With a 3.8% yield, McDonald's (MCD -0.08%) is one of the highest paying dividend stocks in the Dow. But that has more to do with a slumping share price than a growing payout. The fast food giant just earned itself a third straight appearance in the Dogs of the Dow list, having underperformed the market again in 2014.

Meanwhile, dividend increases have slowed to a crawl lately. After a 15% boost in 2011, income investors' raises are down in the single digits these days. Last year's 4.9% nudge was the smallest since before the financial crisis.

Annual raises of McDonald's quarterly dividend. Source: Company Financial Filings.

Following earnings

Investors can't really fault the company for being stingy. After all, McDonald's dividend policy is just following the same path as its earnings growth. Profitability has taken a big hit since 2012 as customer traffic levels dive and as comparable store sales fall.

With earnings growth down, McDonald's dividend is actually climbing faster than its profits. In fiscal year 2013, for example, per share earnings only grew by 4%, while the dividend increase was 5%. The company has kept up its payout hikes even in the face of declining profit growth. But that can't last forever.

McDonald's payout ratio is up to an uncomfortably high 73% of the past year's earnings. A payout ratio around 50% is normal for most of the market, and anything well above that is usually a red flag for dividend investors.

MCD Cash Dividend Payout Ratio (TTM) data by YCharts

Shareholders shouldn't expect a quick earnings rebound, either. Profits were flat in the most recent quarter as comps tanked by a further 3% in the U.S. market. CEO Don Thompson said in a press release that the company's challenges have "proven more formidable than expected and will continue" into the current quarter.

Cash is king

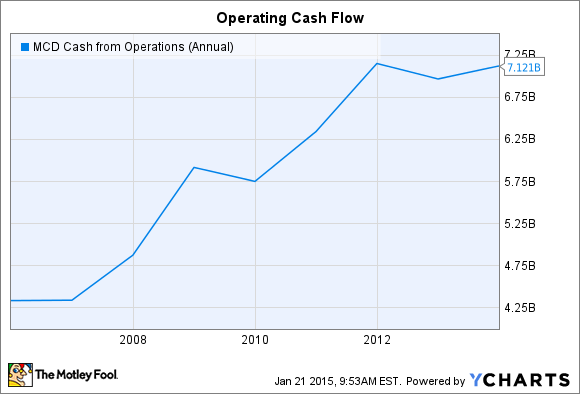

Still, McDonald's has a few good options for raising capital to fund increasing returns to shareholders. For one, the burger giant remains a cash generating machine. Operating cash flow was $5.2 billion through the first three quarters of 2014. That was a full $3.4 billion above the company's commitment to capital expenditures -- things like store renovations and new restaurant launches.

The good news for investors is that while profitability is down, operating cash flow is right on pace with the prior year and chugging along near all-time highs.

MCD Cash from Operations (Annual) data by YCharts

McDonald's also has access to cheap bonds and can take on basically as much new debt as it wants at ultra low rates. And the company can raise cash by refranchising its restaurants. McDonald's expects to sell more than 1,500 of its 7,000 company-owned locations to franchisees by the end of next year. Sure, that strategy will pressure sales growth. But it should also boost profitability and keep the cash reserve pile growing.

Management last year set a target for cash returns to shareholders through 2016 that amounts to almost $7 billion per year. In 2014 that spending was almost evenly split between dividends and stock repurchases.

Thanks to its many sources of capital growth, McDonald's should have no problem hiking its spending on both those categories in the next few years. That would be true even assuming earnings don't bounce back to strong growth. Still, with an uncomfortably high payout ratio, dividend investors shouldn't count on anything like the hefty double-digit raises that we saw just a few years ago from McDonald's.