The average offshore oil driller has lost half its market value in just six months, and several stocks are down more then 75%. For investors with the right temperament, the urge to go scavenger hunting can be irresistible.

I applaud such investors -- but I also warn them against relying on common financial metrics to evaluate these stocks. To avoid mistakes, consider five factors that don't always show up in the financials.

1. Backlog

Offshore drillers work on contracts ranging from a few months to years. Contracts are often signed in advance, and the company's contract backlog measures how much future revenue the company has coming.

|

Oil Rigger |

Contract Backlog ($b) |

Backlog / revenue |

|---|---|---|

|

North Atlantic Drilling (NYSE: NADL) |

$6.3 |

5.63 |

|

Transocean Partners |

$2.3 |

4.18 |

|

Seadrill (SDRL +0.00%) |

$18.3 |

3.84 |

|

Vantage Drilling |

$2.8 |

3.34 |

|

Rowan Drilling (RDC +0.00%) |

$5.4 |

3.27 |

|

Diamond Offshore (DO +0.00%) |

$8.2 |

2.96 |

|

Pacific Drilling |

$2.7 |

2.79 |

|

Atwood Oceanics (ATW +0.00%) |

$3.0 |

2.72 |

|

Transocean (RIG +3.32%) |

$23.6 |

2.50 |

|

Ensco (ESV +0.00%) |

$10.9 |

2.10 |

|

Hercules Offshore |

$1.1 |

1.10 |

Source: Latest company filings

Riggers come in all different sizes -- Ensco is more than 50 times larger than Hercules Offshore -- so it's useful to compare a company's backlog to its sales. The larger the backlog relative to sales, the less uncertainty there is around future revenue.

But not all backlogs are created equal. Some contracts make it easier for customers to cancel than others. For example, two-thirds of North Atlantic Drilling's reported backlog is in contracts with Russian state oil firm Roseneft -- a deal that, in December, was abruptly put on hold.

2. Rig Fleet

Offshore rigs -- the equipment used to drill under the ocean -- come in all shapes and sizes as well. Rigs can drill in different water depths. Demand has been gradually shifting to deeper water, and those rigs can command higher rates than shallow-water rigs.

Source: Latest company 10-k filings

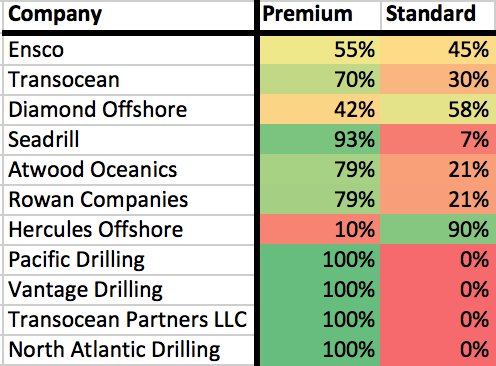

Rigs can also be categorized by how high-tech they are. Newer, spiffier ("premium") rigs can produce oil more efficiently, so they fetch higher rates than older, low-tech ("standard") rigs.

Source: Latest company 10-k filings

Newbuilds

A new deepwater drillship might cost $500 million and take two years to build. That might sound grand in boom times, but when oil prices plunge and demand shrinks, it can become difficult to make those large payments to the shipyard.

Once the rig is built, the company will incur high costs to keep it -- whether or not it is generating any revenue. Seadrill, for example, has a whopping 19 rigs under construction, many of which don't yet have contracts. With demand for rigs weakening, the company is scrambling to find customers. I wouldn't be surprised if they are forced to offer below-market rates to induce customers to bite.

| Company | Current Fleet | Under Construction | % Under Construction |

|---|---|---|---|

| Ensco | 62 | 7 | 11% |

| Transocean | 71 | 12 | 17% |

| Diamond Offshore | 33 | 3 | 9% |

| Seadrill | 52 | 19 | 37% |

| Atwood Oceanics | 12 | 2 | 17% |

| Rowan Companies | 33 | 1 | 3% |

| Hercules Offshore | 59 | 0 | 0% |

| Pacific Drilling | 7 | 1 | 14% |

| Vantage Drilling | 8 | 0 | 0% |

| Transocean Partners | 3 | 0 | 0% |

| North Atlantic Drilling | 9 | 1 | 11% |

Customer concentration

It's difficult to predict how major oil companies such as Chevron and ExxonMobil will respond differently to falling oil prices. Investors ideally want a driller with a diversified base of customers that will shelter profits in case one or two severely cut back spending.

|

Company |

Largest customer |

Top 2 customers |

Major customers |

|---|---|---|---|

|

Transocean |

12% |

22% |

Chevron, BP, Royal Dutch Shell |

|

Hercules Offshore |

15% |

27% |

Chevron, Saudi Aramco |

|

Seadrill |

16% |

30% |

Petrobras, Total, Statoil, XOM, BP |

|

Ensco |

17% |

NR |

Petrobras |

|

Atwood Oceanics |

19% |

34% |

Chevron, Apache, Hess, Noble |

|

Rowan Companies |

26% |

37% |

Saudi Aramco, Total |

|

Vantage Drilling |

28% |

52% |

ONGC, Petrobras |

|

Diamond Offshore |

34% |

NR |

Petrobras |

|

Pacific Drilling |

56% |

78% |

Chevron, Total, Petrobras |

|

North Atlantic Drilling |

57% |

71% |

Statoil, Shell, XOM, Total |

|

Transocean Partners |

67% |

100% |

Chevron, BP |

Source: Latest company 10-k filings. NR = Not Reported.

Companies with larger fleets like Transocean and Hercules Offshore are better able to spread around their customer risk. The three most concentrated riggers on this list each have fewer than 10 rigs -- Transocean Partners owns just three -- making diversifying a challenge.

Putting it together

Extrapolating last year's revenue growth forward doesn't make any sense if this years' newbuilds are not yet contracted. And when a major oil company is embroiled in a corruption scandal (cough, Petrobras), it affects the driller reliant on the defamed company for 25% of its revenue much more than the drilling expected just 2%. This information doesn't show up in revenue growth rates or P/E ratios, but it's absolutely key to making smart, Foolish investing decisions in this space.