Dividend stocks are great. These companies have cash flow coming out the ears, ample capital on the books, and investor interests first in every decision.

But not all dividend stocks are the same, particularly in the financial industy. Financial companies are in the business of risk -- meaning that you have to decide how much risk is appropriate to cash in on some of these high yields.

A fantastic bank with a dividend that makes me nervous

New York Community Bancorp (NYCB 1.69%) is one of the best-run banks in the country. The bank focuses on -- and takes advantage of -- rent-controlled multifamily housing deals in New York City. With rents in these buildings artificially held below market rates, the properties are virtually assured to be 100% occupied in both up and down economic cycles.

New York Community Bancorp recognizes this and has smartly invested about two-thirds of its loan portfolio into that niche. That keeps loan losses low, earnings predictable, and the dividends flowing. On a trailing 12-month basis since 2010, the bank's return on equity and return on assets have been strong and remarkably consistent.

So what's the problem? It all starts with the bank's dividend payout ratio. According to data from YCharts, the bank has paid out about 91% of its earnings as dividends over the past 12 months. That's ridiculously high.

Thus far that level of payout has been sustainable because the bank has purposefully slowed the growth of its balance sheet to remain under the regulatory threshold of $50 billion. However, sacrificing growth is not sustainable in the long term, and management has spoken to this reality multiple times in the past several quarterly earnings calls.

Eventually, New York Community Bancorp will need to grow, and that growth will require investing more of the bank's profits back into the company and less into shareholder dividends.

The bank's current dividend yield is 5.9%. Enjoy this dividend now, because it may not be around for much longer.

A double digit yield with more downside that I can stomach

While not a bank, Annaly Capital Management (NLY +1.00%) does operate with a very bank-like business model.

It also sports an 11.5% dividend yield, but we'll circle back to that in a minute.

Annaly is a mortgage REIT, commonly abbreviated as mREIT. The company follows IRS rules that force it to pay out a very high dividend in order to enjoy a favorable tax status, just like all other REITs.

The difference between Annaly (and other comparable mREITs) and traditional real estate REITs is that mREITS use borrowed money to invest in mortgage backed securities issued by Fannie Mae and Freddie Mac. In other words, they buy bundles of mortgage loans instead of directly investing in the real estate itself.

The company's profits are the difference between the interest it pays on its borrowed funding and the interest it receives from its portfolio of mortgage bonds. It's really not so different from a bank borrowing money in the form of deposits, loaning that money out to borrowers, and pocketing the spread.

Another big similarity with banks is interest rate risk. If the cost to borrow rises or the interest rate yield on loans collapses, both banks and mREITs suffer. In today's world of near-zero interest rates, that puts many mREITs and banks in a tough spot.

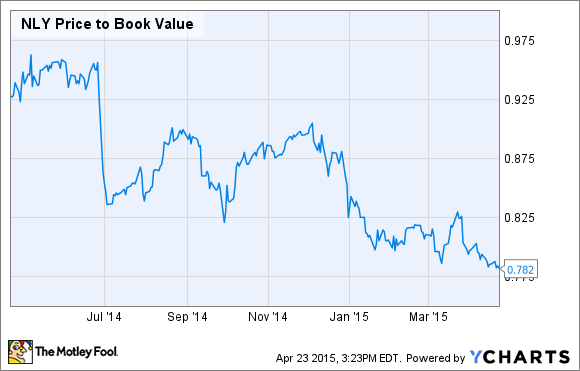

Many experts in the mREIT industry think Annaly Capital Management is more exposed to interest rate risks, which are capable of hurting profits and crushing the dividend, than its peers. The market agrees, having pushed the company's stock down to a discount of over 20% to book value.

When you dig into the weeds of Annaly's financials, the outlook doesn't get much better. For example, one analyst with FBR & Co. recently published an analysis that predicted an 8.4% drop in 2015 earnings per share at Annaly if short-term interest rates were to rise just 0.25%! That was 3.4% worse that Annaly's next closest peer.

With short-term rates effectively at zero today, that means there really is only one direction for them to go: up.

On the other side of the yield curve, if long-term rates fall, then that would likely cause an increase in mortgage repayments as borrowers refinance to get lower rates. If that happened, Annaly would then have to reinvest that cash into new mortgage bonds, also with lower yields. Lower yields on mortgage bonds mean tighter spreads and less profit. Not good.

If long-term rates were to rise, Annaly would face another problem that could be just as devastating to the dividend. Remember that in the bond world, when bond yields rise, their price correspondingly decreases. In this case, that means rising mortgage rates would cause the book value of Annaly's portfolio of mortgages to decrease. That will drive its book value lower, and again, that's not good for the stock.

For Annaly Capital, the deck seems to be stacked. It's a possibility that the company's management has hedges in place to mitigate some of the more extreme outcomes, but on a fundamental level the outlook does not seem attractive. Investors beware.