It's been a rough ride for stocks of late. Several Dow components have lost billions in market cap since the beginning of August alone. Are these bargains to pursue or traps to avoid? I answer this question below with respect to the three worst performers in the Dow this month.

The three worst-performing Dow stocks in August

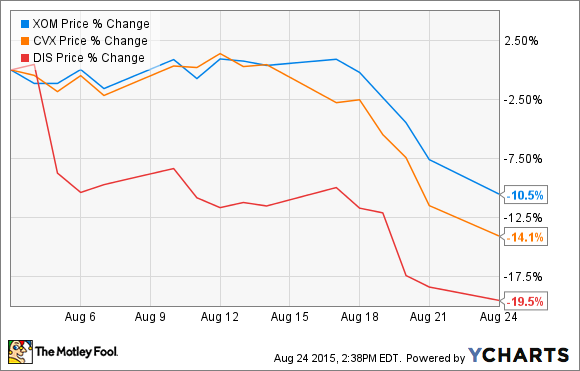

Two of the three worst performers in the Dow are oil companies -- ExxonMobil (XOM -0.33%) and Chevron (CVX -0.64%), which have lost 10.5% and 14.1% this month, respectively. The sector got hit with the double whammy of the overall market weakness and the fact that oil prices are at multi-year lows.

The biggest Dow loser, the Walt Disney Company (DIS -0.36%) may be a bit more unexpected, and has given up more than 19% of its value this month. Disney's second-quarter revenue came in below expectations, so the stock was already on a downward trajectory when the recent sell-off began.

Time to buy big oil?

If you're a long-term investor, you shouldn't really care about temporary issues. Sure oil prices are low now, but how will it affect ExxonMobil and Chevron over the long run? Along similar lines, is Disney's revenue miss a temporary speed bump, or a sign of trouble to come?

Photo: Ildar Sagdejev

From a long-term perspective, I think that ExxonMobil and Chevron are tremendous bargains right now. Obviously, revenue and profitability will lag until oil prices rise, but that isn't permanent.

Chevron will be just fine in the long-term, with more than $12 billion in cash on hand, and profits still rolling in even with oil prices as low as they are. And, ExxonMobil has an extremely diversified business, with substantial exposure to the refining and chemicals business -- which actually do better when oil prices take a dive. Chevron has this kind of exposure as well, but not to the extent of ExxonMobil, which could partially explain the additional drop in the share price.

Exxon's production is actually increasing, up 3.6% from last year, and Chevron's increased by an even more impressive 9%. Now, this isn't necessarily a good thing for the companies while oil is so cheap, but it could amplify the effects of an eventual rebound in oil prices.

Finally, both of these oil giants are actually in a position to benefit in the long run from the oil industry's pain. When a sector is hit hard by a major negative catalyst (like low oil prices), smaller companies begin to struggle to remain solvent, leaving the large, stronger companies to pick up the pieces. I already mentioned Chevron's $12 billion in cash, and Exxon has virtually unlimited access to cheap money with its AAA credit rating. During the financial crisis, the strongest companies were able to acquire their weaker rivals for pennies on the dollar, such as how Wells Fargo scooped up Wachovia. The same logic applies here, and I'd be surprised if both of these companies didn't do some "shopping" in the near future.

Source: wikipedia user Jrobertiko

Diversity and pricing power

Walt Disney is also a solid long-term investment, but for different reasons. First, the company's brand name is without comparison, giving it tremendous appeal and pricing power in its theme park, film, and merchandising businesses. People will pay more for a "Disney" product, giving the company higher margins than companies with similar businesses -- and therefore more room to absorb adverse conditions. Plus, the Disney brand is only the tip of the iceberg. The company also owns franchises such as:

- ESPN

- ABC networks

- Touchstone

- Miramax

- Lucasfilm (Star Wars)

- Marvel, and all of its characters

Secondly, Disney's revenue stream is diverse. If a recession hits and attendance at its theme parks slows down, the company's TV networks and film studios can help pick up the slack.

Finally, Disney is investing considerable resources into expanding its global presence with the planned opening of Shanghai Disneyland next year, and is actively seeking ways to improve its existing parks. Although there are some short-term negatives (like the fears of the company's TV networks losing subscribers), Disney's strength and diversity will allow it to thrive for decades to come.

Don't forget about dividends

It's also worth noting that when stock prices drop, dividend yields grow. I realize that Disney's 1.3% yield is not exciting, but it's historically high for Disney. And, Exxon and Chevron are paying 4.1% and 5.8%, respectively, at the current share prices -- their highest yields since the 1990's. So, while the short-term may be bumpy, at least you'll be paid well to wait.

The takeaway

Just because a stock has dropped considerably doesn't make it cheap. And, the markets could certainly get worse before they get better, so don't use a correction as an excuse to scoop up shares of just any company simply because prices are lower.

However, by focusing on rock-solid companies like the ones mentioned here that should stand the test of time. All three stocks here have competitive advantages on their side. ExxonMobil and Chevron both have their size and credit ratings which should help them capitalize on weakness in oil prices, and Disney's brand name gives it tremendous pricing power while its diverse business structure means it's not vulnerable to any specific weakness.

This is by no means an exhaustive list of the companies that are great values right now; it's instead merely three great examples of long term winners trading at a discount. When you have the opportunity to find and buy long-term winners at a good price, that's exactly what you should do.