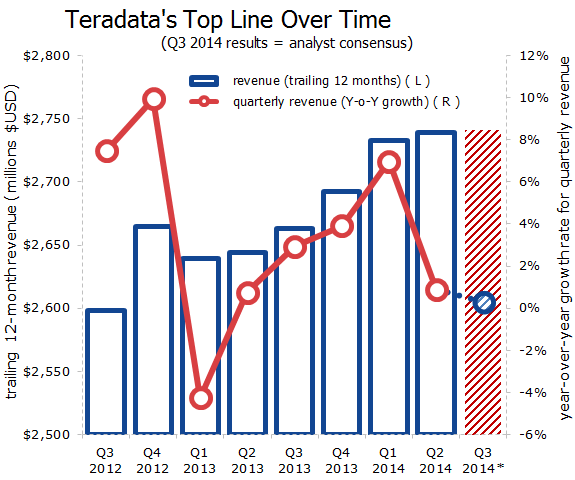

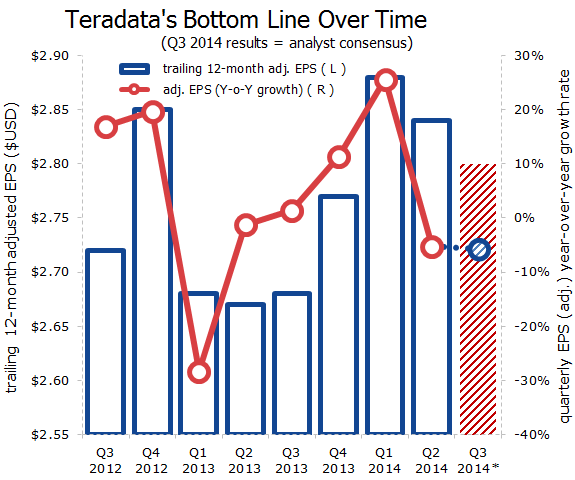

Teradata (TDC 1.84%) is scheduled to report third-quarter earnings before the opening bell on Thursday, Nov. 6. Wall Street's analysts expect the data-storage and analytics specialist to report earnings of $0.66 per share on revenue of $667.6 million, which would be essentially flat year-over-year on the top line and nearly 6% lower year-over-year on the bottom line. Teradata does not provide quarterly guidance, but it currently expects full-year revenue to be at the "lower end" of a 3% to 7% growth range over 2013's $2.69 billion revenue -- let's say $2.8 billion (4% growth) -- and for adjusted EPS to be at the lower end of a $2.85 to $3.00 range.

Expectations are low heading into Thursday's report, but much of the market's bearishness seems baked into Teradata's share price, which has yo-yoed in a narrow range all year to settle into a year-to-date loss of 8%. Since peaking in late 2012, Teradata's shares have ground their way to a loss of nearly 50%. Investors have largely abandoned hope of growth, since Teradata's P/E ratio has tracked its share price very closely since late 2012, which is to be expected, as the company's GAAP EPS is largely unchanged since that time.

Despite low expectations, investors will have plenty to pore over on Thursday to figure out if Teradata's "average is over," to use a phrase made popular by economist Tyler Cowen. Let's take a look at some of the key metrics to watch for in Thursday's report.

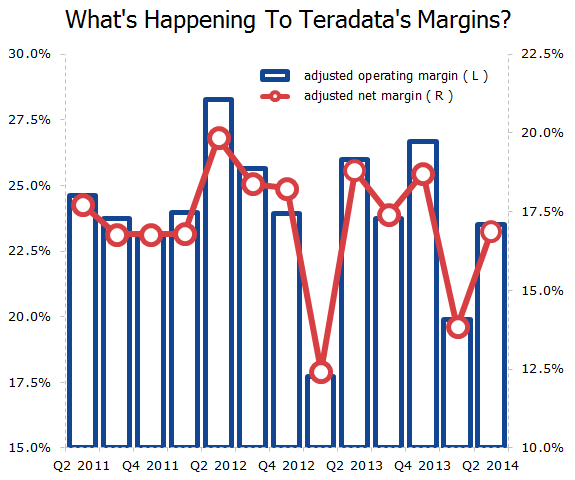

Can Teradata stabilize its wobbly margins?

Over the past few years, Teradata has gradually managed to nudge its top line higher:

Sources: Teradata earnings reports.

