Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Terra Nitrogen (NYSE: TNH) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Terra Nitrogen's story, and we'll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Terra Nitrogen's key statistics:

TNH Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

7.5% |

Fail |

|

Improving profit margin |

41.4% |

Pass |

|

Free cash flow growth > Net income growth |

39.4% vs. 51.9% |

Fail |

|

Improving EPS |

10.9% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

58.6% vs. 10.9% |

Fail |

Source: YCharts. * Period begins at end of Q1 2011.

TNH Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

5% |

Pass |

|

Declining debt to equity |

No debt |

Pass |

|

Dividend growth > 25% |

(37.8%) |

Fail |

|

Free cash flow payout ratio < 50% |

N/A (MLP exemption) |

N/A |

Source: YCharts. * Period begins at end of Q1 2011.

How we got here and where we're going

Like its share price and most of its core metrics, Terra Nitrogen has fallen from the technically perfect score it earned on the first assessment it went through in 2013. The seeds of a slowdown were scarcely evident then, but they've become hard to miss today as all of Terra's key metrics have dropped to lower growth rates -- and in the case of dividend payouts, have actually declined -- earning the fertilizer MLP a decent, but not great, four out of eight passing grades. Commodity MLPs must often contend with economic forces beyond their control, but can Terra regain its footing and again become the dividend darling it once was? Let's dig deeper to find out.

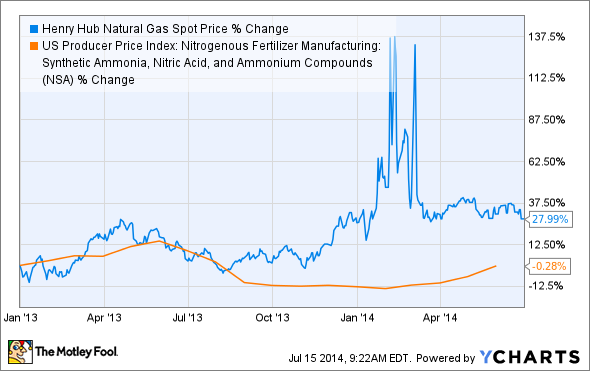

Investors have had to deal with an unusually high degree of volatility from Terra over the past two quarters, which is undoubtedly frustrating after the stock became the second-best stock of an entire decade following the dot-com crash -- it was a 123-bagger from 2002 to 2012! Fool writer Bob Ciura (among others) has highlighted the fact that Terra is subject to a number of different factors it simply can't control, from the cost of its natural-gas inputs to the conditions out on the farms where its fertilizer is put to work. While ammonia-based fertilizer prices now seem to be stabilizing after last year's plunge, Terra still has to grapple with natural gas prices that remain nearly 30% higher today than they were two years ago:

Henry Hub Natural Gas Spot Price data by YCharts

The net effect of this has been to smash profit margins for major natural gas fertilizer makers. On this measure, at least, Terra has held up far better than its close competitor Rentech Nitrogen Partners (NYSE: RNF), which has endured a steep collapse in profit margins into the red over the past two years:

TNH Profit Margin (TTM) data by YCharts

The drop in ammonia fertilizer prices has also hit CVR Partners (UAN 1.13%) hard on the bottom line, even though its primary input -- petroleum coke -- is derived from raw material that has not endured the same price growth (the price of a barrel of oil based on the West Texas Intermediate price has grown about 13% in the past two years). The only related fertilizer company to not endure similar drops in the latest quarter, CF Industries (CF 0.28%), is likely to see its trailing 12-month profit margins shrink again over the course of the year as the one-time impact of the recent sale of its phosphate-fertilizer business moves further into the past. In fact, when we examine gross margins instead, CF's profit-margin performance over the past two years is already worse than all but Rentech's.

As a result, all of Terra's MLP fertilizer peers have slashed their dividend payouts over the past two years. CVR Partners' payout is 25% below what it was in 2012, and Rentech's is a fraction of the dollar-plus quarterly payouts it boasted two years ago. CF, which isn't a MLP, had the wiggle room to boost its payouts a year ago, but its yield is still the lowest of the pack. To drive home the point of these data points, Fool energy specialist Matt DiLallo points out the inherent hazards of investing in tightly focused MLPs with variable payouts, particularly when (as in Terra's case) their primary asset is tied to the cost of a single input processed at a single location. He notes that such MLPs shouldn't form the core of any retirement portfolios, and it's hard to disagree in this instance, since Terra seems to have reached the limits of its once-meteoric growth.

Putting the pieces together

Today, Terra Nitrogen has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.