In April, KGI analyst Ming-Chi Kuo released what he believes to be Apple's (AAPL 0.93%) new product roadmap for the remainder of 2014. If Kuo's timeline proves to be correct, Apple investor's may have some reason for concern, not about the new products being introduced, but about the risk that Apple may again see product supply shortages over the holidays. Conversely, Samsung (NASDAQOTH: SSNLF) has taken a different approach with respect to product updates, and the company's plans should result in a much smoother, more successful transition.

While analyst forecasts should be taken with a grain of salt, Kuo's past Apple predications have been among the industry's most reliable. Lending further credence to Kuo's predictions is the product roadmap's resemblance to previous Apple product update timelines.

Apple's product update cycle

Initially, iPad updates occurred in the first quarter of the year, but in 2012, updates were moved to the third quarter, along with the iPhone update. The new product cycle increased the scale and complexity of the company's product logistics; Apple now has approximately 60 days before the holidays to align both iPhone and iPad supply with global demand. This is not an insignificant task, considering the 51 million iPhones and 26 million iPads sold during the 2013 holiday sales period. With iPhone and iPads accounting for 76% of the company's revenue, it's not unreasonable to question the supply risks Apple is taking with the company's aggressive, late-year product updates.

Product shortages for the 2012 and 2013 holiday shopping seasons

The most recent example of revenue consequences of Apple's product cycle occurred with the September 2013 release of the Phone 5c and iPhone 5s. With no sales history for the iPhone 5c, Apple was unable to accurately forecast demand for either model. As a result, Apple experienced a shortage of the company's most important product, the iPhone 5s, throughout the holiday sales season.

Product shortages for Apple haven't been confined a single holiday quarter. During the company's January 2013 conference call, management reported that the company had experienced shortages of the iPhone 4, iPhone 5, iPad Mini, and iMac throughout the 2012 holiday sales period.. A tough year-over-year revenue comparison, exacerbated by lost product revenue, led to a 12% drop in Apple's stock price immediately following the company's earnings announcement.

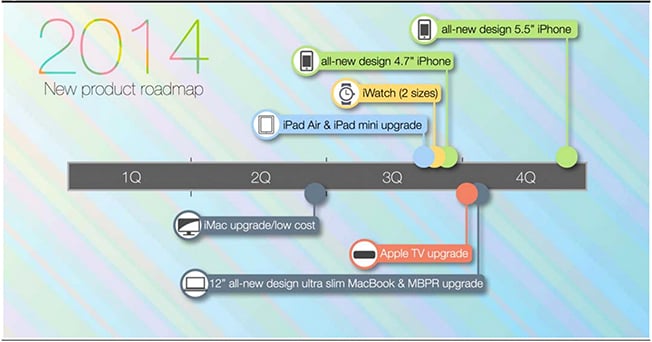

It is increasingly likely, two months into the second quarter, that Apple is again pushing the majority of the company's product updates and new product introductions into the third and fourth quarter of this year. Kuo's 2014 new product roadmap, shown below, illustrates the logistical challenges and supply risks Apple could face heading into the 2014 holiday shopping season. Along with updates to existing products, the company is likely to be introducing a 4.7-inch iPhone 6 and an iWatch, two products without sales history, which increases the risk of inaccurate demand forecasts.

Source: KGI

Samsung's Approach

Samsung, Apple's biggest competitor, separates the release of the company's two premium smartphone models by approximately six months. The Galaxy S was released in the spring, while the Galaxy Note should hit the market in the fall. The six months between launch dates simplifies the company's logistics, allowing Samsung more time to align product supply with market demand.

What to watch

Tim Cook's hints and media reports indicate a busy third quarter for Apple, with anticipated updates to the iPad line, the launch of the iPhone 6, and the introduction of the iWatch. Additionally, the fourth quarter is likely to bring product updates for the Apple TV and Macbook Pro, plus the introduction of a 12-inch Macbook. The past two holiday quarters have shown the challenges Apple faces meeting demand for its products over the busy holiday quarter. Apple investors should be aware of how the company's aggressive, compressed product cycle increases the risk of supply imbalances, which could result in share price volatility in the first quarter of 2015.