Make no mistake about it, 2014 is essentially a building year for Ford Motor Company (F 4.19%). Ford's taking on its most aggressive launch schedule to date, doubling the number of global new model roll-outs and tripling the number of launches in North America. Some investors headed for the doors as soon as Ford said its pre-tax profits were likely to be lower this year as costs associated with these new launches ballooned. Ford has topped earnings expectations each of the last four quarters, and I expect it to do so again when it reports on April 25. Here are two things investors should look for.

Ford CEO Alan Mulally. Source: Ford Motor Company

Bittersweet departure

Bloomberg recently reported that sources inside Ford are preparing an announcement to name Mark Fields as the company's next CEO and reveal Alan Mulally's official departure date. It's possible the company will discuss more details during the conference call, and if it doesn't you can guarantee many analysts and media folk alike will hit the subject during the Q&A session.

The news of Mulally's departure isn't necessarily what investors should focus on -- rather it should be what, if any, his new role will be. It's believed that Mulally isn't planning to disappear entirely and plans instead to take over a corporate governance or business policy type of position, according to Bloomberg's sources. The question is whether that role will be with the Blue Oval or elsewhere. If emerging details emphasize that Mulally will still have some corporate input at Ford, it will help calm investors worried that Ford's corporate culture will revert back to the old ways of poor cooperation and executive infighting.

"A lot of great CEOs leave and then there's chaos behind them," Executive Chairman Bill Ford said April 16 on Bloomberg TV. "Alan and I have talked about that -- the importance of the final act of a great CEO is having a great transition."

Mulally is largely credited with saving Ford from a bankruptcy filing that its two Detroit competitors couldn't avoid. Ford lost more than $30 billion between 2006 and 2008, and under Mulally's guidance was able to return to profitability in 2009 -- a very impressive turnaround. I fully expect the transition to Mark Fields to be as flawless and painless as possible, and if additional details are released during the first-quarter presentation investors would be wise to listen.

Another topic of great importance to Ford investors will be its losses in Europe.

Profit black hole

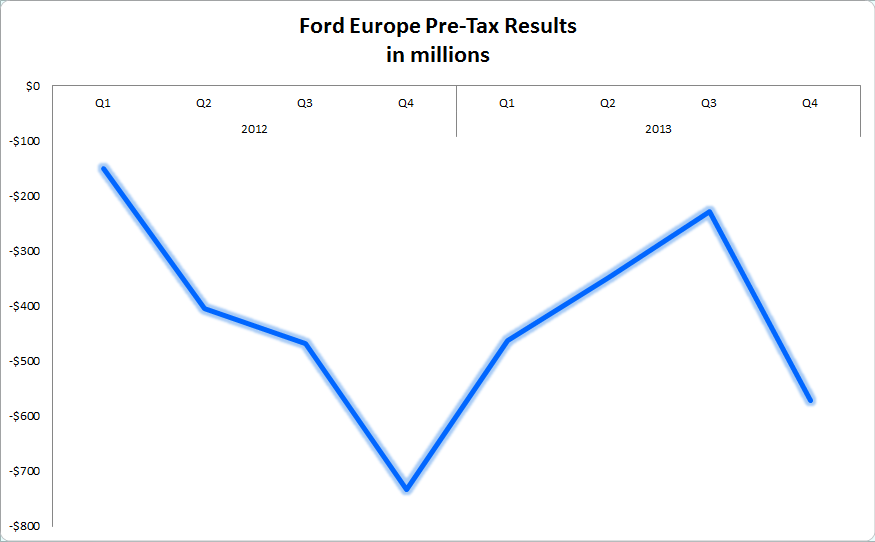

Europe has been a drag on Ford's profitability over the last few years, and that's putting it nicely. Consider that over the last two years alone the region devoured $3.3 billion of Ford's net income. To put that in perspective, had Europe not devoured those profits and simply broken even, it would have added nearly $0.50 per share annually to Ford's earnings, a big deal considering Ford posted EPS of $1.76 and $1.42 over the previous two years.

Ford remains on schedule to break even in Europe next year, and the company continues to gain market share amid tough industry conditions. In the first quarter Ford recorded a strong 11% increase in sales that topped 326,000 vehicles. That marks the 10th straight month of year-over-year sales gains in Europe.

Furthermore, Ford continues to increase its percentage of high-quality sales. Ford considers sales to retail customers and fleets as "high quality" compared to sales from daily rentals and dealer registrations. During the first quarter the company's sales mix in Europe improved to 73% "high-quality" sales versus 27% to daily rentals and dealer registrations.

Source: Ford's quarterly presentations

The graph above illustrates the inconsistency in Ford's losses in Europe last year. Much of last quarter's decline was due to seasonality and one-time charges. Ford's results in Europe will almost certainly be better than last year's first-quarter results from the region, and if the company can trim losses to $200 million -- or better -- investors should be thrilled with the progress.