Source: DreamWorks.

After news broke on Jun. 16 that "How to Train Your Dragon 2" reported lackluster box office results during its first weekend in theaters, shares of DreamWorks Animation SKG (DWA +0.00%) plummeted 11% to close at $24.35 before rising nearly 2% the next day. In light of these developments, some investors might be tempted to throw the entertainment company off stage in favor of The Walt Disney Company (DIS +0.37%) or Lions Gate Entertainment (LGF +0.00%), but is it possible that now might be the time to go all-in instead?

Knowing the difference between mediocre and disaster!

For the weekend, "How to Train Your Dragon 2" brought in $49 million. Although this sounds like a nice chunk of change, the fact that it fell 25% short of the $65 million analysts expected should be cause for concern. Because of the relatively poor release, the film will need a strong international opening in order to justify the $145 million required to make the movie.

Source: DreamWorks.

Despite its lackluster performance, the movie did perform better in its opening weekend than its predecessor, "How to Train Your Dragon." In its first weekend, the film raked in $43 million and went on to report box office sales of $494.9 million. Between its box office, home entertainment, and ancillary results, the film contributed $174.2 million for DreamWorks, second only to the $244.5 million recorded by "Shrek Forever After" in 2010.

Is this a chance to buy DreamWorks on the cheap?

Given that the performance of "How to Train Your Dragon 2" wasn't terrible when compared to its prequel, is it possible Mr. Market is overreacting to the news, and DreamWorks makes for a strong long-term play from these levels? To find out, it's important to look back and see how the business has performed in recent years.

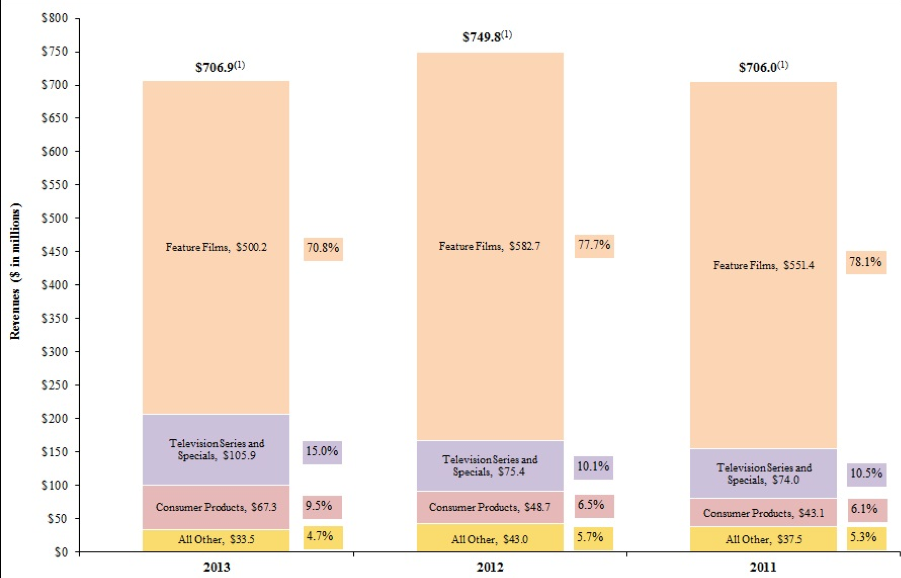

Between 2011 and 2013, DreamWorks saw its revenue stay virtually flat, rising from $706 million to $706.9 million. According to its most recent annual report, this modest uptick in revenue came from a 43% jump in revenue in its Television Series and Specials segment, which rose from $74 million to $105.9 million, and its Consumer Products segment, which rose 56% from $43.1 million to $67.3 million. This was, however, offset by a 9% decline in its Feature Films segment, which fell from $551.4 million to $500.2 million.

Source: DreamWorks.

From a profitability perspective, DreamWorks' performance was even worse. During the past three years, the studio saw its operating income fall 31% from $109.9 million to $76.3 million. The main driver behind this deterioration in profitability was its selling, general, and administrative expenses, which shot up from 15.9% of sales to 27.2% as higher executive compensation, incentive programs, and costs relating to recent acquisitions negatively affected the company's bottom line.

During this same three-year period, rival Lions Gate saw its revenue soar 66% from $1.6 billion to $2.6 billion. Pretty much all of this increase in revenue came from the company's Twilight Saga and The Hunger Games films. From a profitability standpoint, the studio did even better, with operating income skyrocketing 676% from $33.5 million to $259.9 million as higher revenue was complimented by a reduction in the business's cost of goods sold from 57.2% of sales to 52.1%.

Probably the most interesting player in the market, however, was Disney. During this three-year period, the company saw revenue from its Studio Entertainment segment drop 6% from $6.35 billion to $5.98 billion. The drop in sales was due to a 28% drop in Home Entertainment revenue from $2.44 billion to $1.75 billion as its movie unit sales fell precipitously. This was, however, partially offset by an 8% improvement in both Theatrical Distribution and Theatrical and SVOD sales.

Source: Disney.

Even though this performance looks poor, the segment's operating income actually rose 7% from $618 million to $661 million. This rise in profitability for Disney's segment can be attributed to an 8% falloff in operating expenses as well as to a 9% decline in the segment's selling, general, and administrative expenses. Even after adding back unallocated expenses (assuming a pro rata distribution), the segment's operating income managed to grow 4% from $496.6 million to $514.5 million.

Foolish takeaway

Based on the data provided, Mr. Market was anything but happy with the performance metrics posted by "How to Train Your Dragon 2." When you combine these disappointing results with the fact that DreamWorks hasn't necessarily been the poster child for success in recent years, it's understandable for investors to worry. While it's possible that the future could very well be brighter for the business moving forward, a better play might be to consider a stake in Disney or Lions Gate instead.