It's easy to get sucked into the daily headlines and be unduly influenced by them, to the extent that investors narrow their investment horizons into short-term windows. If you are a shareholder, you're probably a little discouraged by Caterpillar's (CAT +1.96%) recent retail sales report -- and it was ugly, to be sure. The heavy-machinery maker faces some difficult quarters during the next year, but let's look at exactly where the company's business is at and why some investors remain optimistic.

Top and bottom lines

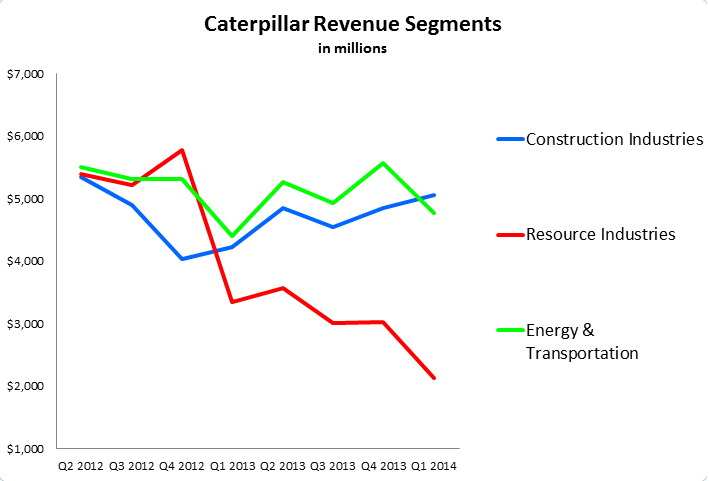

Looking at Caterpillar's top and bottom lines over the last eight quarters will offer a better grasp to what extent plunging sales in the company's resource industries segment have affected its business.

Graph by author. Source: Caterpillar SEC filings.

Eight quarters ago, Caterpillar's revenues were generated very evenly by its machine, energy, and transport business, or M&ET, which is Caterpillar's business outside of its finance division. M&ET is separated into the the segments highlighted in the graph above: construction industries, resource industries, and energy and transportation. As the quarters progressed, Caterpillar's overall business took a hit and China's commodity pricing and mining weakness sent the company's resource industries segment plunging -- with the bottom for revenue still looming.

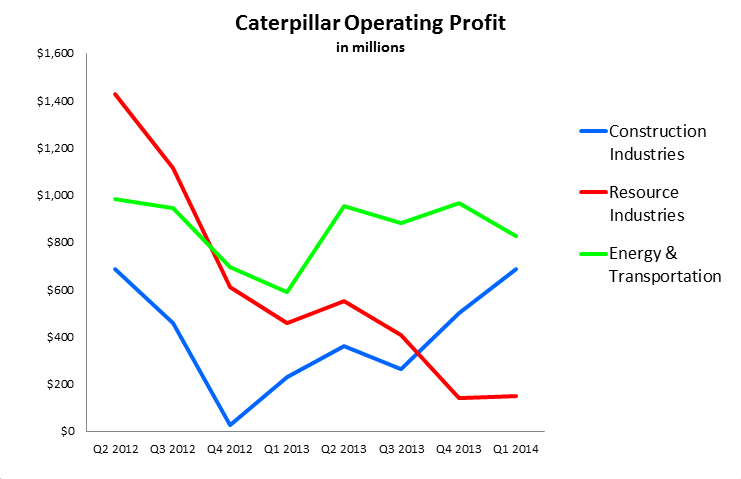

More telling, though, is Caterpillar's operating profit over the same eight-quarter time frame.

Graph by author. Source: Caterpillar's SEC filings.

While Caterpillar's revenue stream was generated evenly by its business segments, eight quarters ago resource industries hauled in the big bucks -- nearly as much operating profit as construction industries and energy and transportation combined. Fast-forward to today and resource industries' profits are a tenth of the other two segments combined, as of last quarter.

Ultimately, over the last eight quarters Caterpillar has witnessed its machine, energy, and transportation revenues and operating profits both plunge 25% and 51%, respectively. Yet, since 2012, Caterpillar's stock price has risen 15%. Clearly investors are hoping for a bottoming of Caterpillar's business and a quick rebound once the foreign mining end market picks up and begins driving sales of its heavy machinery again.

Here are a couple of other reasons why investors hang around.

Returning value and cutting costs

One of the best silver linings around these clouds for Caterpillar investors is the company's ability to consistently return value to shareholders. Since the beginning of 2013, through the last quarter, Caterpillar has returned more than $5 billion to shareholders through dividends and share buybacks. More impressive is that, despite a challenging business environment, the company's dividend has increased at a higher percentage each time it was raised. For example, the recent dividend increases check in sequentially at 5%, 13%, 15%, and 17% gains. All in all, Caterpillar's dividend yield of 2.6% is double that of peer Joy Global (JOY +0.00%).

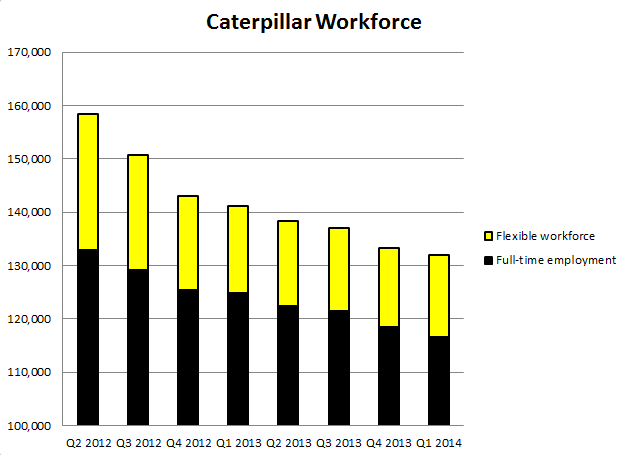

One reason Caterpillar has been able to return value to shareholders is the company's focus on cutting costs. That also played a large role in Caterpillar's machine, energy, and transport businesses producing $1.9 billion operating cash flow in this year's first quarter. Cost-cutting involves layoffs, an unpopular but necessary part of business that Caterpillar has used to offset declining operating profits.

Caterpillar's workforce has steadily been cut. Source: Caterpillar's annual reports.

Investors have also been intrigued by Caterpillar's hunt for new revenue from its dealers. The company believes its distributors are completely whiffing on between $9 billion and $18 billion in revenue annually because of poor communication, lack of execution, and inconsistent customer experience. Management has given dealers until the end of the year to develop a three-year plan to capture those potential sales. Gaining even a fraction of those potential incremental sales could generate incremental bottom-line profits.

Looking ahead

Caterpillar posted better than expected earnings in the first quarter, and the company boosted its 2014 earnings outlook by $0.25 per share to $6.10, excluding restructuring costs. Despite the company's ability to return value to shareholders, significantly cut costs, and develop a strategy to maximize revenue through its dealerships, a continued slump in sales and operating profit could set Caterpillar up for a sell-off late in 2014. After last year's 30% rise in share price, and the 19% increase so far this year, Caterpillar investors are optimistic for a rebound that already seems priced in.