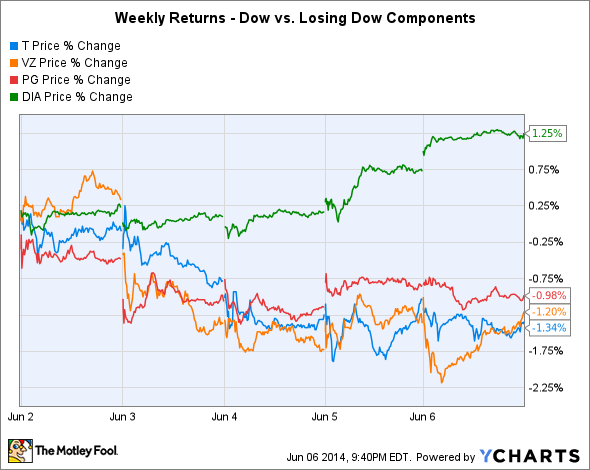

The Dow Jones Industrials (^DJI 0.91%) did well last week, rising more than 1% and reaching new record highs yet again. After a slow start to the year, the Dow has started to gain momentum, and help from the European Central Bank to stimulate the European economy could help jump-start global growth throughout the world. Yet even though the Dow jumped more than 200 points, a few Dow Jones Industrials stocks got left behind, including AT&T (T -0.26%), Verizon (VZ 0.88%), and Procter & Gamble (PG 1.17%).

Dow Jones Industrials Price data by YCharts.

AT&T and Verizon both fell more than 1%, and given that they both represent the major telecom stocks in the Dow Jones Industrials, most of the reasons for their declines were similar. In some ways, the high-dividend Dow telecom stocks act in part like bonds, and as the stock market exploded higher this week, bonds finally started to give up ground. That sent bond yields higher and made dividend stocks like Verizon and AT&T look less attractive by comparison.

Source: National Archives and Records Administration, courtesy Wikimedia Commons.

In addition, both Verizon and AT&T have competitors nipping at their heels from multiple directions. On one hand, within the wireless telecom niche, the Dow components' primary smaller rivals are looking more seriously at joining forces, with a potential merger creating a third U.S. telecom giant that could stand up to both more well-established companies. At the same time, consolidation in the cable industry could challenge the Dow telecoms' ability to compete for video and broadband Internet customers, and investors remain uncertain whether AT&T's merger with a major satellite communications company will adequately address longer-term competitive concerns. Until AT&T and Verizon can convince shareholders that fears of a price war won't actually turn into real problems, the stocks could continue to lag the Dow Jones Industrials.

Source: Procter & Gamble.

Procter & Gamble dropped almost 1%. Defensive stocks in the consumer arena tend to perform best on a relative basis when the Dow and other stock market benchmarks are weak, as investors prefer the stability and dependability of Procter & Gamble and its stable of billion-dollar brand-name products. During strong upward trends in the market, on the other hand, Procter & Gamble doesn't have the same growth potential as some of its Dow peers in faster-growing industries. Even though the consumer giant has worked hard to reawaken growth opportunities in emerging markets and other promising niches, Procter & Gamble shareholders should expect to lag the Dow as long as the bull market continues.

The Dow has made a solid run, but it's overdue for a pullback. If the Dow does fall from record levels, be sure to look to see if these three Dow components play a major role in the decline.