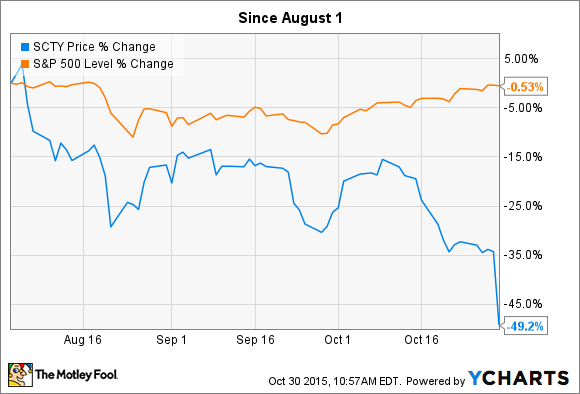

What: Shares of the largest solar company in the U.S., SolarCity Corp (SCTY.DL), are taking a beating today, down more than 25% at the time of this writing, following the release of the company's third-quarter earnings after the market close on Oct. 29. Over the past few months, SolarCity's stock has fallen by half:

So what: SolarCity's earnings included a much larger GAAP net loss than the market was expecting, despite solid growth numbers in revenue and solar systems installed, and a pretty big drop in its cost-per-watt metric, which factors in how much it spends on the business for every watt of power production it installs.

The company also announced guidance for next year that included solar system deployment growth of slightly over 40% at the midrange of guidance. While nearly any business would love to see that kind of growth, it's about half the company's growth rate over the past few years.

The big reason growth is expected to slow? Management is taking its foot off the growth gas pedal, so to speak, and will invest significantly less in geographic expansion next year, versus the past few. Sales, general, and administrative costs have skyrocketed (especially sales) over the past two years as the company has moved into new markets, and on a cost-per-watt basis they are up almost 50% over that period.

CEO Lyndon Rive says that taking these steps now may slow growth a little bit, but it will mean that the company is cash flow positive by the end of 2016. Considering the big complaint has been how much money the company has been spending, versus how much revenue it recognizes each quarter, this is really good news.

Now what:

It's pretty clear the market doesn't see much good in SolarCity's announcement or the results last quarter, but I don't exactly see it that way. If you dig into the company's numbers and look beyond the GAAP revenue the company recognizes each quarter, the huge portfolio of cash-flow-producing contracts it has accumulated -- valued at nearly $9 billion now -- is a direct result of the company's investments in sales and marketing.

Those assets will produce steady cash flows for decades to come, and management says its shift in growth strategy is part of a bigger plan to move past the aggressive-spending, cash-burning growth of the past few years, and start generating positive cash flows within about a year.

To me it sounds like a management team with a plan to take SolarCity to the next level. I wouldn't bet against them. Looking for more in-depth analysis of the company's earnings report? Go here.