AT&T (T +0.21%) is a unique dividend stock. The telecom giant doesn't just sport the highest dividend yield among the 30 Dow Jones (^DJI +1.21%) components. It's also one of just nine stocks on the blue-chip index that have raised their payouts without fail for the last 25 years or more.

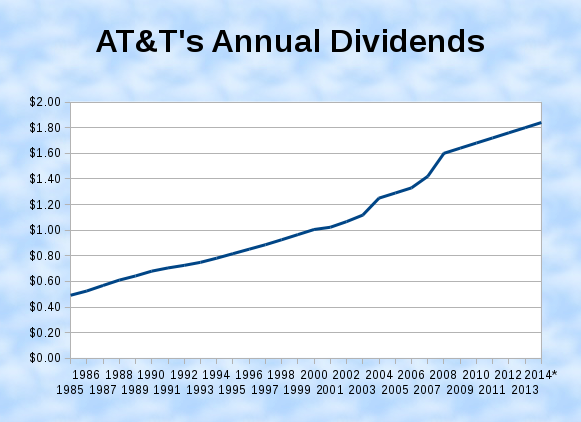

Ma Bell goes beyond the call of duty, in fact. Twenty-five years of consecutive dividend increases qualify AT&T as a dividend aristocrat. But AT&T has actually increased its payouts each year since 1986, just two years after the company started sending out quarterly dividend checks.

Data source: AT&T. Dividends adjusted for share splits. *Estimated payouts for 2014 assuming $0.46 payouts per share in August and November, consistent with policies in recent history.

This unique combination of a juicy 5.2% dividend yield and a 28-year history of unwavering increases is a double win for income investors. High and rising dividends are a great way to build wealth in the long run.

However, AT&T isn't the perfect dividend stock. Not by a long shot, in fact. While the telecom has consistently increased its payouts, the boosts have never been particularly large.

Over the 28-year streak, the average annual increase has been just 4.4%. If you expected the rise of mobile telephony to have loosened Ma Bell's tight purse strings, you'd be wrong: the average level of dividend growth fell to 3.9% over the last decade. Not even the smartphone boom helped, as the payout lifts dropped further to 2.3% annually over the last five years.

The latest increase was a minuscule 2.2% boost.

It's not like the company couldn't afford to strengthen its payout increases. AT&T has consistently spent between 54% and 72% of its trailing free cash flow on dividend payments over the last decade, leaving some room for further increases.

However, big increases don't seem likely.

First, AT&T has invested a lot of money in share repurchases recently. Over the last four reported quarters, buybacks added up to $8.3 billion while dividend checks amounted to $9.6 billion. That's out of $13 billion in training free cash flow, forcing the company to grab nearly $5 billion from its cash reserves to keep both policies going.

Since AT&T rarely holds more than about $4 billion in cash equivalents, that meant taking on debt to finance this buyback spree without slashing dividend payments.

AT&T isn't exactly itching to share its cash flow with investors.

Furthermore, AT&T has some expensive ambitions that don't necessarily include rewarding current shareholders.

The company tried and failed to acquire T-Mobile (TMUS 0.03%) in 2011. The collapse of that proposed $39 billion blockbuster deal triggered a $3 billion breakup fee in cash, plus another $1 billion worth of wireless spectrum transferred to the smaller partner. That's a lot of money, earmarked not to go anywhere near the pocketbooks and portfolios of AT&T's shareholders.

Now the story is repeating itself, as AT&T wants to pay $67 billion for satellite TV broadcaster DIRECTV (DTV +0.00%). This time, the companies have agreed to leave breakup fees out of the transaction, unless DIRECTV sells itself to a higher bidder before AT&T can close the deal. Potential rejection of the merger by U.S. government regulators won't trigger any sort of cash payments either way.

The DIRECTV combination is expected to free up $1.6 billion in annual cash savings by 2017, so you could argue that this particular deal would increase AT&T's dividend payment headroom.

Then again, the cash-plus-stock agreement would dilute current AT&T shareholders' holdings by 15% while adding billions of dollars to Ma Bell's debt balance. Granted, interest rates on corporate debt are near their all-time low, and interest payments are already part of that supposedly increasing free cash flow.

But debt repayment come after the normal calculation of free cash flow, and goes in the same category as -- you guessed it -- dividends and buybacks.

With or without the proposed DIRECTV deal, I'd be downright shocked to see AT&T boost its payouts past the bare minimum. Expect another $0.01 increase of quarterly payouts per share next year, which amounts to another 2.2% boost. The company can't grow payouts any less than that without splitting its shares again, unless AT&T wants to look exceedingly cheap by adding a fraction of a cent to the quarterly policy.

Yes, AT&T has a long history of dependable dividend increases, but they're painfully small and there's no end in sight to this order of priorities. Serious income investors can do far better, even without stepping outside the Dow.