Image source: Silver Wheaton.

Silver Wheaton (SLW 4.17%) plies its trade in the precious-metals space, but it isn't a miner. That's an important thing to understand, and it vastly changes what you need to watch when the company reports earnings on March 16. Here are the three big issues you'll want to pay attention to.

1. How much?

There are two items to care about here. The first is the most obvious: How much is Silver Wheaton getting for the gold (about 40% of revenues) and silver (about 60%) it sells? Although a recent precious-metals rally is good news, don't expect a pleasant number to show up in the fourth-quarter numbers.

For example, realized silver prices in the third quarter of 2015 were down just over 20% year over year. Maybe the first quarter of 2016 will show an uptick, but you should go into the fourth-quarter earnings release expecting a big year-over-year decline in the prices Silver Wheaton was able to get.

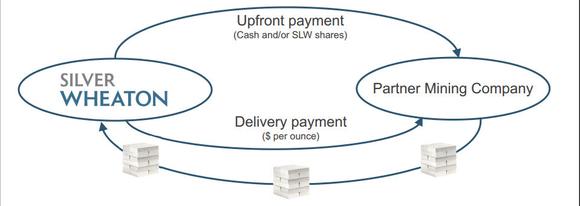

The second important part is how much silver and gold Silver Wheaton "produced." This is where it's important to understand that Silver Wheaton is a streaming company, paying miners cash up front for the right to buy their future silver and gold production at reduced rates. This method provides miners with cash to fund development or just to shore up their finances, and at the same time, it expands Silver Wheaton's production. In the third quarter, Silver Wheaton "produced" and sold a record amount of silver and gold. So look for impressive production numbers in the fourth quarter and for the full year.

Streaming basics. Image source: Silver Wheaton.

2. How's the balance sheet?

Silver Wheaton's basic business model is to use cash and short-term financing to ink new streaming deals. Generally speaking, it then issues shares to pay down any debt it took on to fund a deal. This is why the company's been able to grow production during the downturn. It's taking advantage of weakened miners such as Glencore and Vale that desperately need cash. In fact, it provided those two struggling miners with roughly $1.7 billion, combined, last year.

After the Vale deal, which was for $800 million, Silver Wheaton issued an equal dollar amount of new shares. That allowed it to pay down the short-term financing it used to fund the deal. However, a couple of months before the Glencore deal, Silver Wheaton announced plans to buy back its own stock because the price of its shares has been at relatively low levels.

That changes things -- a lot. Silver Wheaton doesn't appear to be at any risk of going belly up, but its ability to do big deals could be limited if it doesn't have as much access to capital markets as it has in the recent past. So you'll want to watch to see what the company says about its financial position and the impact that will have on deal-making, paying close attention to its bank lines of credit and access to capital markets. Note that if deal-making slows down, so, too, will the streaming company's "production" growth.

3. What about that tax thing?

The last issue to pay close attention to is Silver Wheaton's ongoing row with the Canadian tax authorities. Canada says Silver Wheaton hasn't been doing its taxes the right way and it owes, using back-of-the-envelope math, around $400 million. That's big money for a company that had net earnings of roughly $200 million in 2014.

Worse, if the Canadian tax authorities win this fight, Silver Wheaton's future earnings will probably be lower because its tax rate will be higher. So this is both a near-term and long-term issue for the company. It isn't likely to share much on this topic during the formal remarks. But listen in to the analyst question-and-answer period to see what information you can glean from the discussion.

Good and bad

When all is said and done, you shouldn't expect the fourth quarter of 2015 to be all that great financially. Weak precious-metals prices pretty much guarantee that. But operationally, you should be pleased with Silver Wheaton's production numbers. You will, however, want to pay close attention to its capacity for making more deals, since the shift toward stock buybacks appears to have changed the normal business model. With miners still struggling, now is a really good time to make deals -- it's clearly not a good thing if Silver Wheaton is locked out of the action.

Then there's the tax issue, which has been hanging around the streaming company's neck for some time. That's a big uncertainty and can change Silver Wheaton's future profitability. That helps explain at least part of the low stock price, but it also highlights why it's so important for you to pay attention to the topic when analysts get a chance to query management.