One of Royal Gold's investments. Image source: Royal Gold.

Gold prices have been heading higher of late, taking precious-metals stocks along for the ride. But Royal Gold (NASDAQ: RGLD) stock hasn't rebounded like some others. That's not a sign of trouble -- it's one of strength. The thing is, you need to understand what Royal Gold does to see why. And that's why investor perception is the biggest problem with Royal Gold stock.

A volatile commodity

For most precious-metals companies, the often volatile prices of gold and silver are a driving factor for stock prices. It makes complete sense -- the higher the price of what you sell is, the more revenue you're going to bring in. And, equally important, the more money that tends to fall to the bottom line. When gold prices fall, however, gold miners' results can quickly erode.

Take a look at Barrick Gold (NYSE: ABX). When commodity prices were peaking in 2011, Barrick made nearly $4.50 a share. Last year the number was a nearly $2.50-per-share loss. But why is this, and why is it that Royal Gold hasn't lost a penny in over a decade?

Essentially, mining for gold and silver is expensive. Maintaining an existing mine requires huge cash outlays for things such as employees and equipment. And building a new mine results in even uglier math, since production doesn't start to flow until after a miner has spent oodles of cash on construction.

That said, as long as a miner can keep its costs contained, high precious-metals prices generally lead to robust top- and bottom-line results. That's why Barrick Gold's shares are up nearly 120% this year as gold has started to rebound. Meanwhile, Royal Gold's shares are only up 55% or so. What gives?

A different equation

The thing is, Royal Gold isn't a miner. It's more of a specialty finance company that gets paid in silver and gold. That's why there's less of a rebound today, but why there was also less of a fall when gold was tanking. To give you an idea, since the start of 2011, Royal Gold shares are up about 10% or so. Barrick Gold is off around 70% over that span even after the recent advance.

So what's the biggest problem with Royal Gold? Perception. You need to understand what Royal Gold does to really appreciate its position in the precious-metals market.

When a miner like Barrick builds a new mine, it has a few financing options, including tapping the capital markets or taking out a loan from a bank. Those are fine, but they can be a drag on financial performance. A third option is to work with a streaming company like Royal Gold, which provides cash up front for the right to buy gold and silver at reduced rates in the future, when the mine comes on line. This can work with operating mines, too -- it just means the precious metals start flowing right away.

It's kind of a win/win. Barrick gets needed cash, and Royal Gold locks in cheap gold and silver, without any need to take on the risks, costs, and vagaries of mining. Its costs are pretty much set as soon as it signs a streaming deal.

But here's the really interesting thing: Royal Gold's cash is most desirable when it's hard for precious-metals companies to tap other sources of capital. In other words, when gold prices are low, Royal Gold can ink some good deals. The recent commodity downturn has, indeed, been something of a blessing. For example, it was able to ink a $610 million agreement with Barrick in 2015.

The steaming deal calls for Royal Gold to pay just 30% of the spot price per ounce of gold until 550,000 ounces of gold have been delivered from one of Barrick's mines. The price jumps to 60% after that. But based on the amount of gold expected to be delivered annually, that's over a decade of prices at the low end, which essentially locks in wildly profitable gold and silver purchases for Royal Gold.

Why would Barrick or any other miner agree to this? After all, it looks like highway robbery. That answer is pretty simple. With its shares down 70% since 2011, investors aren't likely to be too receptive to a stock sale. Debt and bank loans, meanwhile, would increase expenses at a time of weak revenues. And interest rates for a loan during an industry trough are likely to be pretty steep, too. Inking a streaming deal with Royal Gold, while not free, doesn't hurt as much today.

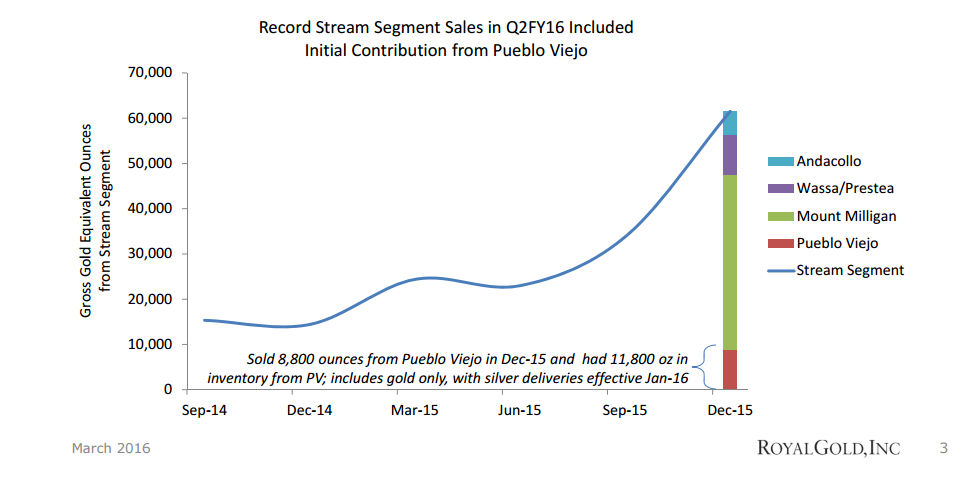

Selling lots more gold. Image source: Royal Gold.

Know what you own

A robust investment environment is why Royal Gold didn't fall as much and why it hasn't gone up as much, either. Essentially, Royal Gold's business model is different from those of miners. And far more consistent; Royal Gold has increased its dividend every year for a decade and a half. So the biggest problem with Royal Gold is really in understanding what the company does and how that affects its business.

When gold is in rally mode, Royal Gold isn't likely to benefit as much as a miner. But when precious metals are falling, Royal Gold's growth opportunities expand while its low-cost structure remains solidly in place. If you're conservative and looking for precious-metals exposure, that might be exactly what the doctor ordered.