Only a few weeks ago, AutoNation (AN +1.71%) CEO Mike Jackson sent shockwaves through the automotive industry. At a time when major automakers were celebrating a record high U.S. sales level for new vehicles, Jackson ruined the party by announcing he expected gross profits to check in between $250 and $300 lower per vehicle. It was a signal that while sales might be hitting records, those sales were coming at a cost, thanks in part to incentives and discounts from some manufacturers.

Let's take a look at AutoNation's fourth-quarter and full-year results to see if it was as bad as Jackson predicted, and what it means going forward.

The highlights

AutoNation's fourth-quarter revenue totaled $5.3 billion, a 6% increase from the prior year's $5 billion. Top line growth was driven by stronger performance in all of its business segments: new and used vehicles, parts and service, and finance/insurance. AutoNation's retail new vehicle unit sales increased 4% compared to last year's fourth-quarter, but only saw 1% growth on a same-store basis.

Thanks to an 11% increase in profits from its parts and service segment, gross profit checked in with a 4% increase to $812 million for the quarter. AutoNation's adjusted net income checked in at $107 million, or $0.96 per share, which was below analysts' consensus estimates of $1.03 per share. The result was also a decline from the 2014's fourth-quarter results of $117 million or $1.02 per share.

There was certainly some pressure on margins, as well as bulging inventory, neither of which are great signs for the automotive industry going forward. Said Mike Jackson, chairman, CEO and president:

"In the fourth quarter, new and used vehicle margins on a combined basis declined by $217 per vehicle retailed, or 11%, as compared to the fourth quarter of 2014. As of year-end, our new vehicle inventories increased 13% on a same store basis, as compared to the prior year, driven by a 49% increase in Premium Luxury inventories. We have begun, and will continue through the first quarter, to take the necessary steps to align our costs, inventory, and pricing strategy to adjust to the current market."

Now, investors also have to consider that part of the disconnect between AutoNation's results and the record profits set by automakers such as Ford (and potentially GM when it reports early February) is that those automakers are selling just about every SUV and full-size truck they can produce. However, AutoNation's business is much more diverse, split between imports, domestics, and luxury vehicles. It may be that a chunk of its import and domestic passenger cars were sitting on the lot for too long, and needed discounts to be moved. AutoNation's revenue during the fourth-quarter was almost evenly split into thirds between domestic, import, and premium luxury vehicles.

Essentially, investors should consider the possibility that AutoNation's gross profits suffered due to a less-than-optimal mix of vehicles on dealership lots. If that's the case, expect a rebound in AutoNation's gross profits in the quarters to come, because the company can correct that by leaning more heavily on ordering domestic SUVs and trucks.

Silver lining?

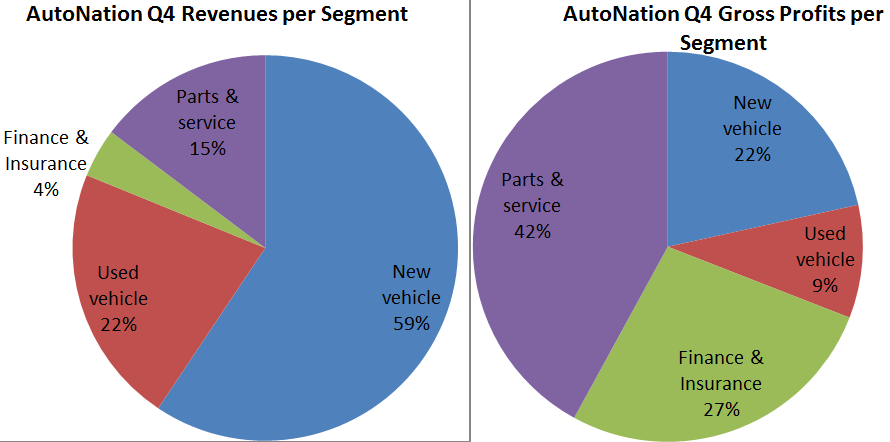

The good news for AutoNation shareholders is that while its gross profits per vehicle declined, the company's most profitable segment will continue to generate strong profitability regardless of what's going on with vehicle sales. That's because, despite not generating a big revenue figure, its parts and service business has far higher margins.

Chart by author. Data source: AutoNation's Q4 presentation.

Ultimately, it was a slightly disappointing fourth-quarter for AutoNation investors. However, I think it's a speed bump rather than a new trend. AutoNation's team will put a better mix out on dealership lots throughout 2016 to capitalize on consumers' desire for SUVs and full-size trucks. The company will also be adding 22 stores, including 51 franchises, which it acquired in 2015, that are expected to generate an additional $1 billion in revenue annually. Despite its stock price dropping 5% after it reported its fourth-quarter results, America's largest auto retailer will be just fine going forward.