Internet auction king eBay (EBAY +1.76%) released its earnings for the fourth quarter of 2013 on Jan. 23. Once more, the company reported a great quarter. Annual revenue growth came in at 14%, while earnings growth reached 15%. These figures confirm eBay's ability to protect its market share, despite Amazon.com's (AMZN +1.43%) rapid expansion, and the appearance of new, innovative marketplaces in the tech space, like Groupon in the U.S. or Taobao in China.

However, the most interesting news regarding eBay's latest earnings is that activist investor Carl Icahn has nominated two of his employees to eBay's Board of Directors. The reason? Icahn is proposing to spin-off eBay's online payments platform, PayPal, as a separate business. But why does Icahn want eBay to spin-off its fastest-growing service?

If eBay's a cupcake, PayPal's the cherry on the top

In the past two years, PayPal --which was acquired in 2002 for $1.5 billion-- has become eBay's main growth driver. As a result, PayPal already accounts for more than 40% of eBay's total revenue.

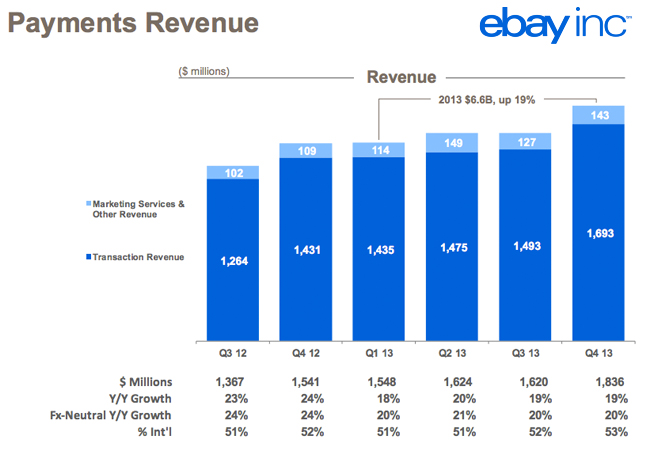

Notice that although eBay's auction business is still expanding, its growth rate is well below Amazon's top-line growth figure. The situation is completely different for PayPal, which as the main platform for online payments enjoys a strong reputation and economies of scale. In 2012, PayPal grew its top line by 19%, reaching $6.6 billion in annual revenue. The service now handles more than $180 billion in annual transactions.

The auction website faces fierce competition from Amazon, which does not mind reinvesting all its money into massive warehouses and other distribution and logistics improvements to capture market share. But PayPal, as the most important player in the online payments space, has built a strong economic moat, thanks to network effects. Buyers are attracted to PayPal due to its mass acceptance, while sellers are attracted to PayPal's more than 143 million active accounts.

The best part of the story is that PayPal still has plenty of room left for growth. The service, which processes roughly 78% of eBay's global gross merchandise volume, could benefit enormously from mobile e-commerce. Around 40% of new PayPal users in 2013 came from mobile devices. More important, many of PayPal's new users are young customers from emerging markets, which form a very attractive user base, as the have a lifetime of potential transaction growth ahead, according to analyst R.J. Hottovy.

Source: eBay Investor Relations

Icahn's plans

For Icahn, the spin-off of eBay's fastest-growing service is a "no brainer." The activist investor was quoted as saying by Bloomberg news agency that such a move would boost PayPal's value.

As a separate business, PayPal could benefit from a richer market valuation. This is because of two reasons. First, thanks to the recent economic and financial recovery, 2014 could be a great time to do an initial public offering. More importantly, MasterCard and Visa --which are PayPal's main competitors-- are currently trading at around 10 to 12 times sales volume. Under a 12 times sales multiple, PayPal as a single entity could be worth up to $75 billion. This market valuation is actually higher than eBay's total market capitalization.

Final Foolish takeaway

At first glance, Icahn's proposal to spin-off PayPal looks attractive, as the payments system could benefit from a richer valuation as a single entity.

However, the reality is that meaningful significant synergies do exist between PayPal and eBay's auction marketplace. For example, both services share technology, traffic, analytics, and data. The scale and network effects that both businesses experience as a combined entity, could be worth billions, as PayPal acquires eBay customers with virtually zero cost.

At the moment, Icahn's stake in eBay is said to be close to 2%. Unless he increases his stake massively, a spin-off of the PayPal business is unlikely.