The 787 Dreamliner in action. Image source: Boeing.

Boeing (BA 0.96%) used to be a strong dividend stock. Just one year ago, the defense and aeronautics giant offered investors a 2.3% dividend yield, just a bit below average yields on the Dow Jones Industrial Average (^DJI +0.16%).

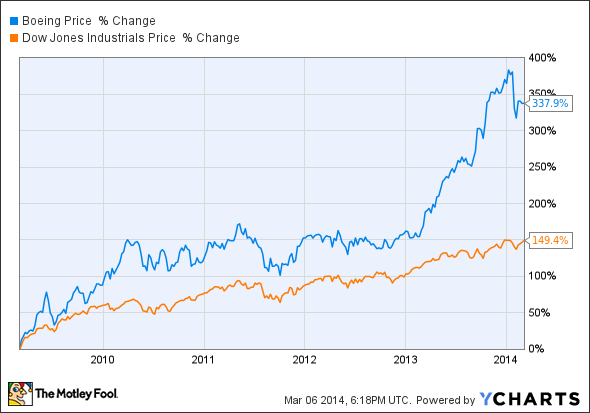

But then something happened. Boeing's yield stood at just 1.7% last night after bottoming out at 1.3% in January. The company boosted its quarterly payouts by 50% in December and that increase took effect today, so the stock is back to the old 2.3% yield again. But dividend investors might still wonder what happened to Boeing's yield over the last 52 weeks.

The answer is of course quite simple -- and a terrific problem to have. Boeing's stock price skyrocketed, driving effective dividend yields way down:

So there's nothing wrong with the dividend itself. Boeing is traditionally a strong steward of shareholder-friendly dividend boosts, and likes to keep payout expenses close to 32% of incoming earnings. This way, Boeing gives itself room to react to short-term market changes while rewarding shareholders for a long-term commitment to the stock.

Boeing's soaring share prices ride on the back of the 787 Dreamliner's strong sales and future-proof design philosophy. This jumbo jet comes with high fuel efficiency and low maintenance costs, and promises to be the backbone of Boeing's passenger aircraft output for decades to come.

If that's not enough of a long-term thesis for you, Boeing is preparing to bid on a new long-range bomber design for the U.S. Air Force. That contract will require many as 100 units at $550 million a pop, adding up to a $55 billion total value -- to be delivered in the middle of the 2020s. This potential catalyst is not for day traders.

Boeing is clearly planning to be around for the long haul, and looks likely to keep growing dividends consistently as well. There's nothing wrong with this dividend policy, and few investors complain about market-crushing share price gains like the ones that keep Boeing's yields down right now.