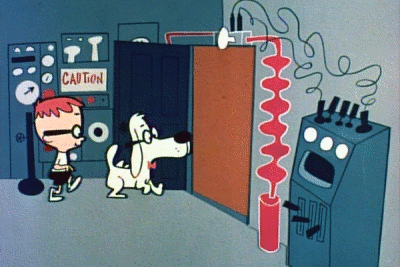

The famous WABAC machine from The Rocky and Bullwinkle Show. Source: Wikimedia Commons.

A softer-than-expected performance for Mr. Peabody & Sherman has some investors selling shares of DreamWorks Animation SKG (DWA +0.00%). That's a mistake, Fool contributor Tim Beyers says in the following video.

The stock is down about 3.4% over the past week and more than 18% year-to-date. If only executives at distributor Twenty-First Century Fox (FOXA +0.00%) had Mr. Peabody's famous WABAC Machine. They could go back in time and boost their marketing push for this latest try at developing a new animated franchise for the DreamWorks/Fox team-up.

Or maybe it wouldn't have mattered. Mr. Peabody & Sherman cost $145 million to produce, putting box office break-even at $580 million in worldwide grosses. Only eight of the 28 DreamWorks Animation-produced epics tracked by Box Office Mojo have reached that plateau. And of those, only two were franchise openers: 2008's Kung-Fu Panda and 2013's The Croods.

Tim says the sell-off in DreamWorks stock is still undeserved.

Mr. Peabody & Sherman gets strong ratings from audiences at Rotten Tomatoes, earning a covered "A" CinemaScore. That should help build buzz for the film and boost walk-in traffic in the coming weeks. The stock, meanwhile, trades for less than half the long-term earnings growth rate analysts expect -- a bargain that won't last forever.