Photo: Young Productions

"Warren Buffett has lost his investing ability."

That's what they try to tell you. Don't listen. He is still one of the best investors of all time.

Over the weekend Berkshire Hathaway (NYSE: BRK-A)(NYSE: BRK-B) released its annual report which includes the valuable letter from Warren Buffett. It is full of facts, figures, wisdom, quotes, and quips, but there was one number that stood above all the rest.

The trend ends

Last year, Buffett revealed in his annual letter there had never been a five-year stretch in which Berkshire Hathaway failed to beat the S&P 500 when comparing its book value growth to the appreciation of the stock market. Yet he cautioned; "the S&P has now had gains in each of the last four years, outpacing us over that period. If the market continues to advance in 2013, our streak of five year wins will end."

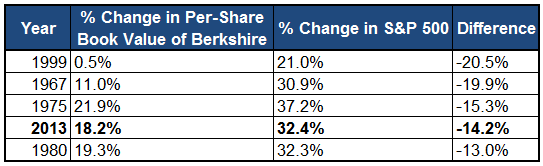

Although Berkshire Hathaway posted a staggering 18.2% growth in its book value per share in 2013, it was far surpassed by the 32.4% growth seen by the S&P 500 last year. This gap of 14.2% was the fourth largest difference in the 49 year history of Berkshire Hathaway:

Source: Company Investor Relations.

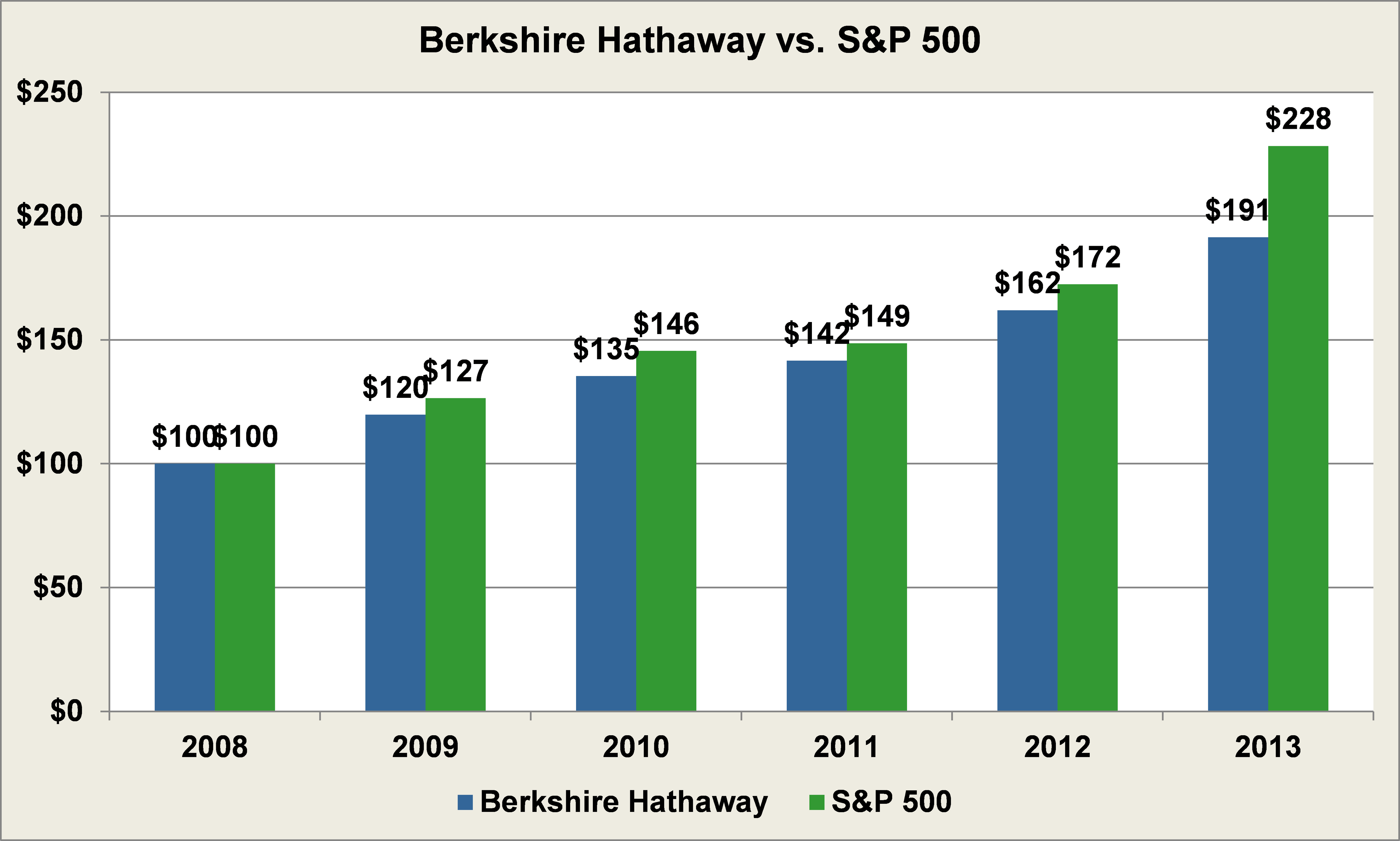

This now means for the first time in the company's history, Berkshire Hathaway fell short of the five year return of the S&P 500. $100 invested in the book value of Berkshire Hathaway at the end of 2008 would now be worth $191, and $100 invested in the S&P 500 would be worth $228:

Source: Company Investor Relations.

