Would you like to give shares of stock in companies such as Apple (AAPL +1.25%), Walt Disney (DIS 1.23%), or Tesla Motors (TSLA 3.36%) to certain kids or adults on your holiday shopping list if the process of buying stock for someone else was simpler?

If so, Stockpile's recently launched stock gift cards might interest you. Here's what you should know.

Image source: Getty Images.

Who are the companies "hawking" these new stock gift cards?

Stockpile, which recently raised $15 million in Series A funding, is a 5-year-old licensed stock brokerage firm that operates entirely electronically. The Silicon Valley-based company has been selling virtual stock gift cards online for about a year, and began rolling out its physical cards to retail outlets in October.

California-based Blackhawk Network (NASDAQ: HAWK) is Stockpile's retail distribution partner. Blackhawk, which began as a division of grocer Safeway, is a leading supplier of the ubiquitous gift cards displayed in retail locations everywhere. Safeway fully divested of Blackhawk Network beginning with a 2013 IPO.

What benefits do stock gift cards -- and Stockpile's trading platform -- provide?

Stock gift cards simplify the process of buying stock for someone else, especially a minor. The idea for these cards came to Stockpile co-founder and CEO Avi Lele when he wanted to buy stock for his nieces and nephews, but didn't do so because he'd have to obtain their Social Security numbers and open custodial accounts for them. With a Stockpile gift card, the recipient can turn it in for the stock the buyer chose, or for a different stock or ETF, or for a retailer gift card. When kids or teens set up a Stockpile account, they can own stock by having an adult on the account with them.

Stock gift cards -- along with Stockpile's trading platform in general -- allow for broader access to stock investing because they allow people to buy fractional shares in a company. Additionally, Stockpile doesn't have a minimum amount required to open an account, or a minimum account balance necessary to avoid monthly fees. Apple stock before its 7-for-1 split in 2014 provides a great example of the fractional share issue. The stock closed at $645 per share on the trading day before this split, so even $500, an ultra-generous gift, wouldn't have allowed you to buy a share of stock in the iPhone maker.

How does the gifting process work?

