Intuitive Surgical (ISRG 1.15%) handily beat expectations last week when it reported second-quarter results. Revenue and non-GAAP EPS were 3.4% and 14.8% higher than expected. The outperformance was driven by higher-than-expected sales of its sales of its Da Vinci surgical systems. But beyond these closely followed metrics provided in Intuitive Surgical's second-quarter earnings release, some of the most valuable new information and commentary for the quarter was made available during its conference call following the release.

Da Vinci Xi. Image source: Intuitive Surgical.

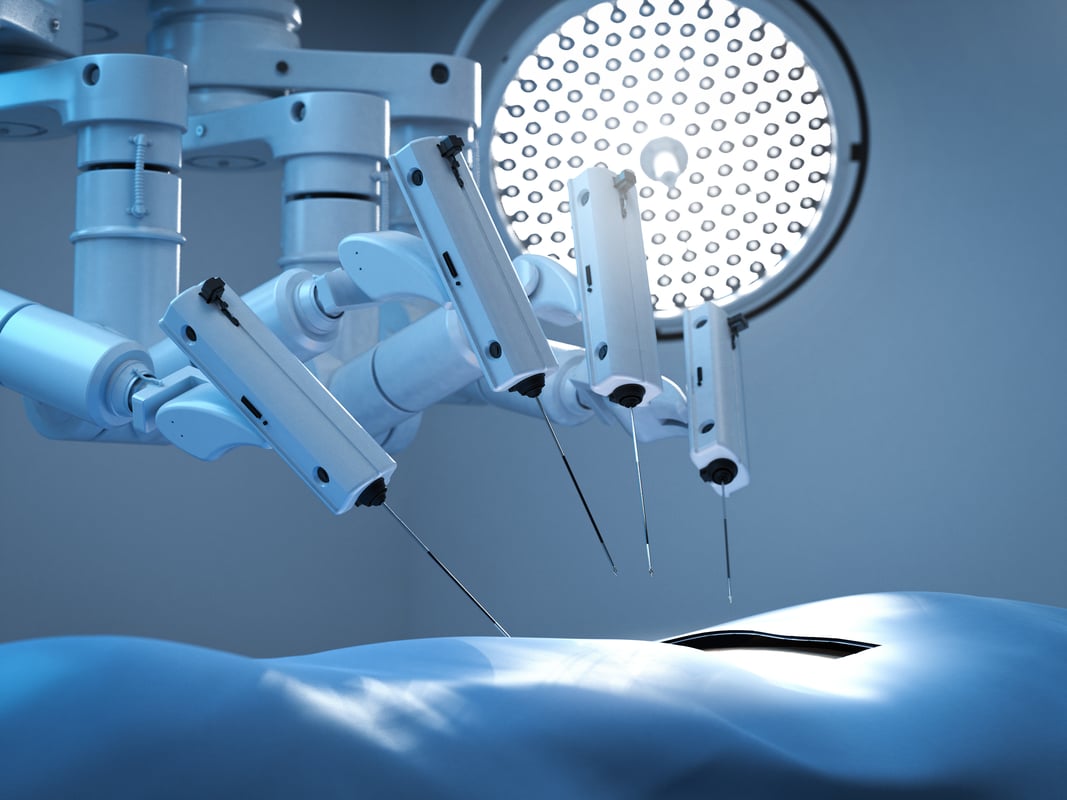

One key item discussed during the call was what management believes will drive Da Vinci upgrades. While Intuitive Surgical certainly sells Da Vinci systems to new customers, one key catalyst for sales growth will likely always be existing customers upgrading their systems -- especially in the near term given the fact Intuitive Surgical's newest system, the Da Vinci Xi, was launched less than two years ago.

During the call, management detailed three specific reasons its current customers are upgrading to new systems.

New features on the Xi

With the Xi, there are greater possibilities than with its previous Da Vinci model. These new capabilities help drive sales for customers looking for greater outcome benefit and new service lines relative to what their existing system brings. One key differentiator for the Xi, for instance, is Intuitive Surgical's recent rollout of the Xi's integrated intraoperative table, which allows a surgeon to position a patient using gravity. This movable table helps serve as a catalyst for upgrading, management explained.

Utilization growth

Another driver is simply demand for greater procedure capacity.

"There are people who just buy purely on capacity," Intuitive Surgical CEO Gary Guthart said. "They have used the existing capacity of their system. As procedures grow, they look to do additional procedures. They will buy a second system or so."

Intuitive Surgical continues to help nudge this catalyst along by always finding new procedures for Da Vinci.

Guthart explained:

We're always out scanning -- really from the bottom of your feet to the top of your head -- to think about where is current surgery difficult or outcomes suboptimal, and in a place where our kinds of technologies can make a difference.

In Q2, global Da Vinci procedures grew about 14% year over year and 8% sequentially.

Geographic expansion

Other times, current customers simply want to add a system to a new location.

Guthart continued:

And the last one is really capacity -- again -- but often: 'Is it in the right place?' If you are a larger institution or an integrated delivery network, you may be interested in moving the capacity to a different region or a different part of your service network. Sometimes they do that by moving systems. Sometimes they do that by buying systems.

During Q2, Intuitive Surgical shipped 118 Da Vinci systems, up 23% from the year-ago quarter and 19% sequentially. While system sales account for just 30% of Intuitive Surgical's revenue, sales of new systems also serve as a driver for its instrument, accessory, and service revenue.

With Intuitive Surgical's financial performance continuing to improve and the new Xi Da Vinci proving to facilitate greater demand, management continues to reinforce the case for holding Intuitive Surgical stock for the long haul.