Alliance Resource Partners (ARLP +0.54%) recently reported earnings for the fourth quarter and full year 2015. It wasn't good reading. The worst part of the quarterly update, however, was the setup for 2016.

Alliance Resource Partners logo. Source: Alliance Resource Partners.

What do you want to hear first?

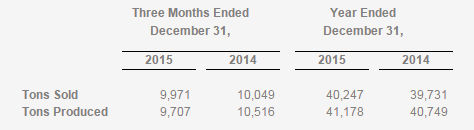

There was some good news in Alliance Resource Partners' quarterly update, but not much. For example, the coal company based out of the Illinois Basin was able to increase the amount of coal it mined in 2015 over 2014 by a small margin. And it was able to sell a touch more, as well. Both numbers were at record levels in 2015.

But that wasn't enough to offset continued weakness in coal pricing. So, revenues of $2.27 billion were down about 1% year over year and missed analyst estimates of $2.31 billion. On the bottom line, analysts were expecting $3.07 a share, but, using some back of the envelope math to pull out one-time charges, Alliance only put up roughly around $2.70 a share. The fourth quarter numbers were even worse.

The really bad news

And that's where the really bad news comes in. The fourth quarter was not only weak year over year, but it was weak sequentially, as well, suggesting things are getting tougher in the coal market. Some of the fourth-quarter falloff was weather related, since a warm start to winter caused utility customers to delay taking shipments. But the bigger picture downward trend was still obviously in play.

That's why Alliance has taken actions to curtail its production, something it really hasn't done before even while competitors like Peabody Energy and Cloud Peak Energy (CLD +0.00%) have been pulling in their horns for more than a year. Cloud Peak, for example, saw shipments peak in 2011. They've fallen each year since. At this point, Alliance doesn't appear capable of bucking that trend anymore.

Alliance's produced and sold stats... not good reading. Source: Alliance Resource Partners

So Alliance has been pushing work to its lowest cost mines and reducing shifts and production days to cut output and keeps costs in check. It expects coal demand to be as much as 7% lower in 2016 in the regions where it produces. So lower production is almost certain for Alliance in 2016. Add to that continued low coal prices, and the top and bottom lines will take a double hit.

That helps explain why the board chose to keep the distribution steady when it announced third quarter results. It kept the distribution static again this quarter, too. Here's the more troubling thing for income investors, however: For 2016 the company expects distribution coverage to be between 1.1 and 1.2, well below the 1.66 achieved as recently as the third quarter.

To be fair, 1.2 times coverage is considered solid in the limited partnership space and the distribution should hold unless the coal market turns even uglier than Alliance is projecting. But the trend is the bigger picture issue to watch, and investors are right to be nervous since Alliance's business is clearly taking a turn for the worse.

All is not lost

So in all, Alliance's 2015 is one the partnership and its unit holders would rather forget and 2016 could be even worse. However, Alliance is still doing better than just about every other coal miner production wise and financially. If you are a contrarian investor looking for a coal miner to buy, Alliance is probably your best bet. You'll just need a strong stomach to weather this deep industry downturn. If you are an income investor, meanwhile, the distribution looks solid for now, but it looks like things are going to get worse before they get better.