Apogee Enterprises (APOG +0.60%) has done a good job of holding its own in a tough environment in the construction industry, with its focus on glass products for architectural windows and other building applications having given the company a lucrative specialty business. Coming into Wednesday afternoon's fiscal second-quarter financial report, Apogee investors were hopeful that the company could continue to sustain its relative strength, but the company's results instead raised some concerns about whether Apogee can continue to grow on its past trajectory. Let's take a closer look at Apogee Enterprises and see if the glass-maker can get back its lost momentum in the months to come.

Apogee's results turn cloudy

The latest report from Apogee included some things that investors weren't entirely excited to see. Revenue growth slowed to just 4%, with sales of $240.8 million falling about $6 million short of the consensus forecast among those following the stock. Bottom-line performance was slightly better than expected, with adjusted earnings of $0.50 per share topping estimates by a penny and representing 43% growth compared to the year-ago quarter.

A deeper look at Apogee's numbers shows some areas where its growth has clearly started to slow down. Backlogs of nearly $511.9 million were up 7% from a year ago, but that was far slower year-over-year growth than the 22% that Apogee posted last quarter.

In addition, Apogee's various segments were mixed. The large-scale optical technology arena posted the best percentage gains, as revenue climbed 16% and operating income jumped 36% thanks to high demand for picture-framing products. The important architectural glass segment saw operating income double on a 10% rise in sales, and architectural framing systems also posted solid growth. Only the architectural services segment fell short, with a 12% drop in sales and a fall of more than 20% in operating income.

Apogee trumpeted its results, with CEO Joseph Puishys noting that "Apogee's top-line growth was driven by strong mid-teens growth in our U.S. products businesses. This impressive growth was partly offset by project timing in our installation business, as well as by the impact of foreign exchange and weak foreign markets." Nevertheless, Puishys emphasized that its healthy backlog ensures further strength for Apogee looking forward.

Will Apogee disappoint investors?

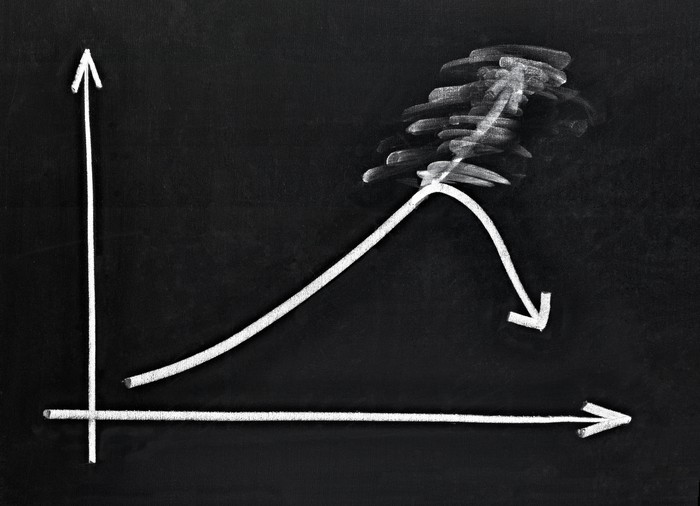

Nevertheless, Apogee warned that some negative factors could have an influence on its results in fiscal 2016. Puishys said that "construction site delays are shifting some work from fiscal 2016 into fiscal 2017," and as a result, the company cut its guidance on revenue growth from its previous range of 10% to 15% to high single-digit growth rates for the full fiscal year. That's a far cry from the nearly 14% growth that investors had hoped to see, and even though the company repeated its past earnings guidance for $2.10 to $2.25 per share, many shareholders had hoped that Apogee would boost its outlook to come closer to the $2.38 per share consensus forecast.

Still, longer-term, things look favorable for Apogee. The company said that half of its backlog is scheduled for fiscal 2017 and 2018, and Apogee is still looking for $1.3 billion in revenue for fiscal 2018 with a 12% operating margin turning much of those sales into profits. Moreover, with its push into new markets both geographically and in terms of new products, Apogee thinks it can keep delivering growth over the long haul.

Investors weren't entirely satisfied with that long-term view, however, with the stock plunging more than 8% in the first couple of hours of after-market trading following the announcement. Given the stock's solid performance recently, it's not surprising to see the slightest disappointment cause a major share-price move. For those willing to look beyond the short-term implications, however, Apogee might just be giving investors a chance to cash in on its long-term promise.