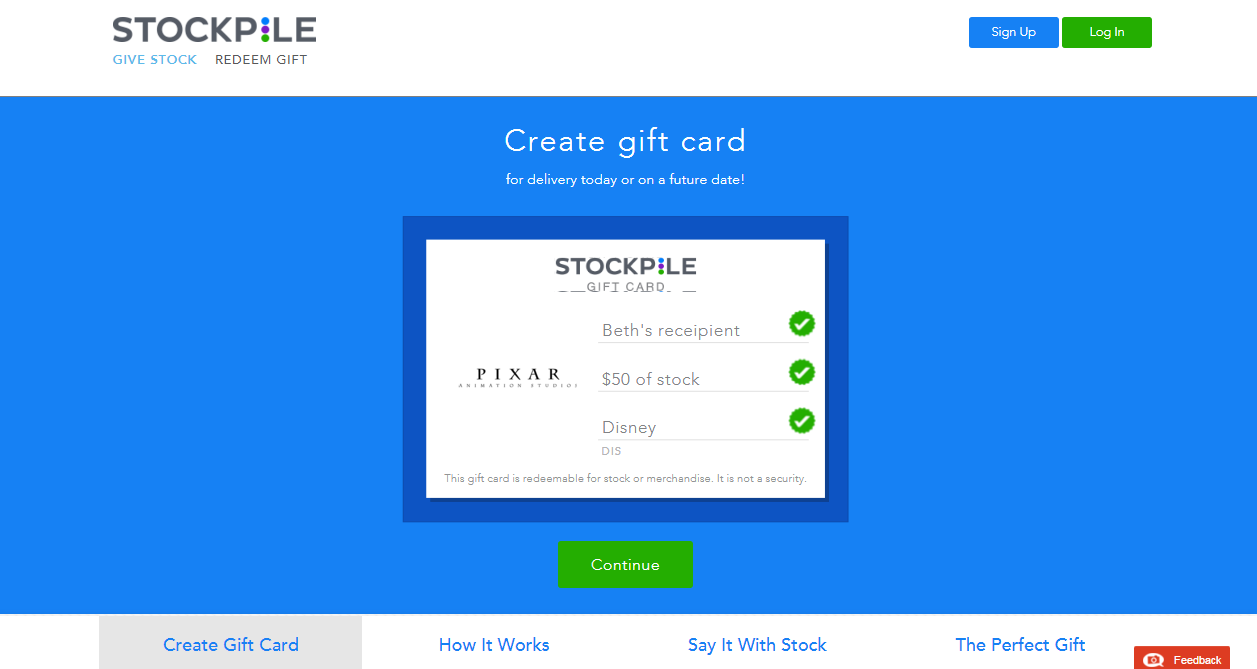

Image source: Screenshot. The site allows you to search by company name, stock symbol, or brand.

- Buyer purchases a stock gift card at a retailer for $25, $50, or $100. Online cards are available in any whole dollar amount up to $1,000. Cards are available for many popular stocks, and various exchange-traded funds (ETFs). General cards that allow you to fill in the stock of your choice are also available.

- Recipient peels off sticker on the physical card to find a code, and enters the code into Stockpile's site or mobile app to redeem the card.

- Recipient can also choose (for no fee) to switch to another stock, exchange for a retailer gift card, or regift to someone else.

What are the costs and fees?

- Physical gift cards: $25 card costs $29.95, $50 card costs $56.95, and $100 card costs $107.95.

- Online gift cards cost the face value of the card plus a $1.99 fee and 3% of card's value. The company currently has an online special where virtual cards for $100 and less cost the face value of the card plus just $1.99.

- Buying or selling a stock or ETF: $0.99. (No buying fee is incurred by recipient of gift cards, as the trading cost is included in the fee the card buyer pays.)

Stock trades for $0.99 are a great deal, with the critical caveat that you, or the recipient of your stock gift, don't buy and sell in very small dollar amounts. There appear to be no "hidden" fees, per my perusal of the company's fee schedule.

Where can I buy Stockpile's physical stock gift cards?

Blackhawk Network began rolling out Stockpile's gift cards in October. Here are the first stores to carry them:

- Kmart

- Buehler's Fresh Foods (all locations in Ohio)

- Giant Eagle and Market District (all locations in Maryland, Ohio, Pennsylvania, West Virginia, and Indiana)

- Safeway (18 locations in Seattle, Wash.)

- Wegmans Food Markets (all locations in Maryland, Massachusetts, New Jersey, New York, Pennsylvania, and Virginia)

More locations have since been added, and the cards should be widely available at major grocers and other retailers.

What's the best way to use stock gift cards?

While this is a subjective question, it's best to give stock gift cards just as you would other prepaid gift cards for things like apparel or restaurants. There are fun and educational possibilities for personalizing your gift. For instance, if your niece loves Pixar's animated films, you could give her a DVD of Finding Nemo -- or just a picture, if that's more within your budget -- along with a stock gift card for Disney, which owns Pixar.

If you believe that physical gift cards trump online ones for children and anyone special, just keep in mind the fees are higher.

Is there a way that I should not use stock gift cards?

Yes. Buying stock for yourself via either physical or online gift cards would be foolish, as you'd needlessly be incurring extra fees. If you want to buy stock for yourself, skip gift cards. Open an account first with a low-commission online brokerage and buy shares directly.

One could also argue that continuing to buy your niece $50 gift cards for additional DIS stock after giving her the initial card, which she and her parents used to set up her account, wouldn't make sense because you'd pay a fee. However, some folks might believe that giving $50 via cash or a check written to her, or her parents, with a note that it's to buy additional stock doesn't have the same delight factor.

These cards have some distinctive advantages in certain situations, in my opinion, but people must be very aware of the fees, as there are ways to use them not so wisely, too.