Digital Realty Trust (DLR 0.49%) and other data-center real estate investment trusts (REITs) find themselves at the fascinating intersection of the fast-paced and ever-changing world of big data and the steady and stable stream of property REITs. A look at the recent company overview for Digital Realty provides two important numbers its investors must be aware of.

2.5% -- 3%

Technically the first number for investors to be aware of is actually a range, but it is nonetheless critically important to know.

One of the interesting things about REITs is that their financial performance can be quite predictable. The leases offered to tenants are often long term and have predetermined annual increases in rental revenues. In this regard, Digital Realty is similar.

But the fascinating thing about Digital Realty is that its leases contain provisions that require rental rates to rise between 2.5% to 3% on average, which is well above the typical rent raises that some of the more typical property REIT investors may be accustomed to evaluating.

For example, popular REIT Realty Income notes that its leases -- which are for properties used primarily in different retail industries -- on average have 1.5% same store rent increases.

This difference may seem small but, as is often the case when it comes to money, it really adds up. A tenant who just signed a 12-year lease worth $100 million annually Digital Realty would pay $134 million in the 10th year given an annual rental rate increase of 3%. However, if that lease was with Realty Income, the tenant would expect to pay $116 million in the 10th year.

Of course, this is not an apples to apples comparison, because leasing the property for a convenience store is very different from leasing for a data center. While Digital Realty and other companies like it are REITs by name, certain aspects of their business are very different than what many of us are used to seeing. In addition, our example also reveals the possible growth opportunities available to Digital Realty if it is able to maintain its higher revenue run rate into the future.

33%

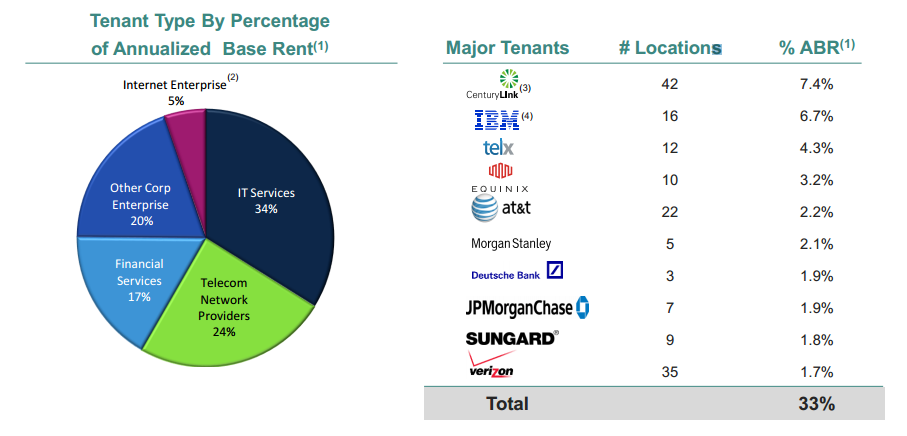

The next number to know is 33%, which is the amount of the total rent Digital Realty receives from its 10 largest tenants. In the same light, and just one percentage point higher, another important number is 34%, which is the amount rent it receives from its largest single industry:

Source: November 2014 Digital Realty Company Overview

Having an appropriate amount of diversity in the composition of customers is important for companies in any industry, and REITs are no exception. One of the most popular aspects of property REITs is their general stability, which could be threatened by a high level of dependence on a single tenant.

While the top two tenants, CenturyLink and IBM, accounting for more than 14% of total revenue is a tad concentrated, it isn't high enough to warrant great concern.

It may seem as if Digital Realty is a risky investment because it only has a few companies that use its properties, but the reality is that it has over 600 tenants across a host of industries. On top of that, Digital Realty maintains strong diversity among those tenants, which should assuage risk-based fears.

The Foolish bottom line

Two numbers alone don't warrant an investment decision, but they do provide a glimpse into what makes Digital Realty so intriguing. More work needs to be done to decide what the future may hold for Digital Realty and its investors, but these two numbers reveal it is certainly off to a good start.