The S&P 500 has an incredible 114% total return since 2009. While this is great for investors that were able to cash in, it makes finding investment opportunities harder than it once was. Still, I believe there are terrific values hidden in the insurance industry.

American International Group (AIG 0.11%) and its epic turnaround story has garnered much of the attention, however, ACE (ACE +2.32%) and its strong growth potential shouldn't be overlooked. Today I'll dig into which of these two insurers is the better buy.

Risk management

The goal of any insurer should be to accurately price risk. ACE has consistently outperformed AIG in this most essential of functions.

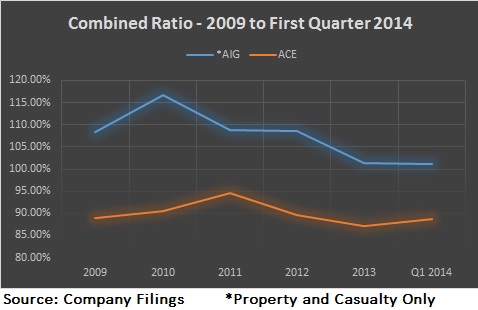

This is clearly shown by looking at the two companies' combined ratios. A ratio below 100% means the company is underwriting profitably -- paying less in claims than it earns in premiums. A ratio above 100% means the opposite, and the company is taking underwriting losses.

ACE has consistently shown strong underwriting compared to its peers. This looks especially true stacked next to AIG.

A higher combined ratio indicates lower prices, and the ability to more easily grow market share. The consistent trend at AIG is towards tighter and tighter underwriting standards, and we should expect the company to push for lower ratios in the future. With that said, ACE's performance and consistency dominates round one.

Investment income

The combined ratio alone doesn't tell the whole story. In between collecting premiums and distributing claims, insurers create profits by investing in long and short-term fixed-income securities -- and to a lesser extent, equities.

Therefore, if a company is great at generating investment income, it can be even more profitable than insurers posting underwriting profits. To judge this, we need to understand the net investment income ratio. The formula shows how efficiently investment income is generated from earned premiums.

After locking in those numbers you can find the operating ratio, which is a measure of the insurers' overall profitability from underwriting and investing.

Put it all together and a ratio above 100% means the company wasn't able to turn a profit through underwriting and investing operations. Conversely, the further below 100% the greater the profitability.

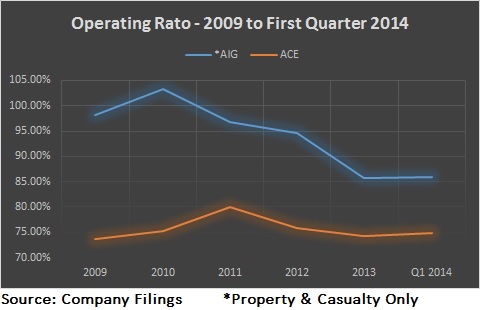

It took a little mathematical gymnastics, but when investment income is added to the equation, it paints a much more favorable picture for AIG. Showing profitability from underwriting and investing in every year but 2010.

AIG's improvements have been substantial, however, I'm giving round two to ACE. Strong underwriting mixed with its solid investing performance gives ACE too much of a head start for AIG to overcome.

Valuation

Price-to-tangible book value allows investors to analyze the value of a company's assets minus liabilities and intangibles such as brands and patents. Since insurance companies are largely asset-based it's a popular metric for this industry.

I like to use this metric in tandem with return on equity, or ROE, -- net income as a percentage of shareholder's equity. Investors should be looking to pay the lowest price-to-tangible book for the greatest ROE.

Following the financial crisis in 2009 AIG was in shambles. More recently, however, we've seen real progress and that's showing in the company's numbers. AIG is still trading at nearly a 30% discount to tangible book value and considering the 9% ROE, that valuation is more than fair despite the company's uncertain future.

ACE, on the other hand, has a larger ROE and a more stable business, which warrants the stock trading at a 40% premium to the company's tangible book value. ACE is more predictable, but you'll pay for it. AIG takes the final round for having a more attractive valuation.

The last word

AIG reported first quarter earnings of $1.6 billion compared to $2.2 billion last year. The fall in income is most likely the culprit for the stocks price decline over the past few days. However, when looking at the bigger picture AIG has made incredible progress, and I think it's well on its way to reclaiming its once strong brand name.

With that said, the company is still very much in turnaround mode, and I believe there's significant risk despite the more favorable valuation.

ACE is in business-as-usual mode. The company has shown strong growth by expanding its global presence -- specifically in the faster-growing economies such as Asia and Latin America. Its continued to develop its non property and casualty lines, which have performed well. Ultimately, I'm favoring the better performer over the better valuation, I see ACE as the better buy today.