TrueCar's (TRUE +1.39%) business is really straightforward and simple: It provides consumers with pricing history and transparency though its website, and offers them a price guarantee they can take to a dealership. On the flip side, the dealership gets an easy sales lead, and will pay TrueCar in the event it closes on a deal sent from TrueCar.

Sounds simple, right?

Not so fast. Unfortunately, some of the dealerships within TrueCar's network of roughly 10,000 dealers aren't thrilled with the situation. In fact, the largest new-car retailer in the U.S., AutoNation (AN +0.50%), ended its partnership, and walked away from TrueCar earlier this year.

Let's take a look at how AutoNation is evolving, and if it's just the first of many dealerships to flee from TrueCar.

Going solo

What's the old adage? "If you want something done right, do it yourself." That's basically the attitude AutoNation is projecting at the moment as it pours capital into developing its own website with the purpose of replacing the online sales that TrueCar provided.

AutoNation has invested about $200 million into technology and branding to improve its website, and enable consumers to use "AutoNation Express" transaction tools to purchase vehicles online -- and it's starting to pay off. A year-and-a-half ago AutoNation's website only generated about 10% of its overall sales, while third-party sites like TrueCar generated 20% of the total sales. As of the third quarter, that has more than flip-flopped, with AutoNation's website generating 25% of unit sales, while third-party websites generated less than 9%.

Is AutoNation the first of many?

At first glance, that seems extremely worrisome for investors in TrueCar. After all, if dealerships can cut out the middle man in online transactions, TrueCar's business will be in a world of hurt. Fortunately, for TrueCar investors, AutoNation doesn't appear to be the first in a trend of dealerships bailing on TrueCar's network.

Investors have to consider that AutoNation is the largest new-car retailer in the U.S., which means it has more capital to pour into a substantial online presence. Very few dealership groups can afford to develop such a system that would enable dealerships to break away from using third-party website sales leads.

Moreover, one of the advantages to AutoNation's online website is that consumers are able to access the inventory between all dealerships. The dealership can then ship the vehicle elsewhere; the consumer is not limited to visiting the dealership in person to purchase a car.

Very few dealership groups have the store footprint that AutoNation does. Consider that, while AutoNation is the largest new-car retailer in the U.S., it still only has about 300 dealership stores operating in 15 states. That means the largest dealership group is still a minor fraction of the entire dealership industry that has a store count of nearly 18,000 -- with TrueCar's network covering roughly half of that amount.

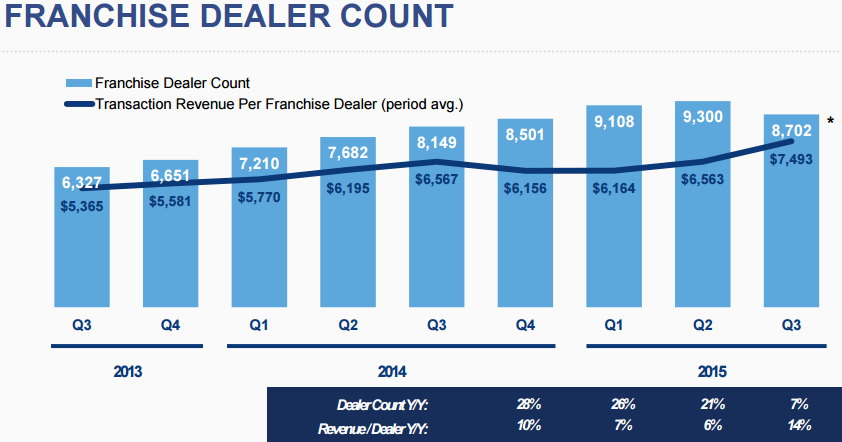

Also, despite the decline in TrueCar's dealership count, which is mostly attributed to the breakup with AutoNation, its revenue per dealership increased this last quarter because the online company simply sent consumers with their guaranteed pricing elsewhere to a dealership not affiliated with AutoNation.

Graphic source: TrueCar's third-quarter presentation.

Also, this week, TrueCar announced that industry veteran Chip Perry had been named as its new CEO. Perry was the first employee of AutoTrader, and investors are cheering the move, which sent its stock up about 18% between Monday and Wednesday. Perry's top priority when he takes over next month will be to repair relations with its network of dealerships.

Ultimately, because the automotive dealership industry is so fractured, there just aren't many groups that can walk away from using TrueCar's website for sales leads. That isn't going to change anytime soon. That doesn't mean that TrueCar isn't facing business problems at the moment, but worrying that AutoNation is the first of many dealerships to end its partnership with TrueCar is not a primary concern.