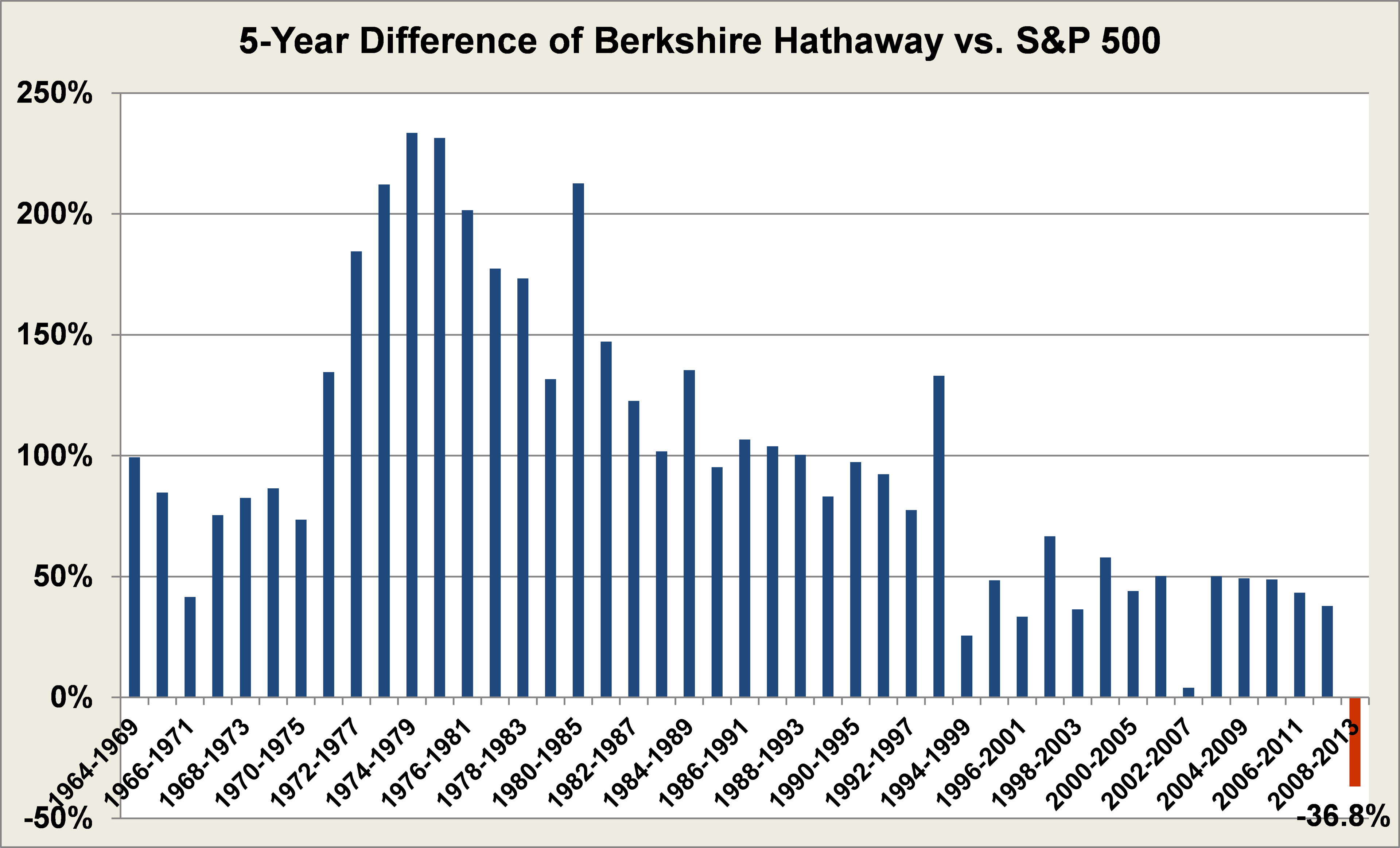

This difference of 37% on the initial investment is a staggering discrepancy between the historical performance of Berkshire Hathaway relative to the S&P 500 when gauging the five year returns:

Source: Company Investor Relations.

While it is easy to think this now indicates Buffett has lost it and should no longer be trusted for investment advice, it turns just the opposite is true.

106,701%

Over the last 49 years, Buffett beaten the S&P 500 by staggering amount -- delivering a return of 693,518% compared to 9,841%.

Yet more interesting is the number: 106,701%. This is the difference between the total overall gain of the book value per share of Berkshire Hathaway from 2012 (586,817%) to 2013 (693,518%).

Said differently, while the book value per share of Berkshire Hathaway "only" grew by 18%, it rose from $114,214 to $134,973, a difference of more than $20,000. When you consider the original book value was $19 per share, the gain in book value Berkshire Hathaway delivered in 2013 would've represented a return of more than 1,000 times the original investment to sit at nearly $135,000 today.

By comparison, if the same $19 was invested in the S&P 500, the gain of 32% would've represented a growth of just a little over $450 on an original $19 investment made in 1964. This difference displays the power of compound interest, but it also shows how remarkable Warren Buffett's performance truly is.

Warren Buffett has long extolled the values of buy-and-hold investing, and it can be clearly seen through this example that true investment gains are not made over the course of a few weeks or months, but instead years. That is why Buffett's success shouldn't be evaluated over the relative return of his company over just one or even five years, but instead over decades of investing.

In his 1988 latter to shareholders Buffett said, "when we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever," which reminds us all investing for the long-term is truly when astounding gains can be made.