Recently, I wrote about why long-term investors could expect shares of Williams Companies (WMB +2.71%), and its MLPs, Williams Partners (NYSE: WPZ) and Access Midstream Partners (NYSE: ACMP), to soar during the coming years. However, recently, the markets have been rocked by sharp drops and rising volatility that have seen shares/units of energy-related investments, like Williams and its MLPs, plunge as much as 15%-20% below their recent highs.

While I still believe in the strong long-term investment thesis behind Williams, investors should know the three categories of risks that could result in shares/units dropping, both in the short term and beyond.

I'm not predicting these events will anytime occur soon, or even at all. I simply want to point out those things that might result in short- or medium-term losses so you can be better prepared as a shareholder/unit holder of Williams Companies or Williams Partners.

Sustained decline in global natural gas prices

European Union Natural Gas Import Price data by YCharts.

This is the biggest threat I think Williams investors, and almost all investors in midstream MLPs, should be aware of. One of the largest growth catalysts for Williams Companies and Williams Partners -- soon to be merged with Access Midstream Partners while retaining its name -- is its $29 billion current and potential backlog of natural gas midstream projects.

These projects, which represent just a drop in the bucket of the $640 billion in projected midstream investments needed by 2030, offer amazing potential growth of cash flows, distributions, and unit prices for MLPs like Williams Partners. However, those figures are predicated on a series of assumptions, including growing demand for natural gas, both domestically and abroad.

For example, according to Wood Mackenzie, U.S. gas demand is expected to rise 36% in the next decade due to U.S. power plants switching from coal to natural gas, as well as a boom in exports of liquefied natural gas, or LNG.

Source: Williams Companies Barclays CEO-Energy Conference presentation

This growth in demand is expected to be met by a 58% growth in gas supply by 2030, courtesy of booming production from the Marcellus and Utica shale formations. Williams Companies and Williams Partners are planning on greatly expanding their midstream infrastructure to take advantage of these trends because, according to the U.S. Energy Information Administration, or EIA, the price of natural gas is likely to rise in the long term, to $7.65/thousand cubic feet by 2040.

However, natural gas prices are highly volatile, as the following chart illustrates.

European Union Natural Gas Import Price data by YCharts.

Should the global economy slow or fall into a recession, then gas prices in Japan, Europe, and America could fall, as well. This could greatly diminish the incentive for oil and gas companies to increase production, and reduce demand for midstream gas infrastructure such as Williams provides.

How likely is such an event? The IMF, in its most recent World Economic Outlook, cut its 2014 global economic growth forecast by 11%, citing falling manufacturing activity in China, Europe, Japan, and South Korea.

While slowing global economic growth wouldn't likely result in gas prices falling over the long term, should the world fall into a prolonged recession, then energy prices could remain depressed long enough for Williams' long-term gas transportation contracts to reset at far lower prices.

Again, I'm not predicting such a crisis will occur; however, a recent survey of U.S. economists found that 52% of them think a Chinese debt crisis is possible within the next few years, so it is a risk you should be aware of.

Market "correction"

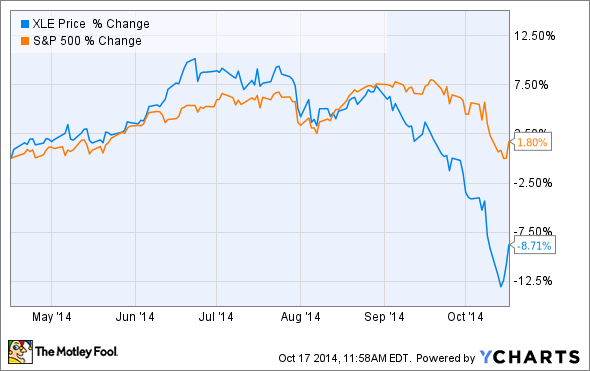

Even if slowing economic growth or a global recession doesn't sink energy prices over the long term, in the near term, market panic may result in shares/units of energy investments crashing relative to a falling market.

This chart clearly shows that the Energy Select Sector SPDR ETF, a representation of the broader energy sector, can be far more volatile than the general market. In fact, while historically the S&P 500 suffers a 10% or greater decline once per year, it's been 28 months since its last correction.

In addition, according to Yale Professor Robert Schiller, this market, after the third strongest bull market in history, is 55.9% overvalued in terms of its CAPE, or cyclically adjusted P/E ratio, which measures the average 10-year P/E ratio adjusted for inflation.

No one can predict market crashes, and I'm certainly not claiming that one is imminent. However, given the global macroeconomic situations we are now experiencing, you should be aware of the possibility of such an event.

Should the market enter a correction and become a bear market then stocks, in general, would plunge, and energy stocks such as Williams might be even more severely affected. While in the long term, I believe this would represent a stupendous buying opportunity for income investors, the immediate financial pain could lead investors to panic and sell at the exact wrong time. As Warren Buffett has taught us, if you can "be greedy when others are fearful," then your likelihood of outperforming the market in the long term is greatly increased.

Company-specific risks

There are three risks that I see potentially negatively affecting Williams Companies and Williams Partners. The first is a failure of management to correct its safety record, which shows 14 accidents during the previous 11 years. During the last conference call, President and CEO Alan Armstrong stated that the company was delaying the restart of its Geismar facility by six to eight weeks to install improved safety systems.

I view this as a positive sign that Williams is serious about preventing industrial accidents in the future, something that is imperative given its $29 billion potential backlog of projects, which the company naturally wants to complete as soon as possible. However, if it cuts corners on safety, then regulators at the Federal Energy Regulatory Commission, or FERC, who must approve its future projects, may not allow Williams to complete its backlog of projects without costly delays to address safety concerns.

The second risk I see is less likely -- a failure of the Access Midstream/Williams Partners merger, which management expects to close this quarter. Williams Companies has announced its intention to raise its dividend by 32% upon the closing of the merger, and the current share price is pricing in this dividend hike. In the unlikely event that it is delayed or doesn't occur, investors could expect the share price to decline as a result.

Finally, failure to achieve the expected 15% dividend growth and 10%-12% distribution growth for Williams Companies and Williams Partners, respectively, is the third company-specific risk that investors should be aware of.

Management claims it can accomplish this growth while maintaining a strong coverage ratio of approximately 1.1 for Williams Partners. However, Williams Partners has had difficulty covering its fast-growing distribution in the past. If the MLP fails to achieve its lofty distribution growth projections, or has to cut the payout due to lack of distribution coverage, then the share/unit price could fall as a result.

Takeaway

Williams Companies and Williams Partners represent two of the best long-term income investments you can make in the energy sector. However, all investors should be aware of both the promise and potential perils of the companies they own. A long-term decline in energy prices, a market crash, or company-specific problems such as industrial accidents or a failure to achieve its distribution guidance, are the likeliest risks facing Williams Partners today.