But its EPS -- on both a GAAP and an adjusted basis -- has struggled to make new highs. The all-time high in trailing 12-month adjusted EPS, set in the first quarter of 2014, was a mere 1% higher than the prior trailing 12-month high set at the end of 2012. In between these two records, Teradata's EPS seemed to stagnate, and it appears that Teradata is now repeating this same unwelcome sequence of events in 2014:

Sources: Teradata earnings reports.

The problem, as is usually the case when a company's bottom-line growth doesn't closely track the growth of its top line, is that Teradata's margins have been somewhat erratic over the past few years. Gross margins have been fairly stable in the 55% range on both a GAAP and an adjusted basis, but quarterly operating margins have gone from over 28% (in mid-2012) to less than 18% (in early 2013), making stops seemingly everywhere in between:

Sources: Teradata earnings reports.

This isn't exactly a positive sign for investors who have endured an extended stretch of barely there revenue growth. When a company can only boost its quarterly revenue at rates tracking inflation, cost controls and other belt-tightening efforts become increasingly important when it comes to showing improvements on the bottom line. Nor is there necessarily any discernible pattern to this variation. The first quarter showed weak margins in 2013 and 2014, but 2012's first quarter was roughly even with earlier quarters on both operating and net margin terms. The second quarter of 2012 was Teradata's best quarter, margin-wise, but the same quarter in 2014 had weaker margins than any quarter (except the two lousy first quarters) since the start of 2012.

Analysts expect Teradata's third-quarter EPS to decline year-over-year while revenue stays roughly the same, which implies that we're in for another quarter of somewhat underwhelming margins. Improving these margins for several consecutive quarters would give investors hope that Teradata can improve its fundamentals even if it can't nudge its revenue much higher from here. A company with flattish revenue doesn't have much of a bull case if its EPS is flat, too.

Will any of Teradata's core segments break through?

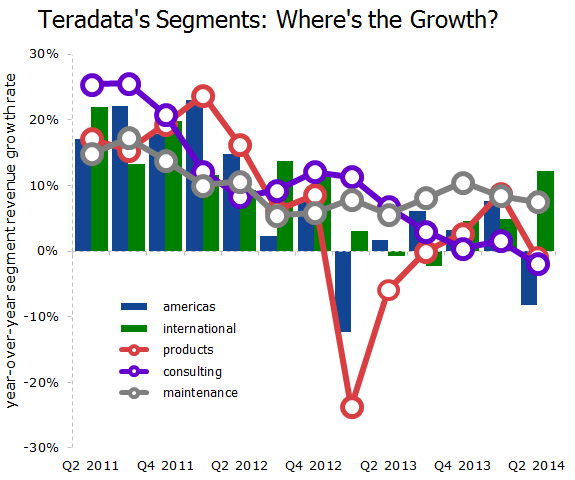

Many companies have segments that might have substantially different growth rates. Some may be small but booming, while others contribute the lion's share of company revenue but are in long-term decline. Teradata's segments, which are separated by both sales category and sales geography, are a bit different. With the exception of a few quarterly anomalies, all of Teradata's segments have followed the same pattern from higher to lower growth rates over the past few years:

Sources: Teradata earnings reports.

The only real surprise in the second quarter was that Teradata's international sales were up by double digits year-over-year while its North American segment declined. Company executives warned investors not to expect this to be the start of a trend during their second-quarter earnings call, pointing out that the segment completed a few deals ahead of schedule and noting that this had the effect of producing results that are "not as robust" as hoped for during the third quarter. International revenue is likely to fall back in line with the trend and North American revenue will probably rebound, and nothing will change in the big picture.

None of Teradata's segments seems to be driving its growth to a much greater degree than any other. Sure, the company's products segment has been in the dumps, but services (consulting and maintenance) revenue has only grown by an average of 5.6% for each of the past six quarters, which isn't enough to reaccelerate overall growth. Revenue from the Americas has averaged no growth over those six quarters, but international revenue has grown by an average of only 3.6% per quarter. Nothing has been really bad, but on the other hand, none of Teradata's segments have been really good, either.

Investors should watch Teradata's segments for any sign of sustained acceleration, but they may be disappointed in the third quarter. Teradata's international segment is the only candidate for such momentum, as it has three consecutive quarters of larger year-over-year growth rates. However, if management's warnings hold true, we may be lucky to see that segment's revenue draw even with its results from the year-ago quarter.