Source: GasLog LTD.

GasLog LTD's (NYSE: GLOG) latest earnings missed Wall Street's expectations, but long-term dividend investors know that their priorities and those of analysts are often different enough that quarterly earnings hits and misses are largely irrelevant. So instead, let's look at three key takeaways that actually matter to GasLog's long-term investment thesis, especially regarding its growth potential into 2016 and beyond.

Earnings miss was due to short-term declining charter rates

Because of a glut in LNG tankers created by a ship count increasing faster than global LNG export capacity, the past few years have seen a massive decline in short-term charter day rates. In fact, over the past two years, spot charter rates have declined from about $130,000 per day to just $30,000.

While most of GasLog's fleet is charted under long-term contracts, the three tankers operating under spot charters has caused a 6% decline in GasLog's average daily charter rate in the past year.

Management has responded by partnering with competitors Golar LNG (GLNG +2.64%) and Dynagas, to create a "cool pool" of 14 spot charter tankers. The pool is a kind of clearinghouse where cooperation on scheduling, marketing, and administrative costs can lower the operating expenses of these tankers, boosting profitability in a time of depressed market rates.

Luckily for investors, while short-term LNG tanker day rates are in the toilet, the long-term prospects of this industry look far better.

GasLog's long-term prospects remain strong

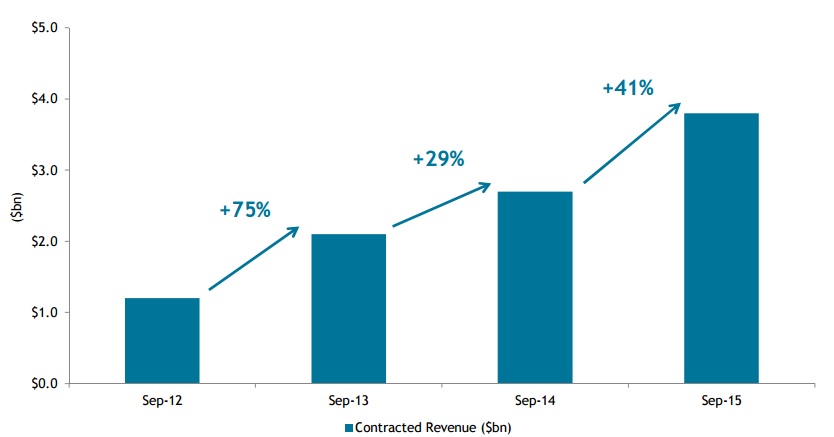

Source: GasLog investor presentation.

GasLog's long-term charter focus has resulted in a strong and growing backlog of contracted revenue that not only funds the company's growth efforts but also secures its generous 5% dividend. In addition to the $3.8 billion in the current contract backlog, GasLog also has a $4 billion options backlog that represents its existing customers' options to extend their contracts as far out as 2026.

Long-term LNG charter rates are likely to remain strong because of a large number of new LNG export projects coming online in the next few years. This is a combination of both strong export supply from the U.S. and Australia and strong import growth from nations such as China that are looking to increase their energy production from cleaner-burning gas power plants.

In fact, between now and 2020, just 10 major LNG export terminals scheduled for completion are expected to increase the world's LNG export capacity by 118.7 million tons per year. Management believes this will increase demand for LNG tankers by 60 to 80 vessels above the current number of global tankers, both existing and scheduled for delivery during that time, which should cause day rates to increase.

GasLog plans on profiting from this long-term trend via its "40 by 17" plan, which calls for an increase in LNG tankers owned by either it or its MLP, GasLog Partners (NYSE: GLOP) over the next few years from 27 vessels to 40. GasLog's plan calls for a combination of new tanker deliveries, as well as third-party acquisitions, both from other LNG tanker companies and major oil companies that are looking to monetize such assets to raise money in a time of low energy prices.

GasLog Partners: tax-efficient growth engine

To help fund its ambitious growth plans, GasLog LTD has a two-pronged strategy. First, it funds growth in its existing fleet with debt, such as the recent $1.3 billion in financing it raised with 14 banks, including the Export Bank of Korea, to fund the construction of eight South Korean-constructed new builds between 2016 and 2019.

Then it secures long-term charter contracts between seven and 10 years in length, ensuring predictable and consistent cash flow.

It can then drop down these to GasLog Partners to pay off the cost of construction and strengthen its balance sheet, allowing for further financing to fund long-term fleet expansion. Meanwhile, through the incentive distribution rights it holds as general partner of GasLog Partners, as well as its 32.9% ownership of the MLP's limited and GP units, GasLog LTD can still profit from the recurring cash flow that its fast-growing fleet generates.

One of the biggest risk to long-term growth plans

While GasLog LTD has four new builds set for delivery in 2016, its short-term ability to drop them down to GasLog Partners might be limited by the MLP's recent declining unit price, which now yields 10.7%.

Thanks to its three most recent dropdowns from GasLog LTD, GasLog Partners' debt levels have grown to levels that might make further short-term fleet growth untenable without further equity offerings, which are becoming increasingly costly at existing unit prices.

Bottom line

In the short term, GasLog LTD may face challenges from falling spot charter rates and from GasLog Partners' potential to be cut off from equity financing of further dropdowns. However, given the strong long-term growth prospects of the global LNG trade, as well as GasLog LTD's ambitious growth plans through 2019, I think long-term investors can look forward to solid earnings, share price, and dividend growth in the years ahead.