try to seize Chevron's Canadian assets to pay for a $9.5 billion judgment.

- Chevron's massive Gorgon liquefied natural gas project is expected to take longer and cost more than previously expected.

BP threats

- Growth rates have decelerated as demand for oil continues to decline in Europe and the U.S.

- BP suffered a serious setback from an unfavorable court ruling over the Deepwater Horizon disaster.

- BP will keep capital expenditures flat at nearly $25 billion per year through the end of the decade.

One dividend to rule them all

In this writer's humble opinion, it seems that Chevron has a better shot at long-term outperformance, thanks to a substantial amount of producing assets in promising regions, and a far lower legal overhang than its peer. Furthermore, an improvement in WTI crude oil prices, and a widening spread between domestic and international oil prices, could also boost margins -- for both companies. BP has been making big moves in the Gulf of Mexico with the possibility of a large amount of recoverable oil reserves, but the Deepwater Horizon continues to plague BP's profitability and its reputation. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!