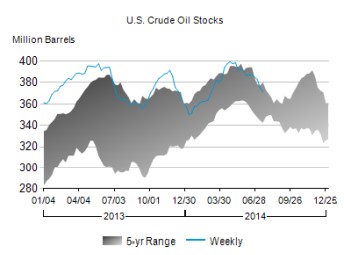

U.S. crude oil supplies fell by 4 million barrels (1%) in the week ending July 18, according to an Energy Information Administration report (link opens a PDF) released today.

After supplies fell by 7.5 million barrels the week before, this report marks a full month of weekly declines. According to The Wall Street Journal, growing economies for both the consumer and industrial sectors were a primary pull behind this latest decline. Imports and inputs declined by 20,000 and 28,000 barrels per day, respectively, from the previous week's levels. Overall inventories are up 1.9% in the past 12 months.

Source: eia.gov

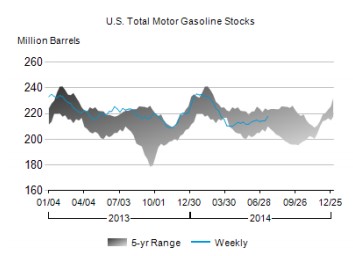

Gasoline inventories expanded by 3.4 million barrels (1.6%) in the most recent week after edging up 0.2 million barrels the week before. Demand for motor gasoline over the last four-week period was down a seasonally adjusted 1%. In the last year, supplies have shrunk 2.2%.

Over the past week, retail gasoline pump prices fell nearly a nickel to $3.59 per gallon.

Source: eia.gov.

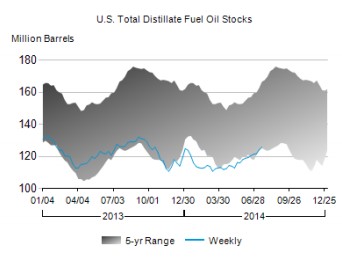

Distillates supplies, which include diesel and heating oil, increased by 1.6 million barrels (1.3%) for the eighth-straight week of expansions. Distillates demand for the last four weeks was down a seasonally adjusted 6.2%. In the past year, distillates inventories have declined a slight 0.5%.

Source: eia.gov.