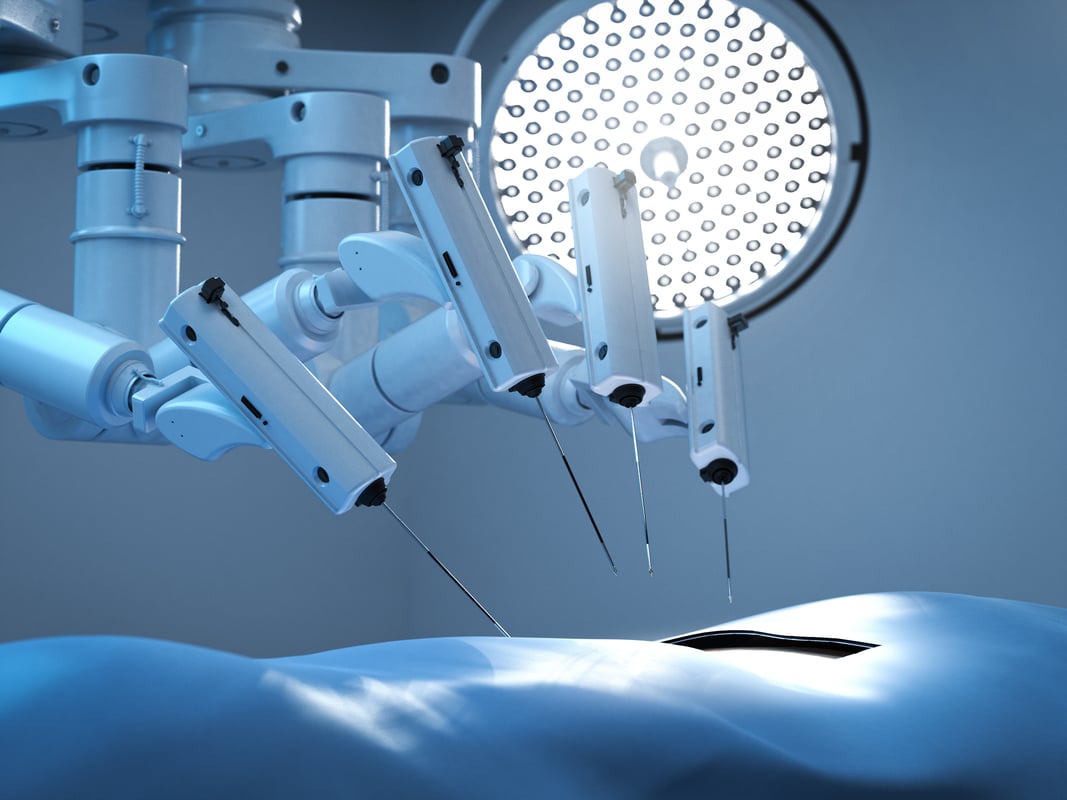

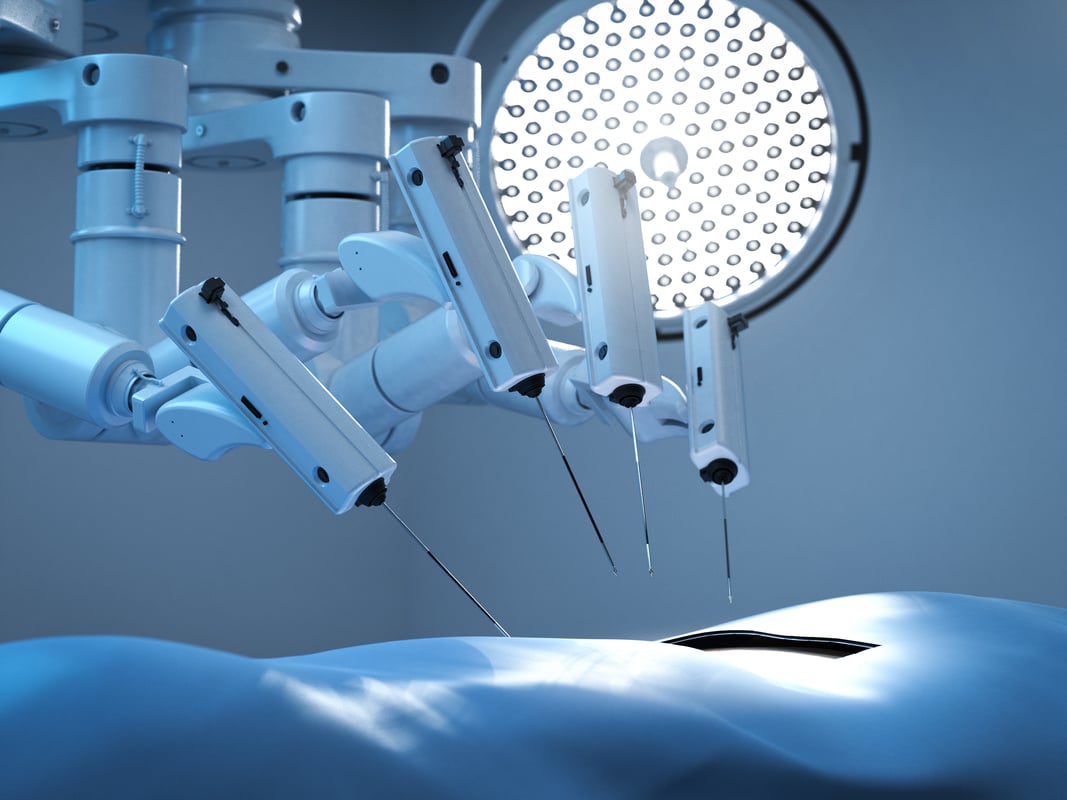

A nurse sets up the flagship da Vinci Xi system for a multi-site procedure. Photo: Intuitive Surgical.

Robotic-surgery veteran Intuitive Surgical (ISRG +1.45%) is set to report its final fourth-quarter 2015 results after the closing bell on Thursday. We already know nearly all of the basic figures, from the number of systems sold to approximate earnings, but the company may still have some surprises up its shiny metal sleeves.

What we know already

The company announced preliminary results on Jan. 13, containing most of the details that typically move stocks after their earnings reports.

So if expected results hold true, we know that total sales will grow roughly 12% year over year, landing near $677 million. Instrument and accessory revenues will jump 16% or so, representing more than 48% of Intuitive Surgical's total sales. That's up from 46.8% in the year-ago quarter.

About 652,000 surgical procedures were performed in 2015 using a da Vinci surgical system. That's a 14% increase from 2014. Looking ahead, Intuitive Surgical's management expects 9-12% procedure growth in 2016.

The company shipped 158 da Vinci systems in the fourth quarter, good for roughly $231 million in collected revenue. Only 16 systems will collect revenues over time under a lease agreement, but that's still a sharp increase from 5 leases in the same quarter of 2014.

System sales are surging in Asia and the U.S., but shrinking in Europe. Average selling prices are holding steady at $1.55 million per da Vinci system, and there are now 3,597 of these systems in service worldwide.

The approximate figures are still subject to audits and adjustments, and may come in slightly above or below the posted numbers. But we're in the right ballpark already, and the system sales figures are hard data. There won't be any major surprises on the income statement, with the caveat that Intuitive Surgical declined to provide any bottom-line guidance.

There, Wall Street analysts expect earnings of $5.00 per share. Now, they largely haven't adjusted their financial models to account for the preliminary results -- the revenue consensus is still stuck at just $653 million. In other words, the table seems set for a positive bottom-line surprise.

