Image source: Apogee Enterprises.

The construction industry has gone through its share of challenges lately, and with its focus on architectural windows and other products used in building projects, Apogee Enterprises (APOG 0.52%) has its fortunes tied closely to activity levels in construction. Coming into Wednesday's fiscal third-quarter financial report, Apogee investors had grown increasingly nervous about the potential direction of the economy and its impact on the business, but they still expected reasonable growth in sales and net income. Apogee only managed to deliver on half of those expectations, posting a surprising drop in revenue and falling short of earnings estimates among investors. Let's look more closely at how Apogee Enterprises did during the quarter and whether a turnaround for the glass maker is in its future.

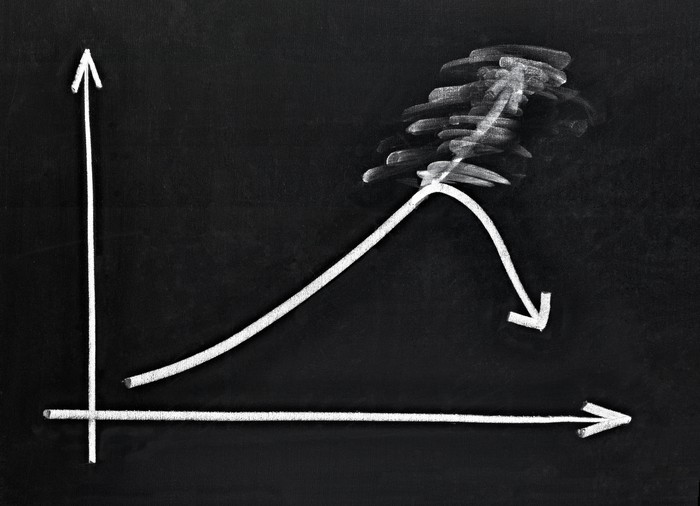

Apogee's sales growth shatters

Apogee's fiscal third-quarter results came as a surprise to many investors. Revenue fell 2% to $238.3 million, badly missing the projections for nearly 9% growth that investors following the stock had expected to see. Apogee managed to grow its net income by an impressive 35% to $18.5 million, but resulting earnings of $0.63 per share was nevertheless $0.02 short of the consensus forecast.

Looking more closely at Apogee's results, conditions continue to be challenging in some areas. The strong U.S. dollar held back Apogee's growth somewhat, but even on a constant currency basis, the company posted flat results on the top line. Backlog growth accelerate somewhat, climbing 10% from the year-ago quarter to $544.7 million and hitting another record high. Even so, gains in the backlog have been less extreme than those that Apogee experienced early in the year. Apogee expects about 30% of the backlog to get delivered during the current fiscal year and the remainder to come next year or beyond.

On a business-by-business basis, Apogee had mixed performance. Architectural services posted a 9% rise in revenue, with the company reporting good operational performance and improving project margins that helped to push operating margins for the segment up by more than 5 percentage points. The key architectural glass unit saw a 5% drop in revenue that came largely from the currency impact of its Brazilian operations, but operating income grew by 44%. Similarly, the architectural framing systems division suffered a 5% drop in sales but grew operating income by 22%, with lower raw material costs and better pricing making up for lower sales. Only the large-scale optical technology unit saw declines in both revenue and operating income, although it managed to keep down the bottom-line declines through cost management and higher productivity.

CEO Joseph Puishys was pleased with the company's results, pointing to backlogs and margins in driving its operational success. "We continue to experience strong bidding and award activity," Puishys said, and the CEO blamed some of the revenue shortfall on "project timing that pushes some revenues into fiscal 2017."

Can Apogee bounce back?

Puishys also thinks that Apogee will finish fiscal 2016 on a strong note. The company raised its earnings guidance for the full year, pushing the bottom end of its previous range up a nickel and guiding for $2.15 to $2.25 per share on the bottom line. Apogee did rein in sales growth expectations for the year, now expecting mid-single-digit percentage growth rather than high single digit. Yet the company believes that fiscal 2017 will bring a return to the double-digit percentage growth that investors have wanted to see.

Apogee also has ambitious long-term plans for growth. "Our strategies to grow through new geographies, new products, and new markets, along with our focus on better project selection, productivity, and operational improvements, are delivering positive results," Puishys said, and the CEO expects that internal investment will result in annual capital expenditures of $40 million to $45 million.

Investors weren't immediately convinced about Apogee's future prospects, reacting badly to the revenue miss and sending the stock down 4% immediately after the announcement. For Apogee to recover, it needs to find ways to accelerate growth and deal with tough conditions in a way that won't lead to further negative surprises in the future.