Halfway through 2014, a review of its latest earnings results shows that one business at Bank of America (BAC +1.73%) has sustained its impressive results from last year.

The big business that could

One of the most intriguing businesses at Bank of America is its investment banking unit known as Global Banking. This division earns money from issuing loans to giant companies, as well as advising those clients when they issue stock or bonds, or decide to buy other companies.

The business had remarkable success last year, topping the industry in the revenue earned from advising clients for investment banking purposes.

Source: Company Investor Relations.

Not only was it leading, but as shown in the chart to the right, it was growing as well. The business notably added the number of clients with expansive relationships that brought the bank more revenue. Its focus wasn't simply to add to the number of clients -- since 2010 Global Banking has seen its total client count fall by 55% -- but instead to develop deeper relationships that are more profitable.

In addition, while it is Bank of America, the Global Banking division has also seen impressive expansion in its international presence. In 2009, just 6% of its earnings came outside of the United States. But in the first quarter that number stood at 32%.

This success didn't exclusively propel the Global Banking business. The bank also noted that referrals of individuals to its Wealth Management unit were up a staggering 63% year over year.

So 2013 was an undeniably good year for the Global Banking unit as its pretax, pre-provision profit rose by 11% to $8.9 billion.

With the latest results in, it turns out the first six months of 2014 have represented much of the same.

The strong results this year

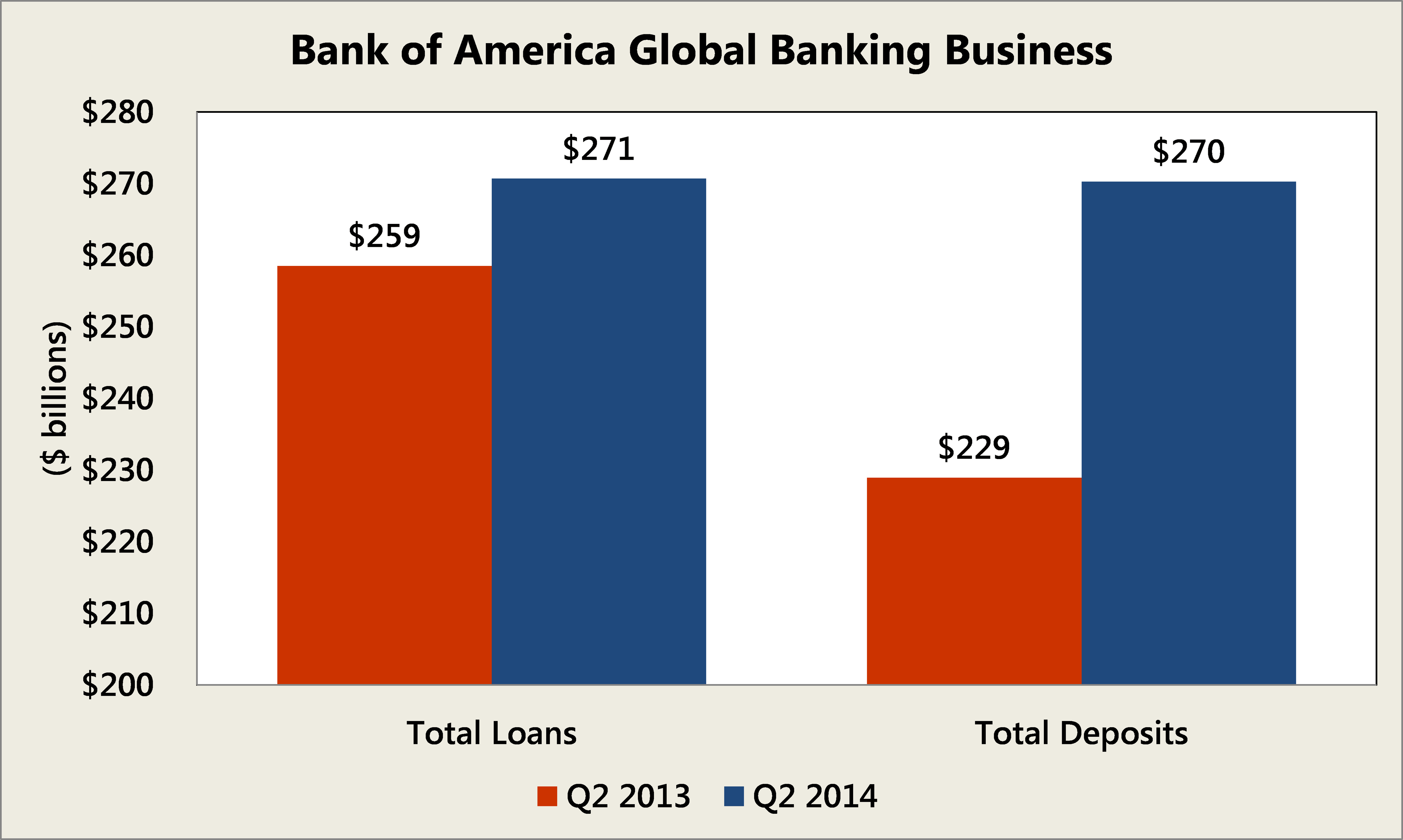

There are a number of impressive results from the Global Banking unit, but a few stand out. The first is that its loans and leases rose by nearly $12 billion year over year to stand at $271 billion by the second quarter of 2014. Even more impressive, deposits were up a staggering 18%, or $41 billion:

Source: Company Investor Relations.

Unsurprisingly, its net interest margin -- the difference between what it pays on deposits and other forms of borrowing versus what it earns on assets like loans -- has fallen from 3.18% to 2.63%. As rates rise in the future, its margin will expand and its profits will rise from having more loans.

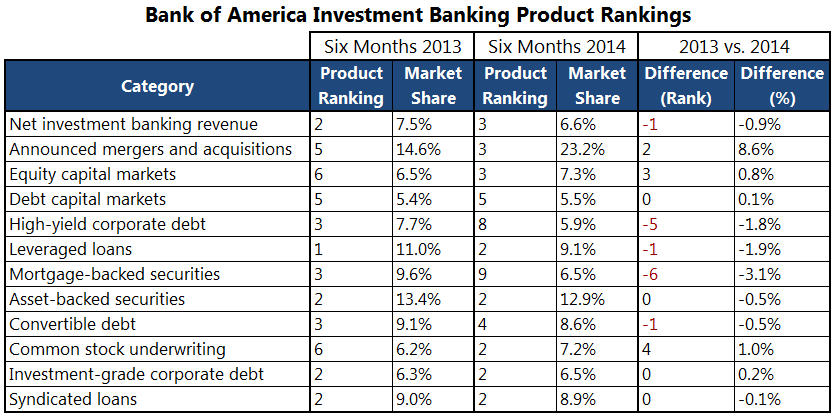

In addition, while the bank has lost some ground in its global ranking for market share of investment banking products, it has also had a number of improvements:

Source: Company Investor Relations and Dealogic.

One of the most surprising -- and encouraging -- items is the stunning growth it has realized in the mergers and acquisitions category. Its market share rose from 14.6% in the first half of 2013 to 23.6% for the corresponding period of this year.

While its net share of the revenue is down slightly, that it has seen such an impressive gain in such a growing category is a reason for optimism. And knowing that Bank of America's total investment banking fees have risen 5% year over year suggests even the slight drops aren't an overall cause of concern.

The Foolish takeaway

As my colleague Jordan Wathen noted, there is a lot to like about Bank of America and its businesses. With the Global Banking unit still delivering impressive results, it is undeniably one business that should still give investors a reason for optimism about the future of the bank.