Editor's Note: this article previously included a quote from Edahn Golan, a diamond industry analyst. This quote has been removed at the request of Mr. Golan.

As the U.S. stock market hits new highs, fears of a market peak have many investors looking to alternative investments such as gold, silver, or rare commodities such as art or even collectible cars.

As Tony Richards, who has served as CEO of Lamborghini and on the board of Maserati explains, "People like tangible investments, rather than boring paper in a bank somewhere."

One of the most tantalizing physical objects one can own is diamonds, and in April of 2013, Sotheby's (BID +0.00%) made headlines when it sold a 74.79-carat white diamond for $14.2 million, far above its pre-sale estimated price of $9-$12 million. Just one month later, Christie's sold a 101.73-carat diamond for $26.7 million. These auctions represent a trend of rising diamond prices that have Wall Street taking notice.

"Supply will probably increase 2% to 3% per year over the next decade, versus demand of about 7% per year," according to Martin Rapaport, chairman of the Rapaport Group, an international network of companies that tracks the prices of diamonds world wide.

Demand growth is being driven by the booming middle and upper classes of China and India, who fueled an 18% growth in global sales in 2011, according to Bain Capital. That year, a 3% contraction in global supply resulted in a 31% spike in the price of rough diamonds (24% for polished stones), and research firm Wealth X estimates that prices will surge another 20% by 2017.

So, does that mean investors should think about cashing in on the diamond boom? The answer is complicated by the nature of the diamond industry.

Global diamond market is complex

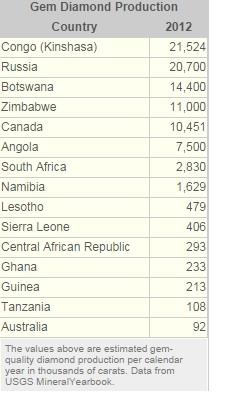

The majority of diamonds produced each year are not of high enough quality for jewelry and are instead used for industrial purposes. This includes diamond windows (for lasers), low-friction bearings, and as hardening and abrasive agents used in drill bits in the energy industry. Globally, annual jewelry (which account for 30% of global diamond use) is a $72 billion market that has tripled in the last 25 years.The above map shows the 15 largest diamond-producing nations in the world. As you can see, the majority of diamonds (65%) are produced in Africa, where the mining of rough diamonds contributes $8.5 billion annually to the continent's economy.

The trouble with investing in diamonds

According to industry analysts it would be very difficult for individual investors to invest directly in physical diamonds, partially due to the markup that occurs at each step of the refining process as well as at the retail level.

It's also because diamonds, like fine art or collectible cars, are each unique. According to Brent Fykes, senior Investment Partner for GenSpring, an asset management firm for individuals with $20+ million to invest, "Each stone is very unique [...] An ounce of gold is an ounce of gold, but it's not like that for diamonds."

In addition, Mr. Rapaport explains there are five key aspects to investing in diamonds: price, transparency, quality assurance, transaction costs, and liquidity. Investors should have a detailed knowledge of each and how it affects the price of diamonds prior to investing, which requires substantial sums of money.

"Our company deals with people who have $100,000 or more to invest."

How can you invest in diamonds

Two diamond-backed ETFs have been proposed by Index IQ and GemShares, who are undergoing evaluation by the SEC. However, industry experts are dubious as to whether these funds, which would hold 1-carat white diamonds, will be able to succeed. "I think the funds will have a hard time getting confidence in pricing," explains Fykes, because the appraisal of something with such unique physical properties makes standardized, established pricing, such as exists in gold and silver markets, challenging.

This kind of ETF would also face the issues of a highly illiquid market, which could make investors leery. As Brent Fykes explains, "If you have to sell diamonds back to the dealer, it's kind of like selling a used car... you know you'll take a haircut."

Are there better alternatives for small scale investors?

Why the world of diamonds contains the potential for profit, I believe it's one that most investors should avoid. This is because currently the only way average investors can gain direct exposure to this market is through physically buying diamonds from a jeweler and the mark up charged by these retailers means that future profits are unlikely.

Investments in diamond miner Rio Tinto (RIO 1.05%) only offer a small exposure to this market, since the miner is predominantly involved in iron and aluminum production.

Bottom line

The world of diamond production and investment is a complicated and specialized one, much like the market for other high-end collectibles such as fine art. Investors interested in the market may want to keep an eye on diamond based ETFs such as those mentioned above but should avoid investing in them until they have proven their investment model is sound, which could take several years.