What we should be looking for

So we'll be looking for a solid earnings figure on Thursday, but that's not all.

In every earnings call, Intuitive Surgical CEO Gary Guthart likes to undated investors on what's next for the da Vinci system. In particular, he keeps us abreast on which approved procedures (by the FDA and similar regulatory bodies abroad) are rising in popularity, and which new procedures these regulators might approve next.

If that doesn't sound like a big deal, keep in mind that regulatory approvals outline the size of Intuitive Surgical's addressable market. Currently, the systems are largely limited to cancer-related organ removals, gynecological treatments, and various intestinal resections. These are respectably large markets, but there's a long list of potential expansions where da Vinci robots just haven't been allowed to make their mark yet.

In the third quarter, for example, Guthart pointed out strong growth in inguinal hernia repairs and prostatectomies. In China, Korea, Japan, and Europe, the robots blazed a trail of neurology procedures. These have not been approved by the FDA yet, but American regulators may pay attention to this growing body of overseas neurology treatments when they draw up rules for similar robot-assisted surgeries here.

Kidney removals may be next on the list in Japan, as that country's regulators are considering Intuitive Surgical's application for such procedures right now. Back home, the American College of Surgeons is considering a movable table for the da Vinci Xi machine, alongside a stabler attachment that would open up new procedure options in thoracic surgery (heart and lung treatments).

Look for fresh updates on these applications, and keep an eye out for further procedure expansions. These machines currently serve a very small niche market in the vast landscape of general surgery procedures, so new approvals are essential for Intuitive Surgical's long-term growth.

Intuitive Surgical shares have gained 16% over the past three months, lifted by a strong third-quarter report and a healthy market tenor in general. Meanwhile, the S&P 500 benchmark took an 8% dive. The stock jumped more than 4% when the preliminary results were published, that was without a bottom-line earnings figure.