IBM (IBM +0.90%) took charge of the Dow Jones Industrial Average (^DJI 0.95%) on Monday morning, climbing 1.8% higher and adding 22 points to the blue-chip index. At the time of writing, Big Blue's boost nearly made the difference between the Dow itself showing green or red for the day.

The catalyst behind IBM's respectable move is a single analyst note, which also shines a favorable light on fellow enterprise software and services specialists Red Hat (RHT +0.00%) and Infosys (INFY +0.28%). Strangely, only two of these three sector neighbors are trading up on the analyst bump.

Analyst firm UBS took a broad look at the tech sector and walked away impressed with the risk/reward ratio in a handful of tickers.

UBS already held a buy rating on Red Hat before this tech roundup. For that reason, it's not surprising to see the stock trading largely in line with the market today -- UBS didn't really say anything new here.

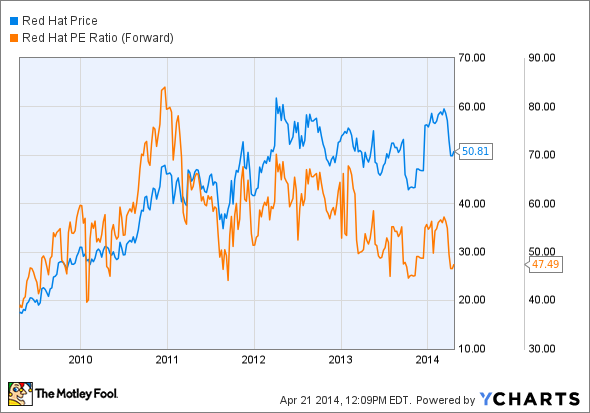

In a separate note at the end of March, UBS reiterated its buy rating and nudged the one-year price target on Red Hat from $63 to $64 per share, in line with Street consensus. Analyst Brent Thill noted that Red Hat's order bookings look strong, pointing to hefty revenue in upcoming quarters.

Margins are under pressure, but Thill reasoned that this is pretty normal for a vendor moving forecfully into a freh market opportunity. In Red Hat's case, we're talking about "re-platforming of the IT infrastructure landscape" onto cloud-based platforms, including the OpenStack framework in which the company is taking a leadership role.

I couldn't agree more. In fact, I took advantage of the buying window that opened when Red Hat reported earnings in March and short-term traders panicked over the deflating margins. So I'm a Red Hat shareholder now, and my investment thesis aligns with the bountiful risk/reward analysis that UBS presented today.

Infosys makes the UBS list thanks to the combination of strong results and soft guidance in last week's earnings report. Like Red Hat, Infosys trades far below Wall Street's consensus pricing. Also like Red Hat, Infosys is restructuring its overall strategy to take advantage of this exploding opportunity in cloud services.

This is another case of weighing short-term pain against long-term gain. Infosys is not a favorite with day traders, but investors with a longer view could take advantage of an attractive discount right now.

Granted, Infosys traded at lower price-to-earnings and price-to-free cash flow ratios in 2012 and 2013, but that was before the strategy shift. Not to flog a deceased bronco, but Infosys shares a rare market opportunity with Red Hat at this point.

I bought Red Hat shares because I think it's worth the risk of high P/E ratios, but more conservative investors could take a closer look at Infosys instead.

Or maybe they should dive right into IBM.

Big Blue isn't just jumping on the cloud market, but is losing an age-old dependency on hardware sales altogether. Mainframe systems have become an extremely lumpy market, and IBM is selling the core of its midtier server products to Chinese peer Lenovo.

IBM wants to sell fewer of these low-margin hardware systems and more ultraprofitable software and services. Image source: IBM.

This will allow IBM to refocus on far more profitable operations such as software licenses and support services. This is the legacy that CEO Ginni Rometty is building. IBM shares are taking a hit from the short-term pain of deconstructing an end-to-end business model that was the envy of the information technology industry.

But again, look beyond the temporary pain and you should see big gains as IBM bounces back with rejuvenated margins. This is UBS' view of IBM, and you should certainly hear echoes of its Red Hat and Infosys analyses.

It's a time of upheaval in the IT industry, and UBS just shone a spotlight on some of the leaders in the new wave. Yes, even if one of them is more than 100 years old.