Activision Blizzard (ATVI +0.00%), the world's largest video game publisher, has enjoyed record profits over the past few years. The blockbuster series Call of Duty has been a big driver of the company's success, along with the subscription-based World of Warcraft, and the recently released Destiny, one of the most anticipated games in quite some time, has been touted as the next billion-dollar franchise from Activision.

ATVI Operating Income (Annual) data by YCharts

But all is not well at Activision Blizzard. The company's heavy dependence on a small number of blockbuster games poses a huge risk to the company's future, and shareholders should be aware that the record profits of the past few years may not be sustainable. Here are three big problems facing Activision that could derail the company and the stock.

Call of Duty's slow decline

The Call of Duty series, which became wildly popular in 2007 with the release of Modern Warfare, peaked in 2011. In that year, Modern Warfare 3 moved nearly 30 million units across the major consoles and PCs, making it one of the best-selling video games of all time. The trend since then, however, has not been so kind.

Source: VGChartz.

The Call of Duty games released in 2012 and 2013 both sold fewer copies compared with the previous year, with Ghosts posting the lowest sales numbers for the franchise since 2008. The next iteration of the series, Advanced Warfare, is set to be released this November, and while it will probably be one of the best-selling games of the year, preorders for the game are reportedly tracking 50% behind Ghosts.

If the decline of the Call of Duty series continues this year, one of Activision's biggest cash cows will be at risk of drying up. Call of Duty is responsible for a significant portion of Activision's annual profits. In fiscal 2013, three franchises -- Call of Duty, Skylanders, and World of Warcraft -- accounted for 80% of the company's revenue and a significantly higher percentage of its operating income. In short, the decline of Call of Duty could have severe negative effects on Activision's bottom line.

No replacement for World of Warcraft

World of Warcraft is a subscription-based massively multiplayer online role-playing game, or MMORPG, where users pay a monthly fee to play the game. World of Warcraft became a massive hit for Activision, rising from just 1.5 million subscribers at the beginning of 2005 to 12 million at the game's peak in 2010. Millions of players paying around $15 per month to play the game is a recipe for enormous profits.

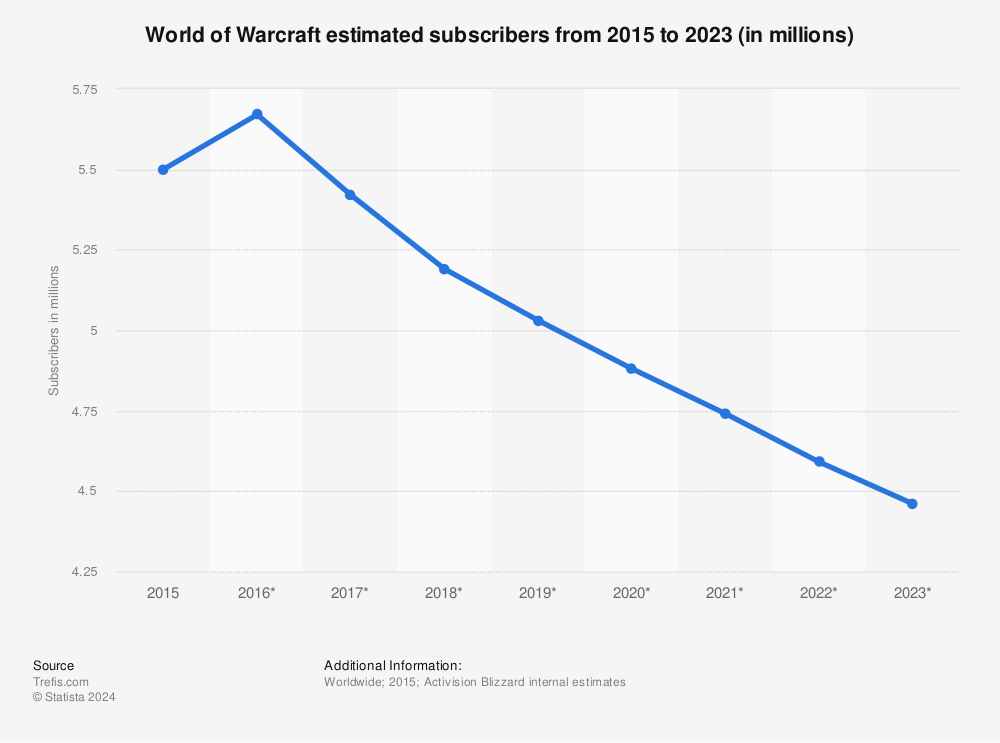

Since World of Warcraft's peak, however, the number of subscribers has been steadily declining, now approaching half of the game's peak subscriber base:

Source: Statista.

It's clear that many players have moved on from World of Warcraft, and while the game will still generate quite a bit of revenue and profit for Activision, its continued decline will need to be counteracted by something else. The company had been working on a new MMO game, codenamed Titan, since 2007, but that game was recently canceled after the Blizzard portion of Activision Blizzard decided to go in a new direction.

The popularity of subscription-based games appears to be waning, and that's not great news for Activision's bottom line. The silver lining is that Blizzard has found success with free-to-play games, notably the collectible card game Hearthstone: Heroes of Warcraft. The game has racked up 20 million registered players, and Activision has stated that the game has far exceeded its initial expectations of generating $100 million per year in annual revenue. Hearthstone makes money with in-game transactions.

More free-to-play games are coming from Blizzard, and if they find the same success that Hearthstone has achieved, it could soften the blow caused by the continued decline of World of Warcraft. But the hole left by World of Warcraft is a big one, and free-to-play games probably won't be able to completely replace the lost revenue.

Destiny could be a problem

Destiny, the highly anticipated game created by the developers behind the Halo series and published by Activision, was released last month to mixed reviews. Activision invested an astonishing $500 million in the game, proclaiming that it would be the company's next $1 billion franchise, and over the next decade plenty of sequels, expansion packs, and downloadable content is expected.

Destiny generated more than $325 million in sales during its first five days of availability, and VGChartz puts the current unit sales across all platforms at about 5.6 million. This is a solid result, but the mediocre reviews could be problematic for the future of the series. Vince Ingenito at IGN summed up his review of the game with this:

Destiny looks and plays wonderfully, but too many of the other promises it makes get left unfulfilled.

For Destiny to be a success for Activision in the long run, the game needs to keep players interested, and the big risk is that players will move on to something else and be less willing to buy additional content later on. The game's Metacritic score in the mid-70s is not a good sign for Activision, and while the game can certainly be improved, the path to making Destiny a $1 billion franchise may be more difficult than the company originally thought.

Final thoughts

Activision is facing a few key headwinds that could adversely affect its profitability in the coming years. The decline of Call of Duty and World of Warcraft, coupled with the unimpressive launch of Destiny, could lead to lower margins than the company achieved during the past few years. The stock has already started to decline since Destiny launched, down about 14% in the past month, and the pain may just be starting for investors.