Both Huntington Bancshares (HBAN +0.47%) and First Republic Bank (FRC +0.00%) trade at higher valuations than many other bank stocks. If you're going to take the plunge on either of these stocks, or another premium-priced company, it's important to understand what that higher valuation is actually buying you.

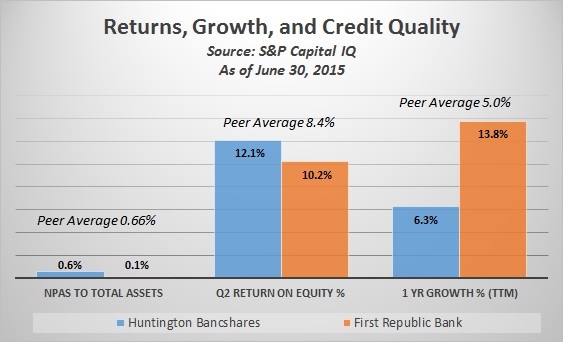

In the case of these two banks, that extra bit of cash buys you a bank with numbers that stand above their peers, including high return on equity, plenty of growth, and fewer problem loans than the comparable alternatives.

Source: S&P Capital IQ. Peer set is average of 60 comparably sized U.S. regional and national banks.

Huntington currently trades at about 1.4 times its book value, and that's down from the 1.5 to 1.6 times before the recent sell-off.

First Republic is even more expensive, trading at a price-to-book value ratio of 2.2 times currently, down from about 2.35 times prior to the sell-off.

A bank's valuation is dependent on a wide variety of factors, profitability being prominent among them, but as a rule of thumb, a bank that trades below one times its book value is considered cheap while a bank trading above two times book value is considered expensive..

The total package

For the current price of a share of either First Republic or Huntington, shareholders get a premium-quality bank across the three most critical considerations in any bank investment: credit quality, profits, and growth.

For regional banks like these, the story starts with credit quality. Banks are in the business of making loans, and those loans must be repaid. Because banks operate at such high leverage ratios, generally with assets-to-equity ratios of 8 to 10 times, if even a small percentage of those loans are not repaid, the bank can quickly find itself losing a lot of money in a short period of time. Those sudden losses can sometimes be so large that they can negate all the earnings the bank has produced going back years. That's why maintaining a strong, long-term credit culture is paramount for any bank. It's about protecting what the bank has already achieved and ensuring the profits will continue flowing in the future.

In terms of profits, banks must earn enough to pay depositors, and any other debt financing they may have on their balance sheets. There must be enough left over after that to satisfy the return expectations of their equity investors. From 2000 to 2006, banks averaged a return on equity of 13.5%. Since 2012, that average has declined to just 9.1%.

Huntington and First Republic have not been immune to that industry-wide decline, but they have been able to achieve strong returns relative to their peers. Of the 60 banks used as the peer set in this analysis, only 28% had returns on equity above 10%. That puts both banks here in the upper echelon of performers industrywide.

Finally, all banks must grow to stay relevant. New loans are required to replace existing loans being paid off. Growth helps to move profitability forward, as well, ensuring that the bank's return on equity stays strong as retained earnings accumulate

In the foreseeable future, investors expect Huntington and First Republic to continue producing higher profits relative to the rest of the industry. That forecast is supported by each bank's current credit quality and growth, and that is why each commands a premium price.